GM {{ First Name | }}

Gary’s out. For real this time. And the markets are rejoicing.

AI agents will take over our world. But first, they need to conquer memes. Whether it's Lola, Flower, or Aixbt, they are learning to trade memes better than us humans.

While the market does a full 180 chasing TikTok trends and meme coins, we’re sticking to the grind—digging deep into Crypto AI because we’re really just chill guys…

Source: Decrypt

PSA: We’ve just hit 2,000+ subscribers! A big thank you for following our writings every week. 🫶

Keep an eye on your inbox over the next few weeks. We’ve got a ton of alpha coming your way, including Part II of our Crypto AI thesis.

In this edition of our weekly AI Edge, we cover:

Lush AI is growing steadily

Drama of the week: ai16z and the Elizas

Sekoia: the best on-chain venture capital AI agent

🦍 State of the Market..

The Crypto AI market climbed another 8.7% this week, pushing its total market cap to $35.4 billion. That’s three straight weeks of gains, a bull market in full gallop.

But apparently, a rising tide doesn’t lift all boats…

LUNA is this week’s biggest loser, dropping 30% to $47M market cap. Why the selloff? The “TikTok meta” seems to be the culprit. Investors are dumping their AI bags for shiny new TikTok coins, chasing the latest speculative high.

Throw in BTC dominance hitting its yearly peak, and it’s no surprise altcoins are feeling the pressure. NMT and FLT joined the pain parade, dropping 15% and 11%, respectively.

Some AI tokens refused to roll over. Take ZEREBRO, which exploded 311% in a week. That’s fueled by a renewed interest in its predictive modelling capabilities and a very vocally active dev who wrote about Web4 and the road to AGI.

VIRTUAL is up 42% this week despite LUNA’s decline. We wrote a deep dive on Virtuals protocol earlier this week. In short, it’s a great place to launch agents.

It’s looking increasingly likely we’ll get an “AI agent summer” in the coming weeks.

📊 Chart of the Week

Lush AI’s 3-Month Growth

Since launch, Lush AI has earned $20,176 in total revenue and amassed 6,780 users. That’s steady, methodical growth over just three months.

Lush AI taps into generative AI to create and monetize hyper-realistic AI influencers, targeting platforms like social media and OnlyFans.

Jenny is their flagship model (pun intended). She’s a viral AI agent with her own token, where token ownership unlocks new content, including NSFW material. They were even recently covered by Al Jazeera.

The world faces a loneliness epidemic, and there’s a real demand for AI companionship.

🌴 ELIZA, eliza, and ai16z

If you’ve seen the headlines about ai16z DAO and the $Eliza tokens, you’re probably scratching your head. It’s a tangled web (i.e mess), so let’s unpack it step by step.

The Key Players:

Eliza: A framework for creating AI agents with multi-model features and app integrations.

ai16z DAO: Known for launching the first AI-led hedge fund via its AI agent Marc AIndreessen). ai16z DAO also created degenspartanai and the open-source AI agent Eliza framework. They partnered with vvaifu.fun to launch AI agents on their platform but insist their involvement ends there. Shaw is the founder/partner at ai16z DAO and is the face of the project.

vvaifu.fun: A launchpad for AI agents and the original home of $eliza

$eliza (ai16zeliza): Launched on vvaifu.fun on November 17th, this token initially represented Eliza framework

$ELIZA (Eliza): A separate token launched by ai16z DAO just days later on November 20th

On November 17th, a community took the reins, launching $eliza, an AI agent on vvaifu.fun. Surprisingly, Shaw consented to the community-driven launch and even greenlit a full community takeover of the project.

The response was electric. $eliza climbed to a market cap of around $40M+, with the community rallying strongly behind the token.

On November 19th, Shaw dropped the bombshell: ai16z DAO was launching a new $ELIZA token via pump.fun. To smooth things over, he announced that holders of the original $eliza would be airdropped the new $ELIZA token.

The reaction? Mixed, to put it kindly. The original $eliza token tanked, plummeting 75% after the announcement. Meanwhile, the new $ELIZA token took off like a rocket, soaring to a $40M market cap before hitting an all-time high of $60M later that same day.

A tale of two tokens—and a community caught in the crossfire. Many people got rekted.

Source: Dexscreener

Under fire from the community, Shaw took to X, releasing multiple statements to address the growing backlash. But the drama didn’t end there. A sharp-eyed sleuth uncovered an ai16z DAO partner’s wallet, revealing evidence that he had dumped $eliza to scoop up $ELIZA, reaping substantial profits.

To cap it all off, Shaw announced that the implicated partner had parted ways with ai16z.

If there’s one thing we’ve learned in crypto: always bet on the most entertaining outcome.

🏆 Caught Our Eyes..

Project Updates

Vana announces the Vana foundation and the upcoming launch of the Vana mainnet and token.

Almanak, a platform for creating and testing financial agents in crypto, will be the first token launch on Legion, a reputation-based launchpad for ICOs. Watch this closely.

Holoworld AI launches its Agent Market on Base. With it, everyone can create 3D-rendered, autonomous AI and personalize, monetize, and unleash these agents.

AI Arena/ARC announces ARC RL (reinforcement learning), a new platform to create superintelligent gaming agents by crowdsourcing gameplay data.

Zerebro goes live on Kamino’s automated Liquidity Vault. Deposit SOL and ZEREBRO to earn ZEREBRO incentives.

Hyperbolic allows developers to quickly create and share interactive AI apps with the Hyperbolic Gradio package on Github. Co-founder Yuchen Jin built a tic-tac-toe game with a simple prompt.

Ora Protocol announces its tokenomics. It is launching on Ethereum with an initial FDV of $333,333,333 (we don’t know why the 3s). They are also implementing a version of DAICO, a hybrid of DAO governance and ICO fundraising.

Vvaifu.fun crosses 400+ agents brought to life with 15000 messages and $200M in volume on launched agents.

Morpheus goes live on their mainnet with $17M in rewards available for compute subnets.

Prime Intellect’s 10b decentralized training run reaches 90% training progress and is training across the US, Europe, and Asia.

Netmind AI completes a buyback of $100,000 worth of NMT and a burn of 3.49 million unmined NMT.

Nillion Network announces a new SDK v0.7.0 that enables a smoother developer experience.

Kuzco, a distributed GPU marketplace for inference, completes Epoch 1, with 2,700+ workers participating.

Bittensor

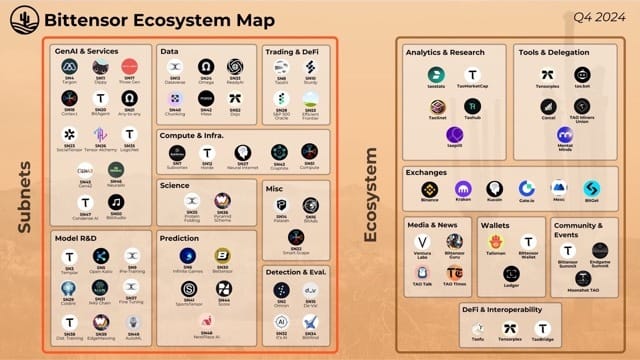

Our friends at TAO times put together a Bittensor ecosystem map.

Yuma announces its intentions to incubate, invest in, and build Bittensor subnets. This subsidiary of DCG is led by Barry Silbert. It’s going to be a big week.

Condense AI (SN47) launches to compress LLM prompts to improve efficiency.

Document Understanding (SN54) launches to process scanned documents.

Endgame is the first Bittensor Summit, which will take place in April 2025. It will focus on answering big questions and expanding quality subnets and miners.

Taopill AI now integrates Bittensor research and media. Taopill Research delivers in-depth subnet and ecosystem analysis, while Taopill Digest offers lighter content with updates and subnet news.

🔥 On X..

OpenAI’s AI agent Operator is coming in January. It will be able to use your computer to buy things.

Anard Iyer outlines his plans for Sekoia to be the best-performing on-chain VC

Where’s the edge/alpha with all these trading AI agents?

Accelxr goes deep on AI agents with this mega report

Infinitely expressive blockchains are inevitable

The API Key to the Internet: Grass

Advait’s list of exciting Crypto AI projects

Why do AI agents need to transact on-chain?

The Luminous Protocol: Complexities of Human-Agent Collaboration

Inference costs are decreasing exponentially since GPT-3 in 2022

Article: Web 4.0: The Agentic Web

Article: AI Agents in DeFI

That’s it for this week! If you have specific feedback or anything interesting you’d like to share, please just reply to this email. We read everything.

Cheers,

Teng Yan & Joshua

Did you like this week's edition?

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.