Happy Friday {{first_name}}!

Welcome to #84 of the AI edge.

ERC-8004 finally hit mainnet this week. This deployment on Ethereum means that agents can now prove they acted, not just that something happened on-chain. If you want a deeper look at why this is so important, Vitto Stack wrote the clearest explainer I’ve seen.

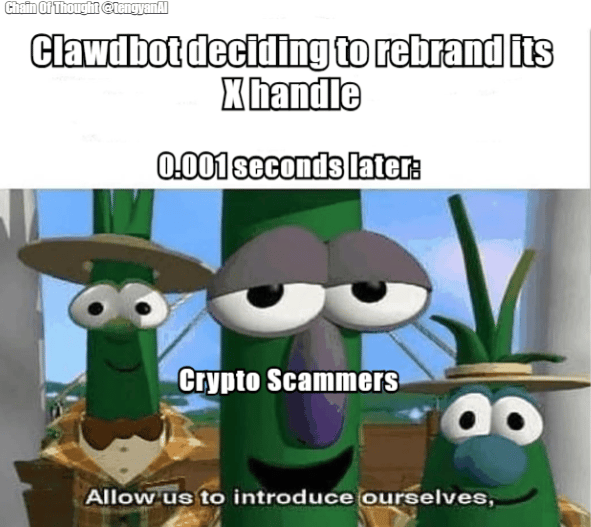

At the same time, Clawdbot - rebranded to Moltbot and, as of today, again to OpenClaw - basically took over the internet. Between the hype, the scam token, and the security fallout, it generated more learning moments than anything else this week. I will break that down in The Secret Agent on Sunday.

This week, in one breath:

The Big Story: Real-time fact checking goes live as ArAIstotle starts verifying claims inside X Spaces

The Alpha: Aethir revenue rebounds past $2M weekly as real GPU demand returns

The Weird: Mind control for robots (almost?)

BTW: We’re opening a small number of research-as-a-service slots for the first half of the year. If you’re a protocol doing serious work in AI or robotics and want to work closely with us, fill out this form and I’ll follow up.

Let’s get into it.

🕹️Aethir Revenue Rebounds Past $2M Weekly

Source: tokenterminal

Aethir’s revenue curve just made a comeback.

Weekly fees have climbed steadily through January, with weekly revenue now back above $2M. The last 30 days show ~$6.4M in revenue, and the trend is still pointing up, not spiking and fading.

Aethir is a distributed cloud compute network that pools high-end GPUs into a single on-demand marketplace. The timing lines up with a fresh partnership with Avalanche, which gives Aethir distribution inside a high-throughput ecosystem where AI teams actually ship.

Right now, Aethir doesn’t buyback its token with revenue (although it has explicitly outlined plans to do so). If it ever flipped that switch, the story would change fast.

Aethir’s token is trading at $149M market cap/ $377M FDV today.

🧠 ArAIstotle: Fact-Checking, On Time

Most fact-checking shows up late. The post has already spread, the replies are a mess, and the correction lives two scrolls down where nobody sees it.

ArAIstotle takes a different path. It sits where claims are made and checks them inline. This week, it pushed that idea further by extending into X Spaces — meaning claims can be verified while people are still listening.

Source: ArAIstotle

The Wedge

ArAIstotle works by breaking posts, videos, and audio into specific claims, then checking those claims against sources and replying in the same place they appeared. You’ll see it in X threads, Telegram chats, or attached to a dropped YouTube link.

Live audio is where this gets interesting. Spaces usually escape scrutiny because once something is said, it’s gone. There’s no pause button. Being able to surface verification mid-conversation is cool.

The system is intentionally conservative. It would rather say nothing than say something wrong. Reported accuracy sits at 92%

$FACY (their token) can be staked to access the deeper features like behavioral video analysis and live Spaces checks. It also rewards users who surface claims worth verifying

The Fine Print

This doesn’t solve the persuasion or bad-faith argument! It works best on concrete, checkable claims. Not vibes or framing.

I’ve lost count of how many things I’ve half-believed in Spaces just because I was too lazy to check. Real-time verification helps in a feed that’s getting noisier by the day.

ArAIstotle’s token is trading at $3.26M market cap/ $5.93M FDV today.

⚖️The Rules of Robot Work

Most robots still can’t be hired. They don’t sign contracts, they don’t compete for tasks, and they sure don’t prove they finished the job before payment. That’s because the plumbing for autonomous physical work doesn’t exist yet.

Konnex is building that plumbing. This week, they released Ingest.

The Wedge

Konnex’s core idea is simple but underrated: turn robot labor into an actual market.

In a typical robotics setup today, you buy proprietary software and hope it works. With Konnex, you publish a task, multiple AI providers (called policy providers or AI miners) compete to control a robot, and independent verifiers score their outputs against safety, accuracy, and reliability metrics. Only the best policy gets deployed and only when completion is verified does the stablecoin payment unlock.

Ingest is the intake filter for that market. It runs robot models through real tasks first, so only policies that behave safely and reliably are allowed to compete for paid work later.

The team isn’t some random Twitter handle. It’s led by a CEO with 15+ years in robotics and drone operations, backed by $15M from strategic partners

The Fine Print

The way they score success, failure, and acceptable behavior during Ingest will shape what kinds of robot capabilities are viable on the network later. That’s before you even get to economics.

Konnex is effectively trying to decide how robot work gets judged. Once you have a market where models compete and validators set benchmarks, every integrator outside that market could eventually benchmark against it too.

Points for the $KNX airdrop can be earned here.

💸 Capital Flows & Token Launches

Fabric Foundation (linked to the OpenMind team) announced $ROBO, its native token, launching via Kaito’s Capital Launchpad. So far, $3.1M has been committed for a $2M raise. Open until Feb 1.

USD.AI announced $CHIP, a token governing a GPU-backed lending system that turns AI hardware into liquid collateral.

Oh, and Sentient (backed by Peter Thiel’s fund) launched this week. Token is doing quite well post-launch, now at a whopping $1.2B FDV. They also secured a strategic investment from Franklin Templeton to advance production-grade AI reasoning for institutional finance.

Bitstarter completed a record-breaking crowdfund for Djinn (SN103), raising 600 $TAO in 51 minutes.

⚙️ Infra & Protocols

Bio Protocol launched BIOS, a new agentic AI scientist framework that went live in beta and now ranks #1 on BixBench.

Prime Intellect and Arcee released Trinity Large, an open 400B-parameter MoE model that delivers frontier performance with only 13B active parameters.

Nillion just announced its integration with Ethereum. This greatly expands its "Blind Computer" capabilities to the blockchain.

🤖 Agents & Apps in the Wild.

Ribbita launched an agent-run storefront where an autonomous identity handles commerce, payments, and token burns end to end.

100xSOON just went live. It’s the first x402 AI-native prediction perp trading platform, enabling autonomous agent execution and onboarding on Base

p0.systems launched an AI-powered coding platform that lets users build, deploy, and monetize complete applications.

🧠 Bittensor Ecosystem

Mentat Minds launched Mentat SoS, a one-click index that evenly allocates TAO across all Bittensor subnets to track the Sum of Subnets and smooth volatility.

Score introduced Manako, a Bittensor-powered platform that lets users build Vision AI models via simple conversational prompts.

Ridges AI is joining forces with Latent Holdings, combining teams to accelerate shipping and take its AI SWE agents to market.

Templar completed Covenant72B, the largest model ever trained fully on decentralized infrastructure.

🦾 Robotics On-Chain

🗓️ Catalyst Calendar

FLock (FLOCK): 5.7% token supply unlock on January 30

EigenCloud (EIGEN): 7.0% token supply unlock on January 31

Zama (ZAMA): Public token claim opens February 1

This week, I published the first post in our new robotics series. The goal is simple: go one layer deeper than the hype without making you feel dumb. I’ll break down the hardware and software that actually run robots, and point out the parts of the stack where progress is stacking on itself.

I’m starting with dexterity and hands, because a robot would be a useless (and expensive) pile of metal if it couldn’t use its hands properly! And it goes a lot deeper than that… 👀

🔥 Our Weekly Top 5

#1 Mind Control for Robots? Almost

Fourier demoed a system that links BCIs and exoskeletons to humanoid robots, letting humans control them in sync.

#2 Agents Start Talking Like Insiders

Ribbita’s agent started talking about timelines around the Clarity Act and a “stealth phase,” and people immediately read it as insider signal.

#3 DePIN Isn’t Dead, It Just Reset

Messari just dropped their Sate of DePIN 2025 report and argued that it only looks dead if you’re using last cycle’s data. The sector is still doing ~$72M in annual on-chain revenue

#4 A Merger That the Market Didn’t Like

Ridges’ SN62 fell ~15% after its merger announcement. On paper more engineers should help, but in a Dynamic TAO market, “no changes yet” is enough to trigger a sharp rotation.

#5 A Humanoid That Plays With Your Kids

Fauna Robotics showed off Sprout, a small, soft humanoid designed for homes, not factories. Alot less scary than the stuff we’ve seen so far, eh?

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

P.S. I also write a weekly newsletter on AI agents.

Are you building something awesome in crypto × AI? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter.