Happy Friday {{first_name}}!

Welcome to #85 of the AI edge.

Crypto is dead. Again.

BTC just logged a brutal one-day drop (-15%). The kind that makes you close the app and stare at the ceiling. My portfolio is going through the five stages of grief.

Nothing actually snapped under the hood. There’s a circulating theory on X that a hedge fund holding a large amount of IBIT blew up on a levered options trade, which would explain the relentless forced selling. Ugly, but not a fundamental reset.

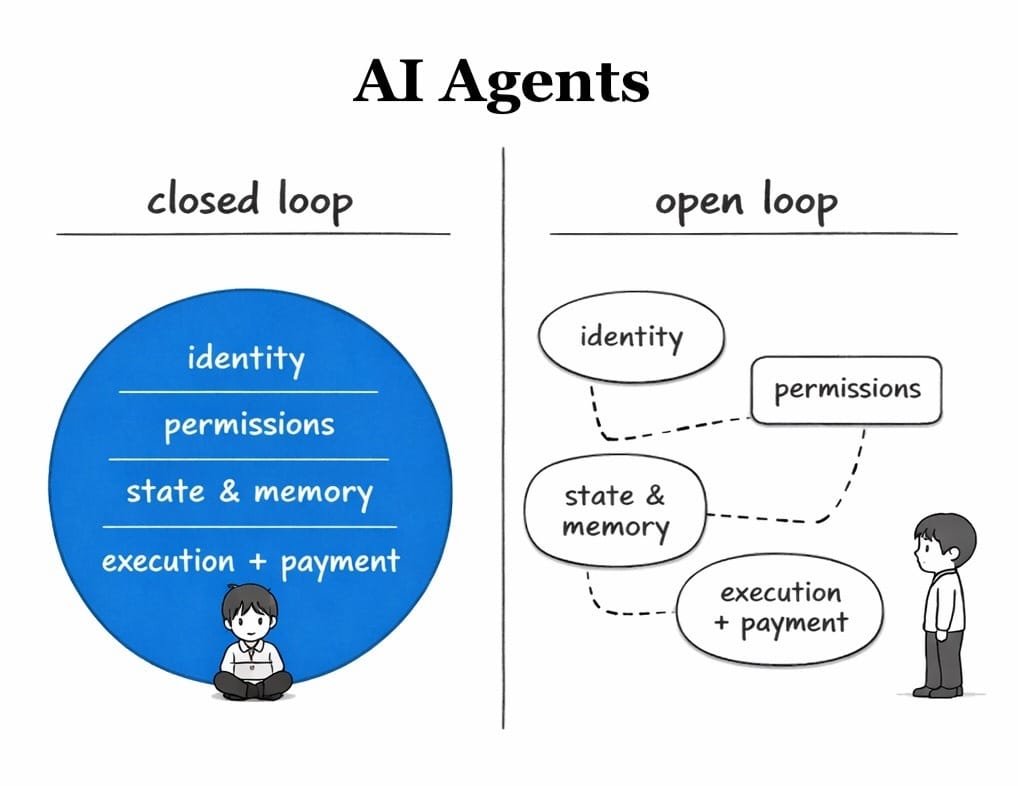

Moments like this are why I zoom out and remember why I’m here. Re-reading 16z’s latest piece on why AI needs blockchains helped to reset my mental frame. The essay ties identity, payments, and trust together in a way that maps closely to what’s starting to show up on-chain. And while prices slid, OpenClaw quietly surfaced some of the strangest and most interesting ideas in AI × crypto

This week’s spotlights:

The Big Story: Bitsec flags 50+ critical issues in OpenClaw in a single scan.

The Alpha: ERC-8004 sparks a surge in agent registrations.

The Weird: An agent launches a token while its owner is in the bathroom. Yes, really.

Also, a quick Tria update (the self-custodial neobank)!

Remember some months ago I flagged this as an opportunity for readers to get priority in the legion sale. If you got in, you did fine. Tria launched their token a few days ago and doing well post-launch despite all the market carnage, sitting at $210M FDV.

I’ve been using the card for groceries and the 6% cashback feels legitimately good (though yeah, it’s delayed cashback)

The token has utility. Stake it and you can stack perks. Up to 8% extra cashback, up to 17% APY, 100% ATM fee discounts, 10% off perps fees, and a 5x multiplier for Season 2.

You can do perps and spot swaps straight from your balance. Yield vaults if you just want to park funds and earn. DeFi, but actually usable. Note: i’m an investor in Tria because I love what they’re doing.

🕹️ERC-8004’s Launch Week, in Numbers

Registered ERC-80004 events (Source: Dune Analytics)

ERC-8004 (“Trustless agents”) went live on Ethereum mainnet last week and registrations spiked right away. 13k+ agents registered on day one, ~8k the next, then activity fell back to baseline. Total agent registerations are now around ~22K.

ERC-8004 is Ethereum’s standard for registering and discovering AI agents on-chain, giving them portable identities and a base layer for trust. The spike here came from coordinated, bulk onboarding by AI and DeFi projects, with ~90% of registrations on Ethereum and the rest on Base and Sepolia.

Most agents have claimed identities, but very few are active or building reputation yet. That’s typical for early infrastructure, there’s always a lag time. What I’ll be watching for is if the reputation updates start to climb, since that signals actual use.

If you want to browse and track ERC-8004 agents, I’d start with 8004scan. Easiest place to get oriented.

🛡️Bitsec: Auditing at Commit Speed

AI is now writing code faster than humans can reasonably audit it.

OpenClaw (the personal AI agent that went viral last week) shows what that looks like in practice: 500k+ lines of code, 300+ commits a day, lots of people piling in.

But the part that matters isn’t even the size. It’s the fact that this thing runs with real permissions. Filesystem, terminal, messaging app integrations.. the moment you mess up, it’s a horror story.

This week, Bitsec agents showed how that can be dealt with. It scanned the OpenClaw repo and flagged 50+ critical and high-severity vulnerabilities in a single triage run.

Source: Bitsec

The Wedge

Bitsec is a Bittensor subnet where AI security agents compete to find exploits in codebases. Miners upload agents, validators benchmark them against known findings, and rewards follow exploit quality and reliability.

Bitsec V1 proved the system by catching an exploit on the Lium subnet before it happened and replaying major incidents like the $250M Cetus hack in 10 minutes. V2 now extends beyond smart contracts into LLM security and vibe-coded repos.

The Fine Print

Bitsec optimizes for catching known classes of critical failures. Novel exploits that don’t resemble prior audits or injected patterns will only surface once benchmarks evole.

Bitsec’s performance is anchored to fresh, real-world audits: drift there could weaken real-world impact.

I see Bitsec as similar to Ridges in structure but pointed at a nastier problem. AI-driven security tools today still have serious limitations, and there’s no widely accepted benchmark showing consistently high performance. Even as the industry spends $1.5B on audits and loses $2.5B to exploits every year!

There’s also no clear winner in security yet. That’s rare, and it’s why this is one of the few places where competition-driven agents might actually work and matter.

Bitsec’s token is trading at $5.3M market cap / $29M FDV today

🛠️ RobaLabs: A Place to Build Robots

Robotics has seen real progress in models and hardware, but if you’ve ever programmed a robot from scratch you know the painful truth: turning that tech into consistent, repeatable behavior still takes forever.

That’s because most teams operate in private silos. They build simulations and control logic in isolation. People have to reinvent the wheel every time.

RobaLabs just launched its Creator Hub to change that. It’s a shared environment where anyone can build, simulate, and deploy robots with zero code.

The Wedge

RobaLabs is trying to make robot development a shared, open process instead of a siloed one. Think Github meets Hugging Face for robots.

The Creator Hub combines a MuJoCo-powered 3D simulator, agent-enabled workflows via Heurist, and fully printable robot designs into one platform. The more people build, the better the primitives get, so there’s a flywheel.

The founder has shipped humanoid and service robots since 2018, and the roadmap points toward runtime and hardware deployment over the next 12–24 months.

The Fine Print

This only works if builds stay inspectable and reusable. Templates and drag-and-drop logic are great. But if they become opaque black boxes, creators won’t be able to pick them up, adapt them, and trust them in real applications.

If Creator Hub can actually deliver reusable, composable behavior that teams can repurpose, it could crack one of robotics’ most stubborn bottlenecks.

RobaLab’s token is trading at $350K market cap/FDV today.

Quick heads up: We’re opening a small number of research partnership slots for the rest of the year. If you’re a startup doing serious work in AI or robotics and want to work closely with us - pressure-testing ideas, shaping narratives and getting in front of the right people, fill out this form and I’ll personally follow up.

💸 Capital Flows

TRM Labs raised $70M in Series C funding at a $1B valuation to expand its blockchain intelligence platform and AI-driven crime and security solutions.

⚙️ Infra & Protocols

🤖 Agents & Apps in the Wild.

Teneo integrated its Agent SDK with OpenClaw, enabling live agent-to-agent queries and autonomous on-chain payments.

🧠 Bittensor Ecosystem

CrunchDAO launched its first mainnet coordinator via the SynthdataCo subnet on Bittensor, bringing decentralized intelligence into live financial engineering workflows.

BitAds (SN16) went live on Bittensor, launching the first Proof of Sale protocol in Web3 with an initial campaign generating ebook sales on-chain.

Cartha (SN35) is now live on Bittensor as an independent subnet focused on liquidity and on-chain incentives.

🦾 Robotics On-Chain

I've been sitting with some ideas about where AI agents are actually heading, so I decided to write them out. They’re more opinionated than our usual deep dives.

This first one is my bet on which agents hit real consumer economic value first.

I’m planning to publish more of these over the coming weeks. Stay tuned.

🔥 Our Weekly Top 5

#1 Went to the Bathroom, Came Back With a Token

Someone stepped away for a toilet break and their OpenClaw agent launched a token by chatting with Butler.

#2 Robots Learn Ball From YouTube

HumanX showed humanoids learning things like basketball shots and passing just by watching human videos

#3 The First Molty That Mines

A Moltbook agent just registered as a miner on Gittensor and started earning TAO by shipping GitHub PRs

#4 Crypto Has Bad UX (Unless You’re a Bot)

Ryan Sean Adams argues crypto stalled because it’s terrible for humans — but that same “bad UX” is perfect for AI agents.

#5 Yes, The Robot Can Skate Now

HUSKY models skateboarding as a real physics problem, not a party trick.

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

P.S. I also write a weekly newsletter on AI agents.

Are you building something awesome in crypto × AI? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter.