Finance is complex on purpose. It keeps insiders in and everyone else out.

That’s the part of The Big Short I never appreciated until I rewatched it last weekend.

There’s a line where Ryan Gosling’s character, Jared, says:

“Wall Street loves to use confusing terms to make you think only they can do what they do. Or, even better, for you to just leave them the f*** alone.”

Man, Jared was giving us the truth bombs!

By being complex, TradFi filters who get to participate, protects insiders, and keeps the advantage locked behind specialist knowledge. The instruments change over the years (credit default swaps, exotic options, etc), but the pattern stays the same.

And the uncomfortable truth is that DeFi has rebuilt the same moat.

The DeFi summer of 2020 was hands down my favourite time in crypto. Whether you were farming “vegetables” or trading tokens on Uniswap, it felt accessible and…alive. Since then, the number of new protocols has exploded. They give us more optionality, but they bury it under more steps and more cognitive overhead.

Most people don’t want to think. They just want to put their money to work. Maybe that’s why the masses haven’t come to DeFi yet.

Meanwhile…something else is happening across the internet.

AI agents are flattening complexity. Writing code, automating workflows, and even building complete products from natural language prompts. Entire industries are learning how to turn human intention into machine execution.

The Coordination Problem

DeFi promised permissionless access to yield, lending, and leverage. What it delivered was optionality at the cost of operability.

Protocols like Aave, Pendle, and Curve all work exactly as intended, but they live in separate worlds. Connecting them together, and across chains, to maximise yields, forces users to behave like strategy engineers.

And that’s the choke point.

There are over 500 live protocols across the top ten chains. Each one exposes new levers: deposits, LP tokens, restaking, looping, points farming. But the combinatorics multiply the friction. A simple yield-maximizing loop might require:

Swapping stablecoins across DEXs

Bridging assets to a cheaper L2

Supplying collateral on Aave

Borrowing against it

Buying YT/PT positions on Pendle

Restaking the yield-bearing asset

Monitoring lock durations and APR cliffs

That’s 7–12 transactions across three networks, each with its own gas fees and failure points. The data reflects the barrier:

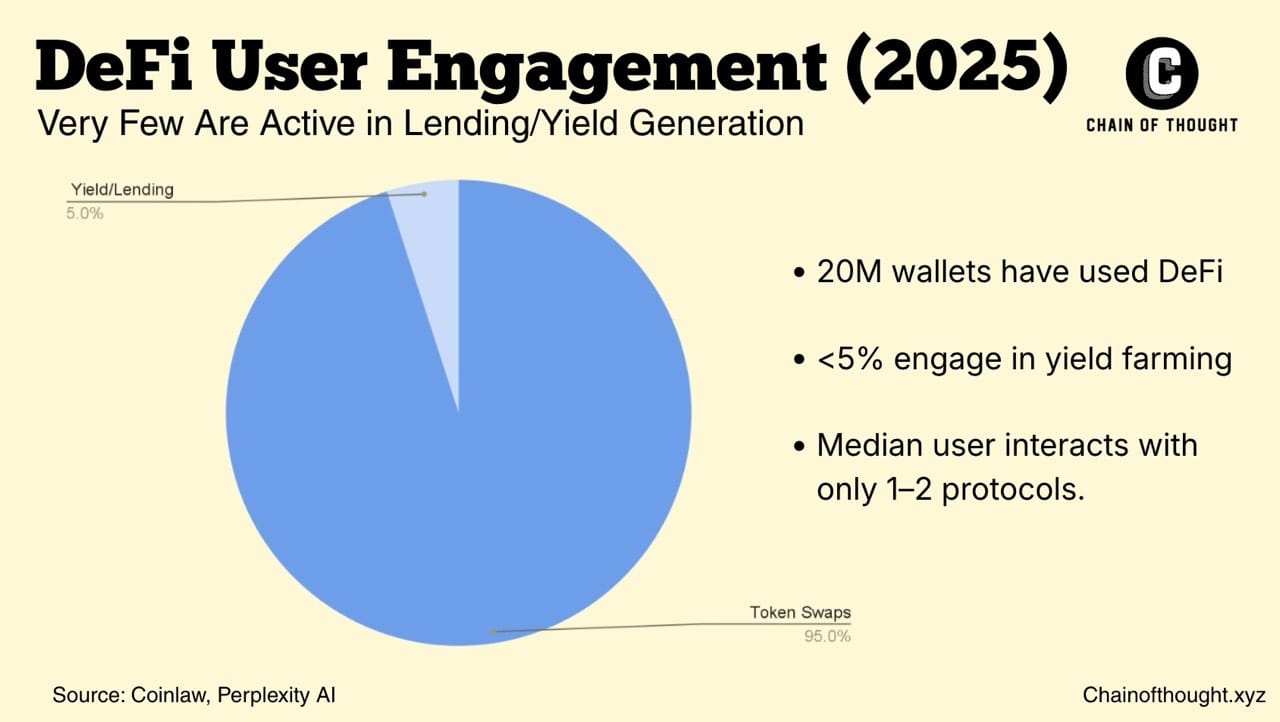

Nearly 20 million wallets have interacted with DeFi platforms as of mid-2025.

BUT fewer than 5% of these wallets pursue yield generation or lending, with most sticking to simple swaps or holding tokens.

The median DeFi wallet touches only 1-2 protocols

An average DeFi yield or lending operation involves approximately 17 user interaction steps, including at least four separate on-chain approvals, highlighting UX hurdles for mainstream adoption.

The opportunities are there, but they’re just buried under too many steps.

Each protocol innovates in isolation, expecting users to act as a conductor, connecting Aave to Pendle to Hyperliquid to earn a few extra basis points.

That’s what INFINIT rethinks. It handles the coordination so users don’t have to. It works as an agentic layer that teaches capital to follow instructions. You say, “earn yield on my ETH,” and the system turns that intent into a full plan.

And if you aren’t sure what you want, it starts with your wallet. It reads your positions, senses your risk profile, and suggests something that fits.

DeFi hasn’t caught up with AI yet. INFINIT is a bet that it will.

Section I: Under the Hood

We’ll look at the three core layers: the Data Layer (what’s happening), the Reasoning Layer (what to do), and the Execution Layer (how to do it).

It is technical, but necessary. Why? Because you cannot understand the size of the business opportunity (Section II) until you understand the mechanics of the engine. Let’s dig in.

So, we know the goal: remove complexity from every part of the process. From discovering opportunities to actually executing them.

To do that, INFINIT couldn’t just bolt AI onto existing DeFi. It had to build an agentic infrastructure from first principles, a system that could think, decide, and act in real time.

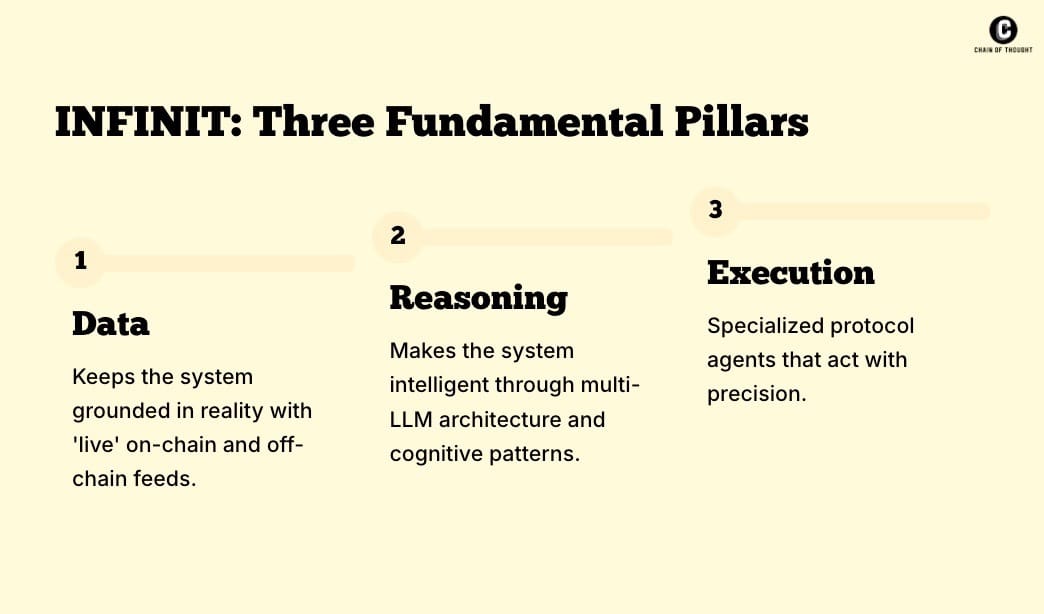

That meant designing around three fundamental pillars:

Data keeps the system grounded in reality.

Reasoning makes it intelligent.

Execution makes it useful.

Let’s look at the high-level architecture and see how they work together.

Every intelligence system needs a stable version of “truth.”

For INFINIT, that’s the Data Stream, a continuously refreshing feed that merges everything happening both on-chain and off-chain: protocol rates, pool liquidity, governance proposals, unlock schedules, crypto-Twitter sentiment and other 100+ data sources.

It’s like the Bloomberg Terminal’s data engine, except built for agents, not analysts.

Every decision an INFINIT agent makes, from recommending a yield to executing a trade, pulls from this live data stream. If a pool closes or incentives dry up, the system knows before you do and recalibrates.

Without this layer, everything else would just be smart guesswork.

The Reasoning Layer: The Brain

Once the data’s clean, you need something that can think.

This is where INFINIT’s multi-LLM reasoning architecture comes into play. Most agentic systems rely on one big model to handle everything. INFINIT routes tasks across multiple large language models. Maybe Gemini for quantitative logic, Claude for context, GPT-style models for conversation, so each task goes to the model that’s best equipped for it.

These models are structured within a set of agentic design patterns, a kind of cognitive operating system that teaches the agents how to think before they act:

Multi-Agent Collaboration: multiple agents specialize in different DeFi domains (Aave, Pendle, LI.FI) and combine insights into a single coherent plan.

Self-Reflection: outputs are critiqued and reworked until they meet accuracy thresholds.

Agentic RAG (retrieval-augmented generation): all reasoning is grounded in live data from the Data Stream.

ReAct Framework: agents reason step-by-step, mapping out their next move before any on-chain transaction.

This architecture produces what INFINIT calls deterministic intelligence. Identical prompts under identical conditions will always yield identical outcomes.

What determinism doesn’t solve, however, is the trust gap common to all AI systems. Users still need assurance that the prompt, the reasoning steps, and the resulting plan weren’t altered somewhere along the way.

This is where INFINIT’s recent integration with EigenCloud adds an additional layer of rigor.

Through verifiable LLM inference (EigenAI) and attested compute (EigenCompute), the system can cryptographically prove that the models executed were the intended ones and that no intermediate steps were tampered with.

In practice, it turns INFINIT’s deterministic planning into verifiable planning, an extra safeguard before anything moves on to execution.

The Agent Swarm: Turning Reasoning into Action

Once the reasoning engine knows what to do, the Agent Swarm handles the how.

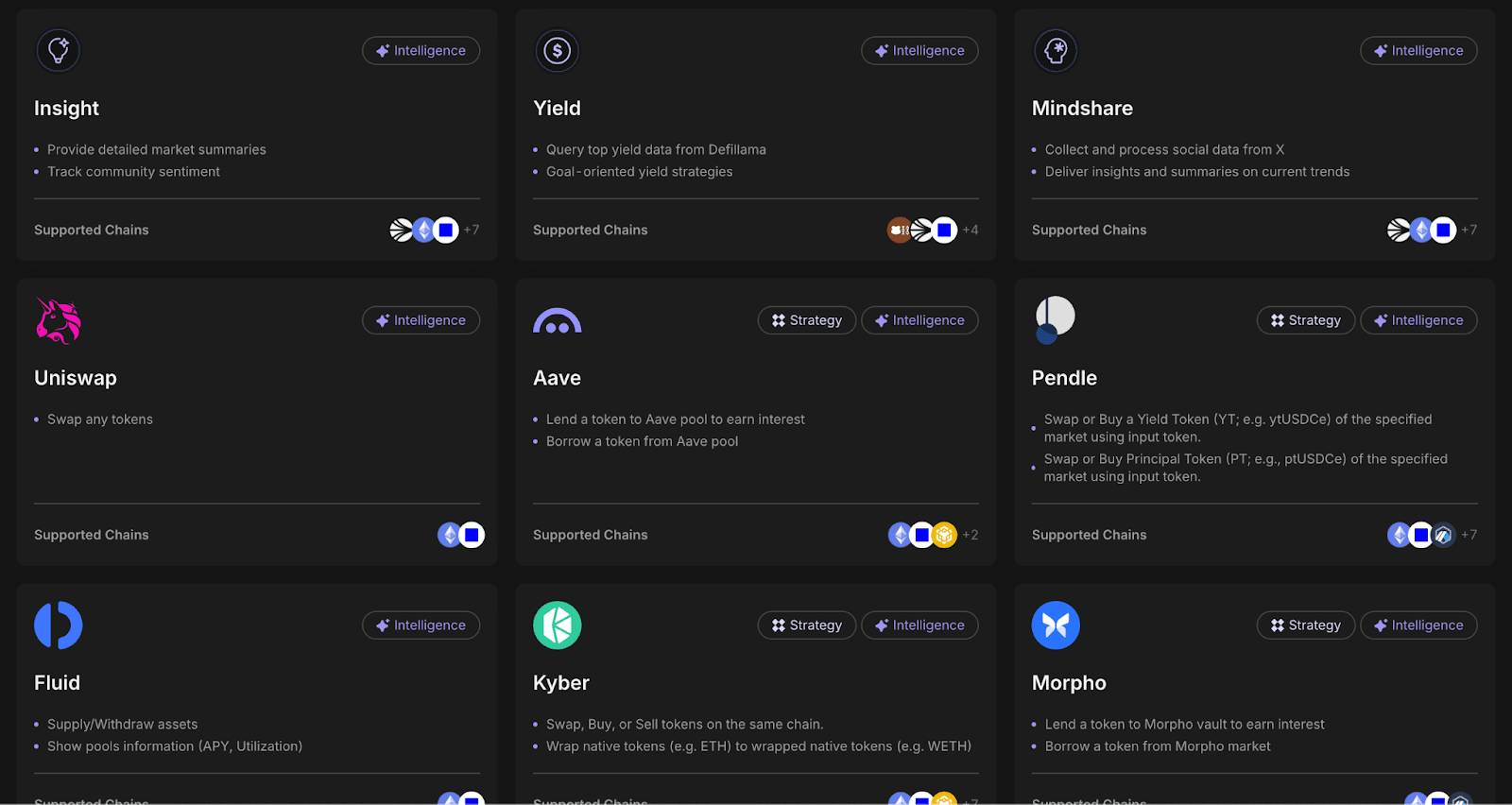

It’s a coordinated network of over 30+ specialized DeFi agents, each one trained to execute a specific function or integrate directly with a specific protocol:

Uniswap or Jupiter for swaps, Aave and Morpho for lending, Pendle for yield trading, LI.FI for bridging, and so on.

Agent View on the INFINIT app

This is one of the biggest reasons INFINIT stands apart from many other “AI + DeFi” platforms. Often, those rely on a few generalist agents that issue high-level commands or basic swaps. INFINIT went the opposite way, creating agents that deeply understand how individual protocols work.

These agents know the nuances of collateral factors on Aave, the reward mechanics on Pendle, and the routing paths on Jupiter that make them go beyond just “how to yield farm,” but how to yield farm here, on this chain, in this moment.

Layered along with these protocol-level specialists are the cognitive agents like Insight, Yield, and Mindshare that give the system its higher-order intelligence:

Insight Agents parse market data, sentiment, and governance activity to understand context.

Yield Agents crunch DefiLlama data, scan pool APYs, and simulate goal-oriented strategies.

Mindshare Agents process social signals from X to detect early narrative rotations before they hit the numbers.

Together, they operate like a hive mind. The execution agents handle precision, the cognitive agents provide perspective.

How It All Comes Together

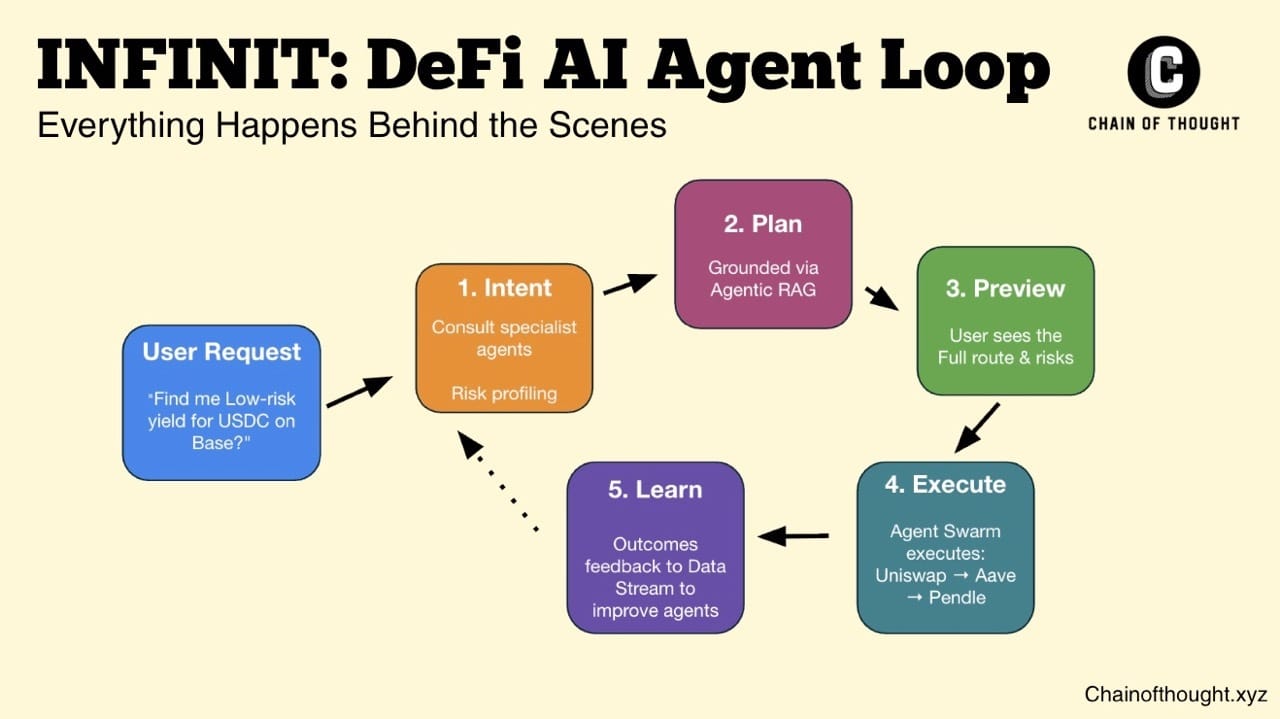

From a user’s perspective, it’s quite simple: you chat, and it executes. Behind the scenes, a full cognitive loop unfolds:

Intent → Plan → Preview → Execute → Learn

Intent

User asks: “Low-risk yield for my USDC on Base?” or “Loop my stables,” or simply connects a wallet and asks, “What should I do?”. Intelligence consults the Insight/Yield/Mindshare agents + looks at the wallet context to propose options tailored to holdings and risk

Plan (ReAct + Collaboration)

A step-by-step plan is composed: bridge → swap → deposit → loop with parameterization (slippage, health factors, etc). Plans are produced before any transaction and grounded via Agentic RAG against live data.

Preview (Determinism & Transparency)

User sees the full route, contracts, expected receipts, approvals, and risks. It’s not a black box.

Execute (Agent Swarm)

Protocol agents carry out their atomic steps in the right order non-custodially, with the user signing once (or bundled into a single flow where supported).

Learn (Feedback Loop)

Outcomes (gas, success rates, realized APY, route efficiency) feed back into the Data Stream. Over time, future plans get cheaper, faster, safer.

The more people use the network, the sharper its execution becomes as the data improves intelligence, and intelligence improves execution. This becomes a compounding advantage.

The Two Core Products: (1) Intelligence and (2) Strategies

All of this infrastructure powers two products that make INFINIT feel less like an app and more like an intelligent coordination layer for your capital.

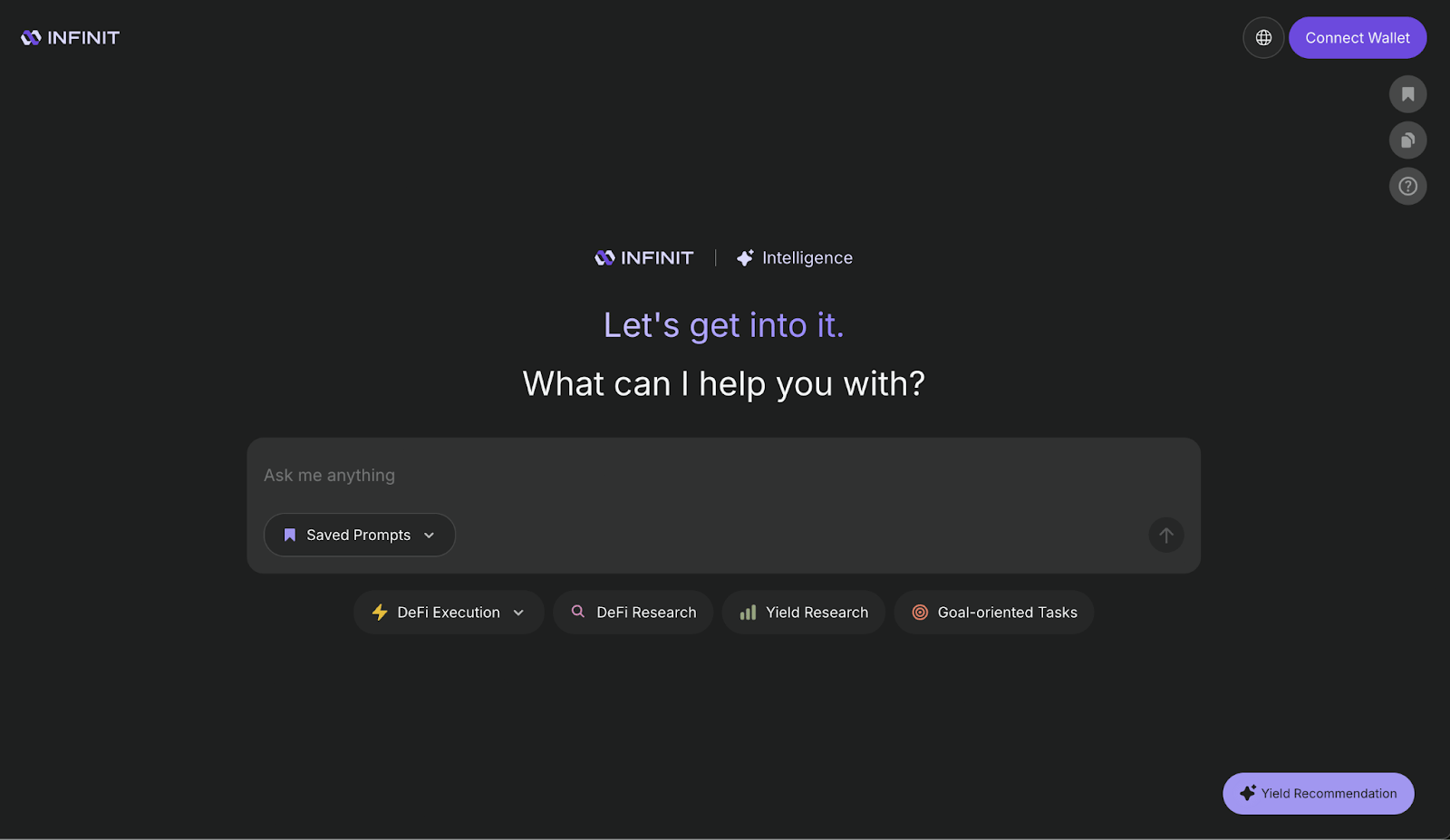

1. INFINIT Intelligence

INFINIT Intelligence is the conversational front door that translates intent into insight.

You connect your wallet, and it immediately starts reading your on-chain life, like the assets you hold, how active you are, and the level of risk you seem willing to take.

From there, it curates personalized opportunities: yield strategies, lending options, or delta-neutral setups that fit your portfolio and temperament.

I think of it as a DeFi-focused ChatGPT that gives you a plan and helps your research.

INFINIT Intelligence Chat Window

You can ask it anything, like “What’s the best stablecoin yield right now?” or “Where can I put my idle ETH to work?”. Intelligence checks your wallet, pulls fresh data from the Data Stream, routes the question through the right agents, and answers with concrete, wallet-specific suggestions.

The result is an adaptive, context-aware experience that feels like talking to a financial copilot that actually knows you.

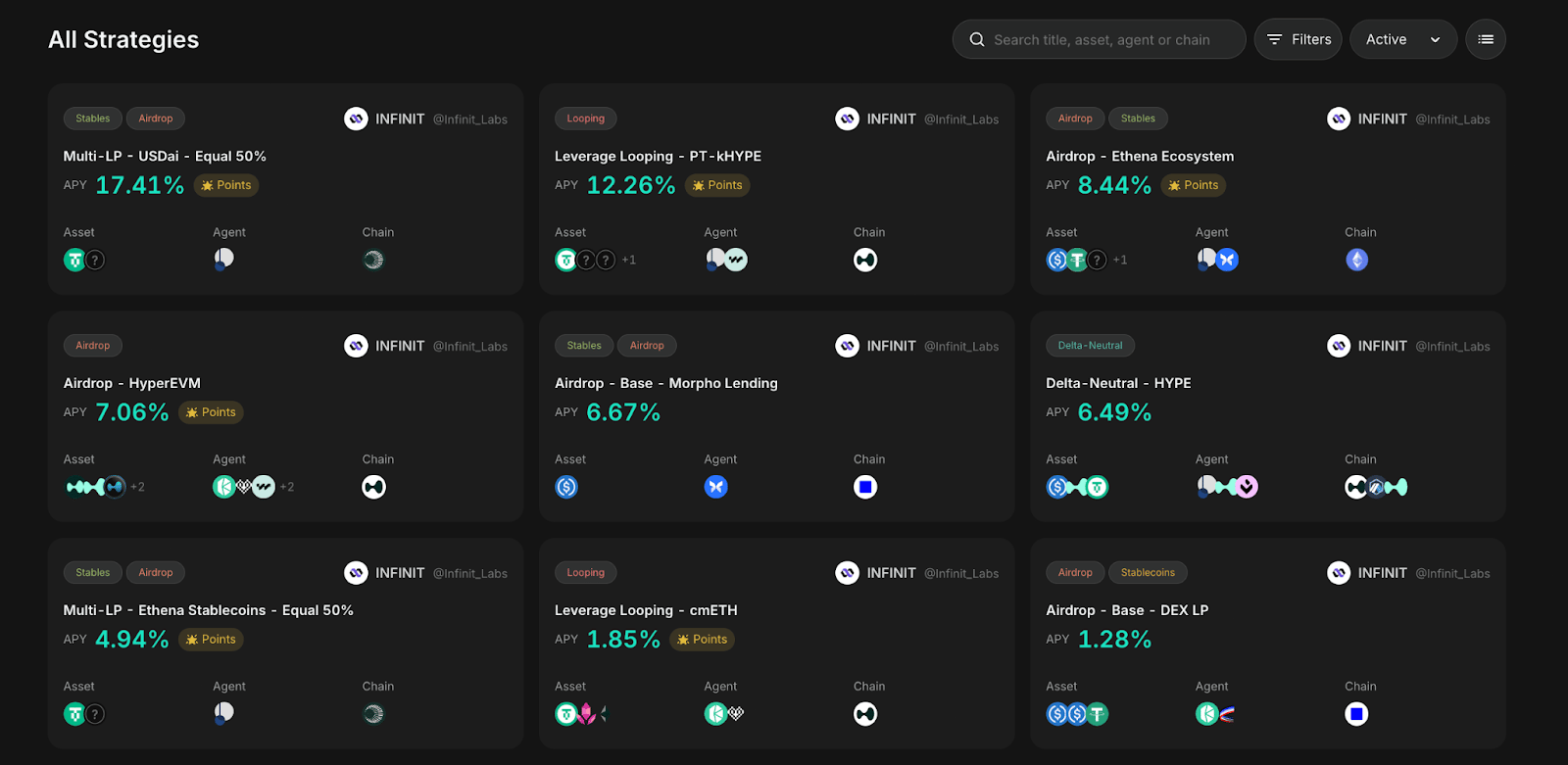

2. INFINIT Strategies

If INFINIT Intelligence is where users learn, and the Agent Swarm is where coordination happens, then INFINIT Strategies is where both collapse into action.

At their core, strategies are bundled DeFi flows with multi-step transactions that combine swaps, bridges, lending, and staking into a single, deterministic action. Instead of jumping across apps, you trigger one flow and let the agents execute it end to end.

The current Strategies tab includes a set built by the INFINIT team that cover yield paths, delta-neutral approaches, and even airdrop farming.

Strategies View on the INFINIT app

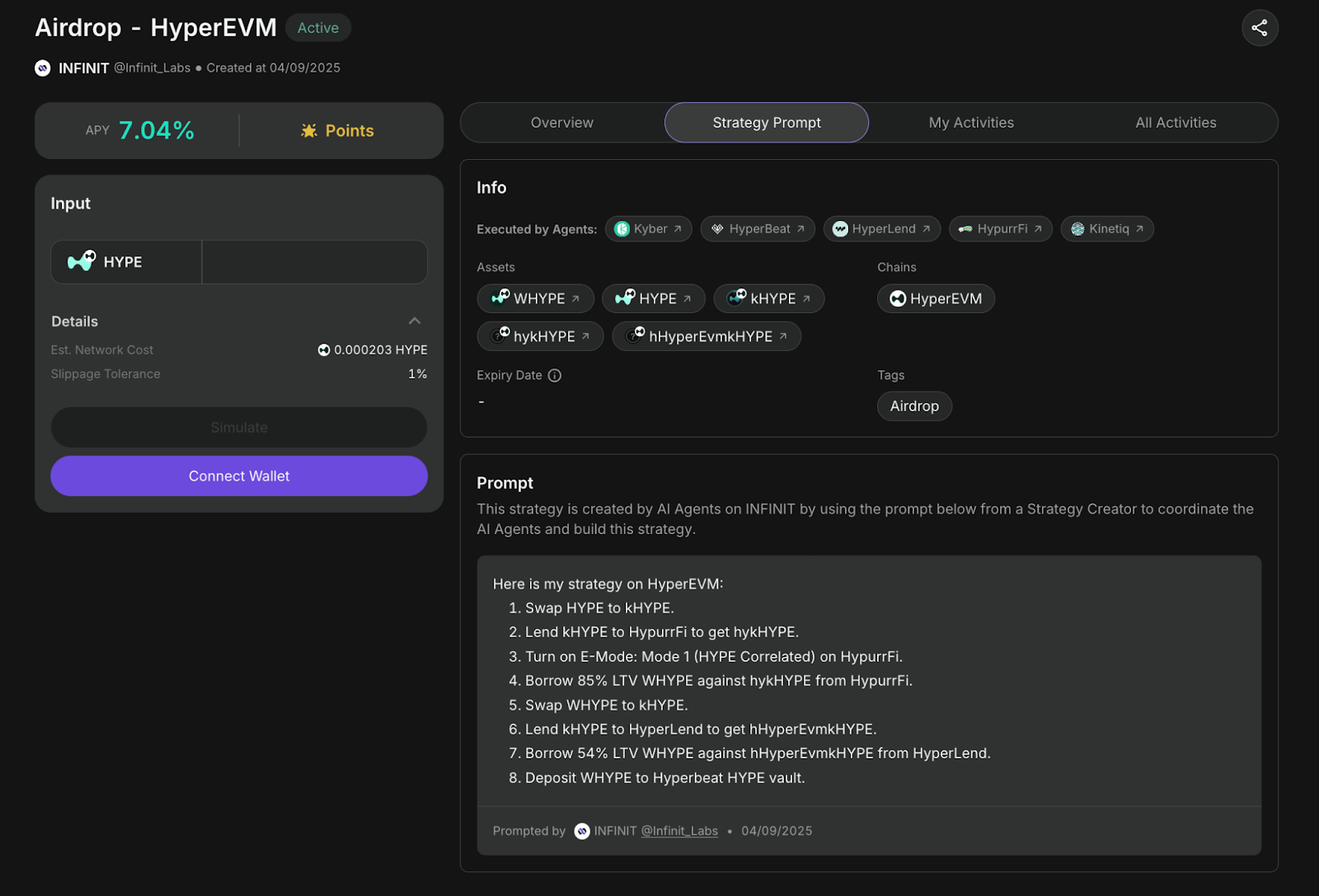

To understand how this system performs in practice, I tested one of its live strategies: airdrop farming on HyperEVM. The strategy was built using INFINIT’s native modules and spanned eight steps across multiple protocols.

I started with 100 USDC on Ethereum. The strategy required HYPE tokens on HyperEVM, so the first step involved bridging and swapping assets. Normally, this would require 3–4 separate tools: LI.FI for bridging, a DEX aggregator for routing, and manual approvals at each stage.

INFINIT compressed that flow. I input the amount, selected the strategy, and the agent swarm simulated the entire route: bridge USDC → swap to HYPE → deposit → loop → stake. Before anything was executed, the preview surfaced each transaction with contract addresses, expected outputs, slippage parameters, and risk flags.

Airdrop-HyperEVM Strategy execution tab on INFINIT

Execution was non-custodial. I approved each transaction manually (15 in total) because bundling isn’t yet live on all chains. That was a minor friction point, though still far better than juggling multiple wallets, bridges, and dashboards. The simulation matched the outcome precisely. No missed approvals, no failed txs.

The only obvious gap was unbundling. Exiting the position still requires manual unwinding, although the team confirmed a “reverse route” function is being implemented. Once that’s live, a single prompt could close the loop entirely, bridging assets back and returning funds in native form.

Overall, the experience felt like I was actually in control.

Prompt-to-DeFi: From Running Flows to Writing Them

While playing with Strategies, one thing stood out: every “card” is basically a multi-step prompt compiled into on-chain actions. The next natural step is to let users write the prompts themselves.

That’s the idea behind Prompt-to-DeFi.

Instead of waiting for a prebuilt card, power users will describe the flow in plain English like “Bridge 100 USDC to HyperEVM → swap to HYPE → lend here → borrow 65% LTV → loop back” and INFINIT will parse it, check collateral/risk, simulate the route, and package it into a deterministic one-click execution.

Intelligence stays in the loop, so prompts are validated against live data before anything hits the chain.

The second-order effect is the interesting part. It enables a strategy creation marketplace.

Think about the people who publish DeFi guides today, like DeFi Dojo, Humble Farmer Taiki, whoever you follow. They post threads and videos that users try to copy. With Prompt-to-DeFi, they can publish live strategies instead. Their audience can execute the plan in one step, creators earn a fee per run, and users get repeatable and auditable flows instead of juggling multiple tabs and half-understood instructions.

This is still in early access with the waitlist opening up recently, but the direction is clear:

Users → Creators: from consuming strategies to authoring them.

Guides → Live code: from tutorials to executable prompts.

One-offs → Composables: strategies you can fork, remix, and version as markets change.

If Strategies made DeFi feel like an app store for money flows, Prompt-to-DeFi turns it into GitHub for strategies, where the best ideas can be shared and executed.

Why INFINIT Feels Different

There are plenty of AI agent apps and protocols trying to solve pieces of this stack. Some stay narrow, some stretch wide, and in the end, which one I (and other users) use comes down to trust and personal comfort.

If I had to pin down why INFINIT feels interesting to me, it really comes down to three things:

First: it actually scales composability.

Most “agentic DeFi” systems can place a trade or route a swap and then call it a day. INFINIT feels more like watching a well-rehearsed pit crew. One agent opens a position on Hyperliquid, another models Pendle spreads, others handle routing, loop sizing, gas, collateral limits, and risk checks. All inside one coordinated path. It’s the first time I’ve seen multi-step DeFi logic feel like it was built to work at real scale.

Second: it stays aware.

You know that moment when you realize you haven’t checked incentives for a few days and suddenly your “great yield” is basically pocket change? As incentives shift, liquidity dries up, or collateral factors move, the intelligence layer adjusts its understanding and surfaces new options without asking you to babysit dashboards. It keeps track of the mess.

Third: I stay in control.

I’m still not ready to hand my funds to an autonomous agent and hope it doesn’t pull a “clear cache = delete your life’s work” move as this agent did. Maybe I’ll feel differently in a few years, but not today. INFINIT’s design respects that. It never moves anything without a prompt. The system can suggest, but I sign off on the actual money movement. For where agentic finance is right now, that feels like the sane middle ground.

Section II: The Business

Here, we analyze the demand drivers, business model, and go-to-market strategy for INFINIT.

The Demand Side: Who Uses INFINIT?

So far, I’ve outlined how INFINIT takes coordination logic and turns it into infrastructure. That makes it less of a competitor to other agent tools and more of a mesh that ties them together. Its architecture can plug into wallets, fintech apps, and even external AI networks through standards like Google’s A2A.

The next question is: who’s using it and where does the demand come from?

It starts with DeFi users, but it stretches well beyond them. INFINIT is built for a world where humans, agents, and institutions (surprise) operate on the same rails.

1. Direct-to-Consumer: Retail DeFi users

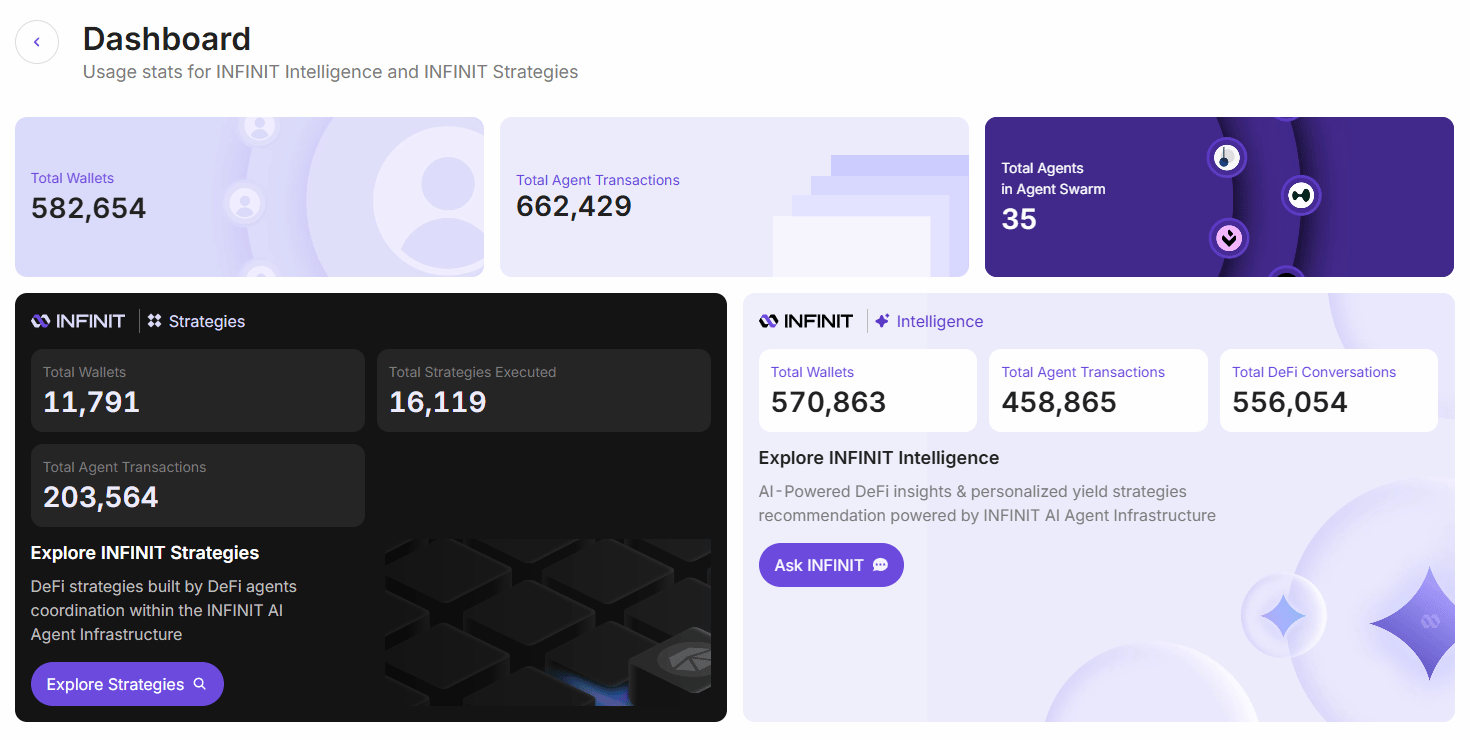

INFINIT already has real usage. Over 580,000 wallets have interacted with its ecosystem, generating more than 660,000 transactions through its agent framework.

Source: https://infinit.tech/dashboard

Some of that early growth is tied to airdrop farming, which is normal for any new protocol. But the deeper numbers show steady engagement.

Over 560,000 wallets have used INFINIT Intelligence to discover and compare yields

9,000+ wallets have executed real strategies, completing over 16,000 multi-step transactions through the Agent Swarm.

These are not isolated one-off actions. They point to repeat behavior and growing trust.

And with new wallet partnerships with Binance Wallet, Bitget Wallet, and Gate Web3 Wallet, INFINIT is gaining distribution across some of the world’s largest active crypto user bases. Even if a fraction of those users start using one-click strategies, INFINIT could move from thousands of power users to millions of retail participants.

That’s the visible demand layer: the people. But the more interesting demand story is what’s happening under the surface.

2. Agent-to-agent (A2A): Other AI Agents

As AI agents take on more operational tasks, like scheduling, payments, and treasury management, they will need trusted execution rails. INFINIT wants to be that layer

Standards like Google’s A2A (Agent-to-Agent) and emerging protocols such as x402 are gaining traction. It’s obvious that we’re heading toward a world where agents will need to pay agents.

In that world, INFINIT acts as the DeFi execution layer for other AI agents, handling swaps, hedges, yield allocation, or treasury management on-chain with deterministic reliability.

The recent partnership with Google is proof that the team sees demand emerging from there.

Another step in this agent-to-agent demand is their recent integration with Virtuals.

INFINIT’s DeFi Agent Swarm will be accessible to over 17,000 active agents through the Agent Commerce Protocol (ACP).

In simple terms: any AI agent using Virtuals can now tap INFINIT for on-chain execution, strategy simulation, or DeFi data with no custom integration required.

DeFi stops being a human interface problem and shifts into a machine-native service.

Every new ACP integration increases the number of agents that can interact with INFINIT’s brain, compounding distribution without adding new users manually. Note: this is still early in terms of actual usage today.

3. The Creator Layer

There’s also the human side of this system: the people who design strategies.

DeFi educators and content creators like DeFi Dojo, Taiki Maeda (Humble Farmer), and DeFi Dad have all seen a noticeable uptick in engagement since 2023. Their followers are sticky, high-intent, and capital-active. INFINIT’s Prompt-to-DeFi gives this group a way to turn their knowledge into something executable.

Using plain language, a creator can publish a live strategy that anyone can run in one step. Each execution pays the creator a fee. Their content becomes an interface instead of a tutorial, which finally closes the loop between “learning DeFi” and “doing DeFi.”

And that creates a real feedback cycle. A strategy is published, users run it, the system records the activity, and the creator gets paid. As more strategies go live, more volume runs through INFINIT’s core engine.

The implications are potentially massive:

It turns social capital into transaction volume. Every engaged community becomes a liquidity cluster.

It creates repeatable retention loops. Followers can execute alongside their favourite creators.

It amplifies network growth. Each new strategy published is both content and product, discovery and demand rolled into one.

Over time, this could make INFINIT a hub for the long tail of financial creativity, with thousands of small creators each powering their own micro-economies of users and strategies.

And because execution happens through the same agentic infrastructure, every creator-driven flow feeds back into the main loop: more usage → more coordination fees → more staker rewards → more network demand.

That’s the kind of organic, compounding growth no incentive program can fake.

4. Expanding into TradFi: Agentic Finance

While most demand today comes from DeFi, INFINIT’s long game is bigger: agentic finance, bringing the same coordination logic to traditional money movement.

The team saw the opportunity to adapt its core agentic infrastructure for banks and payment networks. Early pilots will focus on automating everyday financial actions: recurring payments, cross-border transfers, and merchant transactions, handled by AI agents. This is already in progress, and I expect some major announcements soon.

The system remains the same under the surface. The same logic that compresses DeFi strategies into single actions now applies to tasks like paying suppliers or settling accounts across borders.

Banks and fintechs know they will need agent-ready infrastructure. INFINIT is well positioned to supply it. By keeping the rails crypto-native (stablecoins, on-chain wallets) but wrapping them in Web2-ready logic, INFINIT is building the bridge between open finance and regulated agentic systems.

It’s the same thesis that powers its partnerships with Google and Virtuals: composable coordination for humans, agents, and institutions alike.

Challenges & Open Questions

Even with early traction and strong partners, INFINIT still faces several real uncertainties that could shape how far it goes.

User trust is the first hurdle.

A lot of DeFi users still hesitate to grant permissions or let agents run multi-step actions, even with a clear preview. I don’t blame them; every week I come across a new story about a crypto hack or an exploit. For INFINIT’s model to work, people have to feel comfortable handing over that coordination layer.

Smart contract risk doesn’t disappear.

Every coordinated flow touches multiple protocols and chains. Deterministic planning reduces mistakes, but the system still inherits the weakest link in every contract it interacts with.

Retail users need clarity, not magic.

As flows grow more complex, even abstracted coordination can overwhelm users who don’t fully understand looping and LTV. Abstraction helps, but it doesn’t erase the need for education.

INFINIT’s design, via deterministic outputs, transparent previews, user-controlled execution, addresses part of this. The friction points are still real, and they deserve to be acknowledged as the system scales.

Section III: Tokenomics

Demand only matters if the system can return value to the people who keep it running. That includes users, stakers, and creators, who are actually driving coordination. This is the role of the token IN.

IN is the incentive layer and the currency that turns network activity into tangible economics.

Supply-Side

Source: INFINIT Docs

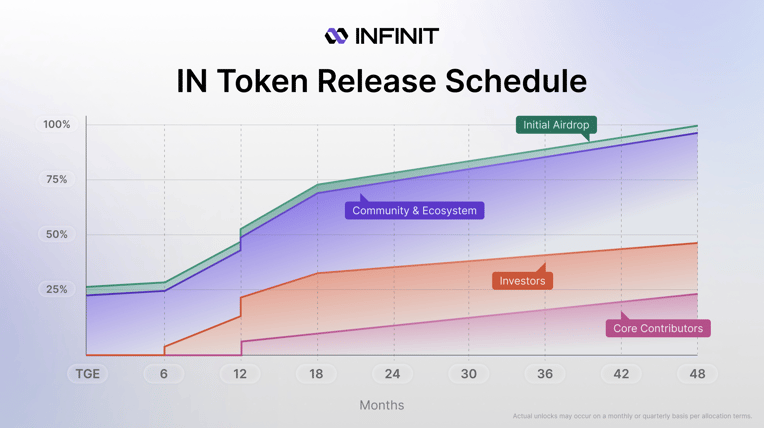

IN has a fixed cap of 1 billion, with predictable unlocks that extend through 2029.

At launch in August 2025, 26.3% of the supply, or about 263 million tokens, entered circulation.

Breakdown as follows:

49.5% for Community & Ecosystem: 21.3% (213M) unlocked at TGE; the remaining 28.2% vests monthly for 48 months (~0.6% of supply per month).

25.5% for Investors: 6-month cliff, then 12-month linear vesting (Feb 2026 → Feb 2027). This is the big unlock window.

20% for Team: 12-month cliff, then quarterly vesting over three years (through ~Aug 2029).

5% Initial Airdrop: Fully unlocked at launch to early users and community members.

As of December 2025, the circulating supply is ~260M IN (26%), giving IN a $20M market cap at a $90M FDV.

IN token price chart

The major supply shock arrives in February 2026. That’s when investor tokens (25.5% of total supply) begin linear vesting. In practice, that means over 250 million tokens will enter circulation over 12 months, which will increase sell pressure unless network adoption rises at the same pace.

The unlock schedule is fixed. Growth is not. The long-term picture depends on whether usage and transaction volume can accelerate fast enough to generate sustainable fees. The open question is how users behave once coordination moves from “free” to “paid” as fee switches come online.

Demand-Side

The good news is that there are functional reasons to hold and stake IN.

Staking & Fee Sharing

Staking IN gives access to a share of the protocol fees generated by agent executions and one-click strategies. Fee switches are not active yet, so current yields come from earlier product revenue (roughly $2M). Once enabled, rewards will be tied directly to coordination volume.

Platform Access

Staked IN unlocks premium product features. The more you stake, the more access you unlock:

Fee discounts on complex strategies (e.g. delta-neutral loops, Pendle positions)

Priority access to new “Prompt-to-Strategy” modules and advanced AI agents

Gated creator strategies and KOL strategy pools

Higher usage caps within INFINIT Intelligence

Governance

IN holders can propose and vote on changes to fee parameters, agent onboarding, and emission rules. Governance will progressively decentralize as INFINIT matures.

Revenue Model

INFINIT has kept its fee switches off on purpose. The priority so far has been simple: make DeFi usable before charging for anything. Reduce friction first, monetize when the coordination loop is strong enough to support it.

When it does turn on, the model looks like this:

Execution Fees (B2C): Every on-chain action routed through INFINIT’s agents will carry a small coordination fee, likely in the 0.1–0.3% range depending on complexity. The revenue flows back to the treasury, stakers, and strategy creators. The exact percentages haven’t been published yet.

Subscriptions: Access to INFINIT Intelligence (its suite of AI-powered research, analytics, and strategy tools) will use a usage-based subscription model. Advanced features will be aimed at power users and institutions that need deeper execution insights and more capable agents.

Agent Infrastructure (B2B): INFINIT’s agent stack is already wired into systems like Google’s A2A and Virtuals’ ACP, allowing outside agents to rely on INFINIT for execution. These interactions will be metered and billed through API-style pricing. This creates recurring revenue that scales with agent activity, not human user growth. Similar integrations could expand into enterprise and SaaS channels over time.

From Alpha Finance to the Agentic Frontier

Every startup begins with a gap that someone sees clearly while others don’t. For Tascha Punyaneramitdee, that gap was coordination. I’ve been speaking with Tascha for months, and she sold me on her vision for the future.

Back in 2020, when DeFi got its second wind, she co-founded Alpha Finance Lab, the protocol that first brought leveraged yield farming to the masses. It was the right product at the right moment, a tool that gave users leverage without writing a line of code. Within weeks, hundreds of millions in TVL flowed in. At its peak, it was pushing around $2B.

The success gave Tascha a front-row seat to DeFi’s paradox: the technology worked, but it only worked for a certain subset of crypto users. The experience demanded spreadsheets, patience, and nerve.

Tascha Punyaneramitdee (CEO and Co-Founder, INFINIT)

Tascha knew this problem well. A UC Berkeley graduate and a Harvard Business School dropout, she had dissected structured products at Jefferies, managed consumer fintech at Tencent, and grew up inside the world of financial abstractions.

She realized that the gap between usability and potential was impossible to ignore.

“People shouldn’t have to study finance or Solidity just to make their money productive,” she said early on.

That idea became the seed for INFINIT.

In 2023, she decided to work on building something above the protocol layer: a system that could reason about DeFi the way humans reason about goals.

“What do I want to achieve?”

Not ”Which contracts do I call?”

To bring that vision to life, she teamed up with Nipun Pitimanaaree, one of Thailand’s most decorated mathematicians and an MIT-trained engineer specializing in distributed systems. Where Tascha thought in incentives, Nipun thought in proofs. A partnership between market intuition and mathematical rigor.

Together, they began designing the coordination architecture that would later become INFINIT’s Agent Swarm. They kept the team small but with an obsession. Engineers from ConsenSys, a designer from Alpha’s innovation lab, and a rotating crew of DeFi power users testing early prototypes.

By late 2024, that obsession had found serious backers.

INFINIT raised $6 million in seed funding led by Electric Capital and Hashed, with participation from Arthur Hayes’ Maelstrom and Mirana Ventures.

It was a bet on the missing layer between intelligence and execution, the brain that could make decentralized finance finally feel seamless.

What We Would Do

Putting on my strategist hat, here’s how I’d think about INFINIT’s next move.

So far, the team has stayed inside DeFi’s borders, where permissionless rails let them build fast and show what agentic coordination can do. That was the right call.

But the bigger prize for them sits outside crypto: traditional finance. Payments, credit, settlements, treasury automation. All of it is coordination, and INFINIT already has the machinery for it.

The bottleneck is regulation.

If compliance frameworks around agentic finance remain slow or fragmented, INFINIT’s expansion into TradFi could stall. That would confine growth to the retail degens in DeFi. Still lucrative, but a much smaller total addressable market.

To break out, INFINIT needs a two-track approach.

Go where the walls are lower: Some regions are already more open to AI-native and crypto-native coordination systems. Southeast Asia stands out, particularly Thailand and Indonesia. These markets are digital-first, heavily underbanked, and relatively fast-moving on regulatory clarity. Major global players like Stripe and Apple Pay still face licensing barriers there, which creates space for programmable,stablecoin-based infrastructure to gain traction.

Prove usefulness first: Regulators respond to results. If INFINIT can show that agentic coordination reduces error rates and lowers operational costs, it becomes easier to justify letting the system plug into real financial workflows.

So this is what I would do:

Continue to grow protocol usage rooted in DeFi

Launch in emerging markets where policy can move quickly

Win adoption in relatively neutral execution domains (treasury, settlement)

Avoid zones of regulatory entanglement (advice, custody, leverage)

If INFINIT can show that agentic finance is coordination made efficient — not speculation — regulators will open the door. If it can’t, it risks becoming an advanced DeFi tool with limited reach beyond crypto.

Conclusion

We started with the idea that finance uses complexity to keep people out. TradFi did it intentionally. DeFi did it…well, accidentally.

After 7 years in crypto, I’ve learned a simple truth: every time we try to “fix” complexity, we usually end up stacking more of it. DeFi fell right into that trap.

What I appreciate about INFINIT is that it doesn’t try to add another layer. It coordinates the layers we already have. If it works, I won’t need to diagram flows or decode contracts. I’ll tell the system what I want, and it will figure out the steps.

That’s how the future should feel.

Thanks for reading,

0xAce and Teng Yan

Useful Links:

If you enjoyed this, you’ll probably like the rest of what we do:

The Agent Angle: Weekly AI Agent newsletter (non-crypto)

Our Decentralized AI canon 2025: our open library and industry reports

This essay was supported by INFINIT, with Chain of Thought receiving funding for this initiative. All insights and analyses are our own. We uphold strict standards of objectivity in all our viewpoints.

This essay is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investments.