Happy Weekend {{First Name }} 👋

Welcome to #78 of the Weekly AI Edge:

The Big Story: Gensyn’s highly anticipated public token sale goes live.

The Alpha: Giza quietly takes the #1 spot in DeFAI.

The Weird: Robots start fighting in a public arena.

TAO’s first halving just went through this week and the price didn’t didn’t do what people expected (the price wasn’t supposed to halve). Yet, it’s down 20% on the week. That’s probably related to the current altcoin bear market.

Last week’s poll leaned bullish, with ~71% of you expecting the halving to be a net positive over time. I still think it plays out well over the mid-term. The bear market offers opportunities for those who do their research and have the iron stomach to ride it out.

With that said, Solana Breakpoint wrapped up last week, and it was packed. New launches everywhere, agents showing up in more places, and x402 v2 going live to make machine-to-machine payments even more real.

Jeremy Allaire (Circle CEO) put it cleanly :

“There will be hundreds of millions, if not billions, of agents working continuously on behalf of people and institutions... and there will be institutions that are all operated by AI.” (h/t s4mmy)

Let’s get into it.

🕹️Giza Takes DeFAI’s #1 Spot

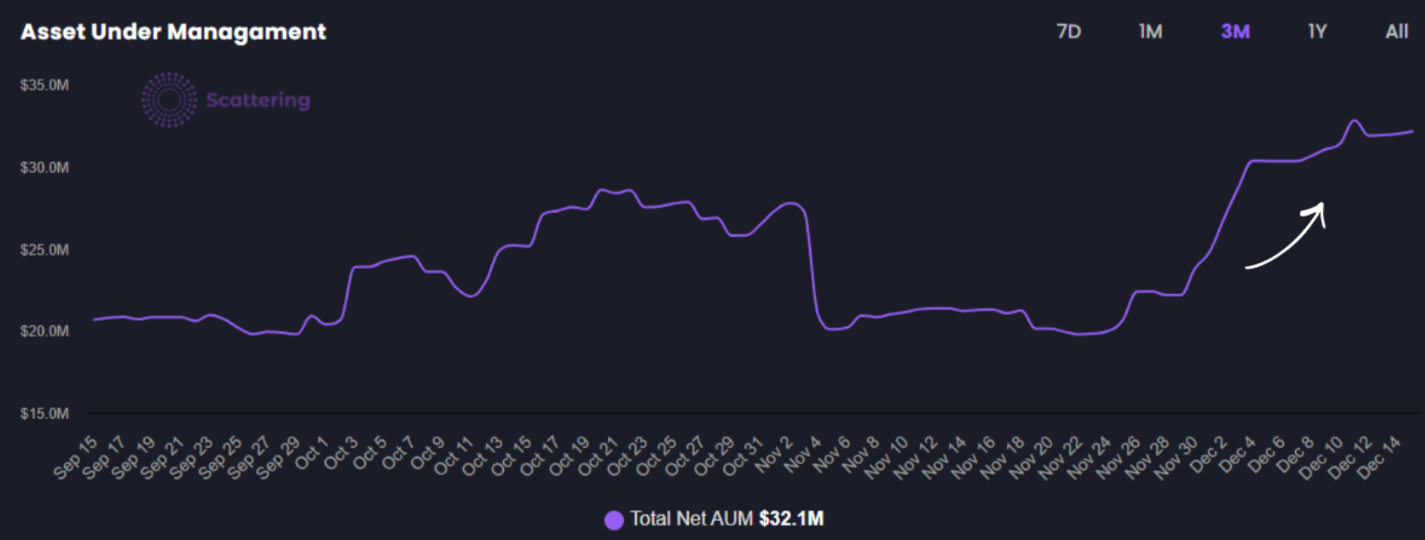

Source: Scattering.io

A chart that told the whole DeFAI story this week.

Giza saw a large inflow in net Assets Under Management (AUM) this week, pushing total AUM to a new high of $32M.

Giza runs non-custodial agents that automatically execute and rebalance DeFi strategies. AUM here means “money actively doing something,” not cash parked on the sidelines.

The timing wasn’t random. Almanak’s TGE blew up, the token dropped 80%, and capital did what capital always does when confidence breaks: it left.

Flows rotated out, and Giza sits in the #1 spot in DeFAI now.

🎭 All Eyes on Gensyn’s Token Sale

Gensyn’s public token sale went live this week and and it keeps coming up in my DMs. Here’s what you need to know.

At its simplest, Gensyn aims to build a decentralized network for training machine learning models. If you’ve seen RL Swarm or Delphi (their products), that’s the direction they’ve been pushing in for a while. The $AI token will power Gensyn’s mainnet.

The sale itself is an English auction with a massive range. The floor is a $1M FDV and the valuation cap is $1B FDV, which matches their round led by a16z. Everyone who clears pays the same final price. If your bid comes in below it, you get refunded.

Over 4,000 participants have put up almost $9M so far. That pushes the current clearing price to roughly a $240M FDV, with one day left in the sale.

If you’ve watched these auctions before, you’ll know that most of the real movement shows up in the final hours, once people see where other people’s commitments and decide whether they’re in or out.

Over the mid-term, I’m bullish if this settles in the lower FDV range, roughly under $300–400M. The work here is real: hard coordination problems for decentralized compute networks, and a step up from the 1st generation of compute networks like Akash and Render.

If it closes at a $1B FDV, though, that feels.. a little ahead of itself. Product adoption and revenue are still early.

COT POLL: Are you participating in Gensyn’s token sale?

AI & Robotics saw a solid pickup in mindshare this week, driven by renewed focus on agentic infrastructure, data pipelines, and concrete integration plans discussed in Solana Breakpoint.

Core crypto primitives like perps, prediction markets, and stablecoins hit new usage highs despite weak price action. AI mirrored this dynamic, but the total market cap had another leg down to ~$16B.

🪙 Token Launches

$THQ went live with 1B token supply and 13.8% in circulation.

🗓️ Upcoming Events

AI Arena (NRN): Token unlock (6.66% of circulation) on December 23

Delysium (AGI): Launches price monitoring & comparison service on December 26

Are you building something awesome in crypto × AI? Or spotted a startup or product that more people should know about? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter each week.

💸 Capital Flows

HolmesAI raised $5M in a strategic round to expand its AI-driven digital avatar and personal agent platform.

TestMachine raised $6.5M to expand its AI-based continuous risk monitoring for smart contracts, exchanges, and DeFi infrastructure.

⚙️ Infra & Protocols

AethirCloud launched Axe Compute, rebranding Predictive Oncology to target enterprise AI workloads on its GPU network.

Render Network uneviled Dispersed, a distributed AI compute network, alongside new AI-3D tools at Solana Breakpoint.

EigenCloud proposed ELIP-12 to redirect EIGEN incentives toward active, fee-generating AVSs, with protocol fees flowing back to EIGEN instead of idle stake.

🤖 Agents & Apps in the Wild.

x402 V2 launched with standardized multi-chain and fiat payments, extensible metadata, dynamic routing, and backward compatibility.

HeyElsaAI officially launched its first product, walletroast.com. This leverages Elsa's x402 technology for immediate user access.

Questflow launched the 0xbitslab agent, its real-time market, memecoin, and onchain intelligence engine on Questflow.

🧠 Bittensor Ecosystem

Grayscale launched the Bittensor Trust ($GTAO) on OTCQX. It is the first publicly quoted investment product in the U.S. designed to provide exposure to $TAO.

Taoshi introduced Vanta Trading, a decentralized prop trading firm using a Bittensor-based network for onchain performance verification.

Bitsec announced the launch of its V2 platform, introducing benchmarked, open-source agent-based code auditing.

🦾 Robotics On-Chain

Peaq launched a Hardware Store on its app, allowing users to discover, order, connect, and earn from supported DePIN devices.

XMAQUINA is partnering with Virtuals to open liquid, pre-IPO access to private humanoid robotics via the $DEUS token, launching Jan 8.

Tether invests in Generative Bionics to build next-gen humanoid robots powered by on-device AI and programmable money.

Robots Enter the Ring at Solana Breakpoint

BitRobot Network set up a live humanoid robot fighting arena at Solana Breakpoint. They ran live, human-piloted combat matches inside a dedicated Robot Arena and let them battle it out till the end.

The Wedge

UFB is a teleoperation fight club. Real humans remotely pilot real humanoid robots and run them through repeated combat-style sessions.

BitRobot’s angle is simple: this is a fast way to generate real-world robot interaction data, at scale, without waiting for autonomy to catch up.

Breakpoint’s Robot Arena fits this perfectly. Public trials, lots of sensors, lots of operators cycling through. UFB is the flashy front-end, but the real goal is onboarding people into teleop

The Fine Print

Every robot is fully human-controlled. How much combat data carries over to autonomous robotics is still an open question. This setup was built first for live entertainment and demos, not clean, production-grade datasets.

That said, humanoids are getting fast in a hurry. I wouldn’t be shocked if the next version is a club where the robots fight each other, no humans in the loop. It could be the next big market.

Silicon Valley loves the winners. It buffs their origin stories and forgets everyone who didn’t make it.

That’s a mistake. The failures carry more signal.

I’ve been tracking K-Scale for months on the robotics side. When they announced they were shutting down last month, I went back through everything to figure out what broke and what the rest of us should learn from it.

They built a functional, open-source humanoid faster than teams sitting on $600M in funding. The goal was simple and insane at the same time: a real robot in your living room for under $9,000.

What they got right (and why it still wasn’t enough) exposes an uncomfortable truth about robotics, capital, and openness in a market that doesn’t know how to pay for it.

This is my autopsy of a beautiful failure.👇

🔥 Our Weekly Top 5

#1 The Bittensor Miner That Never Mined

Inspect onboarded thousands into a Nuance setup that paid nothing, but flooded X with low-quality engagement.

#2 Optimus Logged Off

A teleop operator removed his headset. The robot followed. Gravity did the rest.

#3 GPT-5.2 Enters the 0.1% Club

GPT-5.2 Pro scored an IQ of 147, placing it among the top 0.1% of human intelligence, with 150 now within reach.

#4 China’s Robot Guide Dogs Help the Blind

Shenzhen rolled out a pilot program using robotic guide dogs to help visually impaired passengers navigate the subway system.

#5 Novastro Went Quiet, Then Went to Zero

The founder disappeared, the product never showed up, and a $50M FDV launch is now sitting ~97% down

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

If you enjoyed this, you’ll probably like the rest of what we do:

The Agent Angle: Weekly AI Agent newsletter & deep dives (non-crypto)

Our Decentralized AI canon 2025: our open library and industry reports

Prefer watching? Tune in on YouTube. You can also find me on X and LinkedIN

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.