Happy friday {{first_name}} !

Back from Token2049, my favourite conference of the year! Well, mostly because I get to stay put while everyone flies into Singapore. The crowd was a bit lighter than last year, but still a strong showing. As always, the real alpha was in the side events and hallway chats.

If we caught up in person this week, amazing. So glad to have met you IRL! If not, there’ll be other opportunities.

Some of my takeaways from T2049 were:

Data is the bottleneck. Nobody agrees on how much or what kind of data is needed to scale models, especially in robotics. Evals are critical, and simulations could unlock 100x more training material. One bold claim: we’ll need a billion hours+ of robot data to reach general AI.

Agentic payments could be a trillion-dollar market. Human payments have many intermediaries (Stripe, Coinbase, etc.) that already dominate. Agent-to-agent payments need an entirely new system. Today it’s literally a $0 market, but new players like KiteAI are racing to become the execution layer before the big players set the rules.

Market cycle check. Many fund managers think we’re in the final inning of this bull run. Not that we’re going down, but consider how final innings always play out

Random convo: Robots feeding humans is massive. From kitchen robots like Posha to rotimatic-style devices, the market for automated food prep is a surprisingly huge market.

In other news, Sora 2 finally dropped, and the internet wasted no time doing what it does best: creating unhinged content. Within hours, people had Sora generating videos of fake crimes and were pumping out levels of slop never seen before.

Still, it wasn’t all bad. I mean, it brought Bob Ross back to life.

On one hand, it’s one of the most impressive video generation models we’ve seen. On the other, it’s catching plenty of heat and criticism for “fueling the AI slop machine” instead of chasing the AGI-to-cure-cancer dream.

Understandably so. There have been incredible expectations from AI and something like this naturally seems like a waste of compute and a distraction from the real purpose.

Sam Altman, however, has a different take. He argued that showing off models like Sora isn’t just a distraction but rather helps raise the capital and public buy-in needed to keep pushing toward AGI.

In his view, the “slop” is part of the sequencing, not a detour.

Either way, we’ve got a fresh batch of slop lined up this week, the kind you actually want if you’re trying to stay ahead in this sector.

Let’s get into it.

The COT Meme of the Week

Everyone wants to be a robotics investor these days.

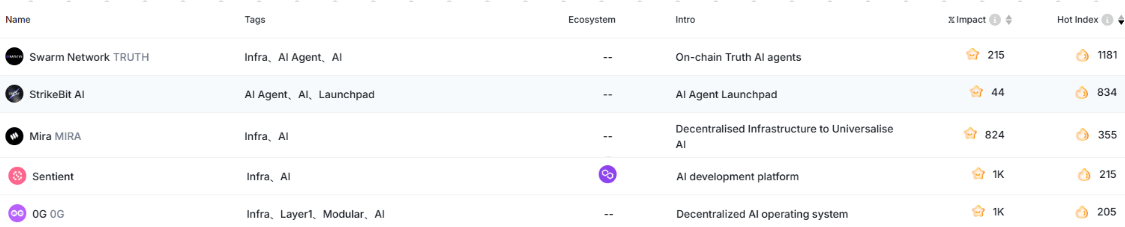

Swarm Network has launched $TRUTH, a token that rewards users for verifying content accuracy and aims to combat misinformation with AI agents.

Sentient AGI partnered with Sidekick Labs to bring real-time research and trading tools into Web3 live streams. Streamers can use Sentient’s GRID network for interactive tools like ROMA and Dobby.

StrikeBit just launched $STRIKE on Binance Alpha and Gate, paired with air drops and early access for platform users

In other news, Aethir just launched the world’s first Strategic Compute Reserve with a $344M DAT backed by Predictive Oncology.

The play: treat GPUs as an asset class. This means yield for holders and guaranteed access for AI builders.

The market response was spicy. ATH doubled in the past month before dumping 30% right after the DAT was publicly announced. Some clearly people got the memo early.

Drama aside, Aethir is already the largest decentralized GPU network with 435K+ containers, selling compute up to 80% cheaper than hyperscale clouds. Wrapping that into a treasury instrument creates a rare combo: real infra revenue tied to a tradable financial primitive.

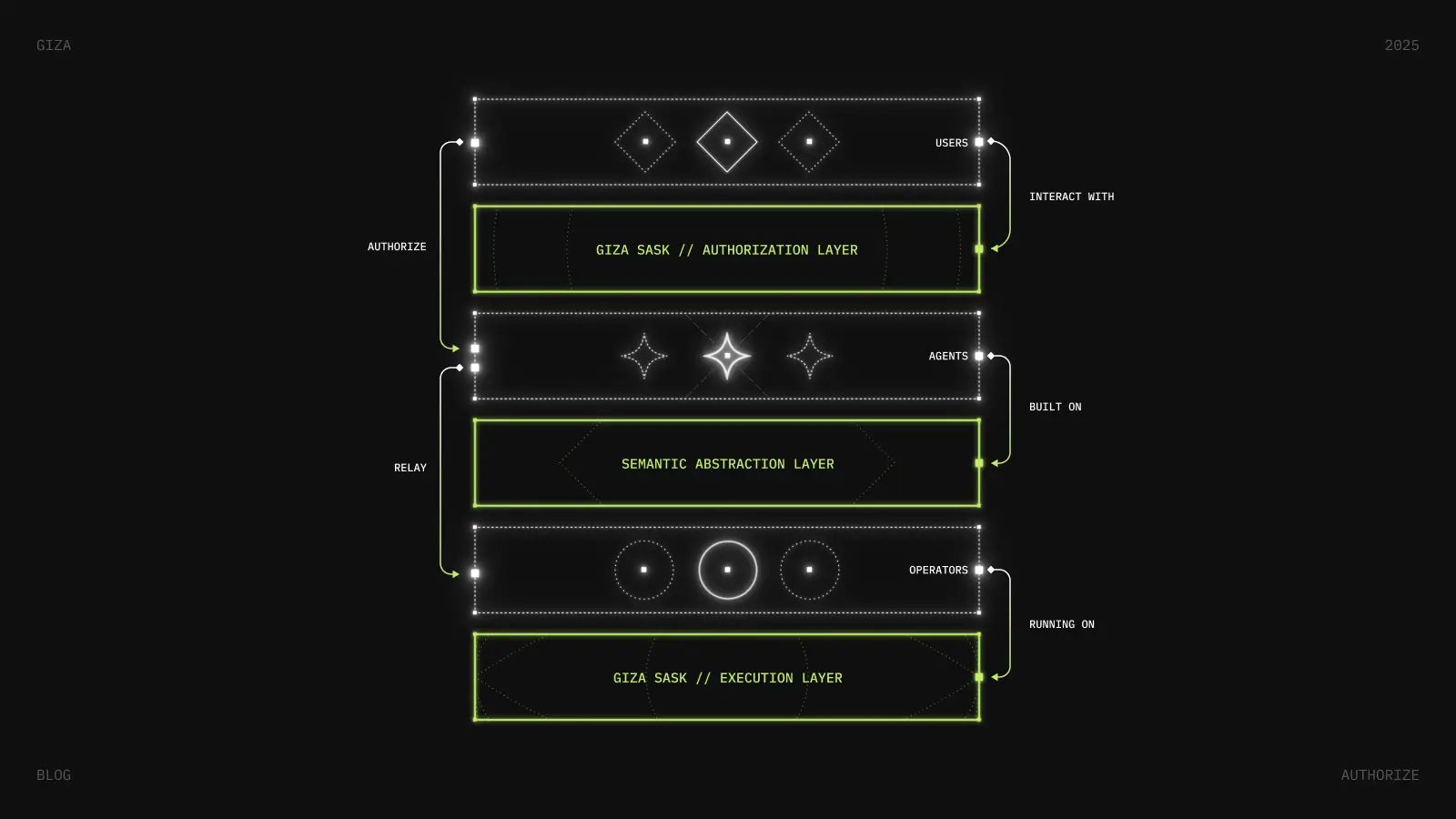

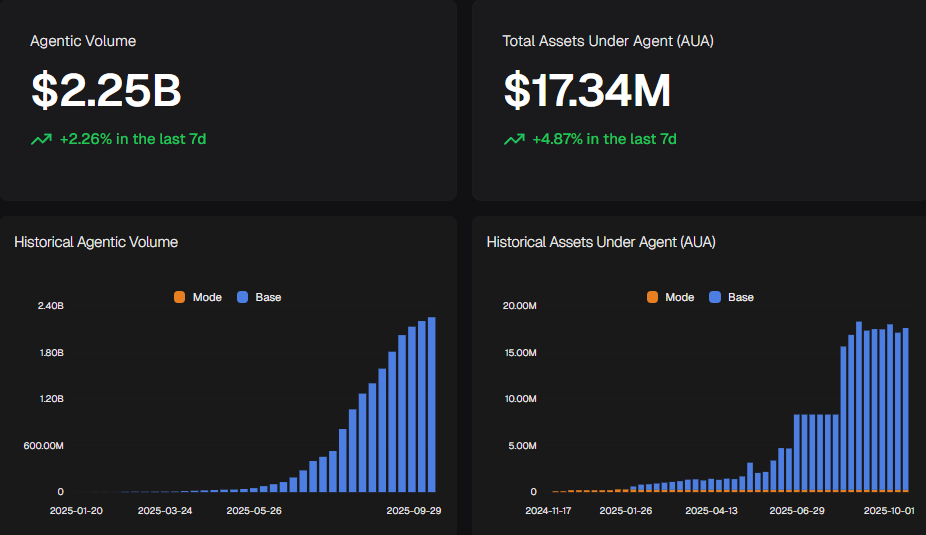

💻 Giza Crosses $2.2B in Agentic Volume

Source: Giza Dashboard

Giza Protocol just passed $2.25B in cumulative agentic volume across its on-chain DeFi agents - a 2x increase from August.

$GIZA agents now account for roughly 3% of Base’s daily volume. Arma, its stablecoin optimizer, manages $17M, while Pulse, built with Pendle, runs over 695 $ETH in PT strategies.

The Wedge:

Giza’s pitch: cut through DeFi’s cognitive overhead by letting agents manage capital directly. Instead of bridging, staking, and tracking positions across dozens of protocols, agents abstract the mess into clean, programmable actions.

The architecture runs on three layers: a semantic layer standardizes protocol logic, an authorization layer with smart accounts and session keys for non-custodial delegation, and a decentralized execution layer secured by EigenLayer.

Swarm Finance is the practical wedge. Protocols post yield opportunities, agents allocate in real time, and fees cycle back through $GIZA. The idea is to move liquidity from being static deposits to something closer to active capital.

The Fine Print

$17M AUA is meaningful, but still a fraction compared to leading DeFi protocols, retail and institutional adoption is unproven.

Many performance claims (like ARMA outperforming static yields) are still based on backtests and self-reported returns. Third-party audits are limited.

What Giza is really testing is whether agents can take the edge off DeFi’s complexity.

Right now even experienced users struggle to juggle strategies across protocols, and institutions aren’t immune to that friction either.

If agents prove they can standardize these strategies into something intelligible and safe, then “agentic capital” won’t be a niche primitive any longer.

📊 EigenCloud Launches Verifiable AI

AI’s biggest unsolved bug is trust. Today, every model runs as a black box on centralized servers. You have no way to prove if your input was tweaked, if the model got downgraded, or if the output was tampered with.

That’s fine for chatbots. In trading, contracts, or payouts, it’s a dealbreaker.

EigenCloud just launched mainnet alpha with two products aimed straight at that gap: EigenAI and EigenCompute.

The Wedge: EigenAI + EigenCompute

EigenAI is a verifiable LLM inference API. It guarantees prompts, models, and outputs haven’t been messed with. If results can’t be verified, operators get slashed. It’s OpenAI-compatible and launching with open-source frontier models.

EigenCompute is verifiable off-chain execution. Devs upload agent logic as Docker images, run them in TEEs for now, and eventually get EigenLayer security plus ZK proofs.

Put them together and you get auditability for AI inference and execution on the same level as smart contracts.

The Fine Print

TEEs are an interim step. The real endgame is zero knowledge proofs.

Verifiability adds cost and latency; throughput under real workloads is untested.

Adoption is the bottleneck: without agents, protocols, and apps standardizing on this, it could stay niche infra.

Still, the prize is massive. Right now, model performance isn’t consistent. Providers tune precision or parameters under heavy load to keep systems stable. That makes outputs unpredictable.

Verifiable inference and compute levels up AI from “best effort” to “guaranteed execution.” That’s the prerequisite for agents that can actually handle money, contracts, and autonomous decision-making without blind trust.

Are you building something awesome in crypto × AI? Or spotted a startup or product that more people should know about? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter each week.

⚙️ Infra & Protocols

IoTeX launched a Real-World AI Foundry, tapping its 40M+ IoT devices to build decentralized AI. This also debuts Real-World Models (RWMs), trained on live, verified data from machines, sensors, and people.

Talus raised $10M from Polychain, Sui Foundation, and Walrus Protocol to build “PredictionAI,” fusing AI agents with prediction markets. Testnet is live with the Idol Agent Contest running through Oct 31.

Prime Intellect launched Liquid Reserved Instances, letting large clusters resell idle compute and making decentralized capacity more efficient.

Bittensor rolled out a major mainnet upgrade with subnet deregistration and dynamic controls, giving subnet owners tighter levers over incentives and governance.

Gopher AI launched testnet for its sovereign L1 and introduced $GOAI, a token designed to support its trust layer for decentralized AI applications.

🤖 Agents & Apps in the Wild

InferiumAI introduced its AI Agent Index, a live tracker of 1,000+ agents. Users can compare scores, performance, and usage in real time.

Fetch.ai rolled out Agentverse MCP servers, letting devs deploy and monitor AI agents from GPT and Claude clients.

Ridges AI agent just beat Anthropic on the SWE Benchmark. It scores higher while running at just 1/70th the cost.

Abacus.ai launched DeepAgent Desktop, a coding agent that claims to outperform Claude Code and Codex.

🌐 The Web2 Giants

Anthropic introduced Claude Sonnet 4.5, a coding model that runs at one-fifth the cost of its peers. It can code upto 30 hours non-stop, beating GPT5-Codex’s 7 hours.

OpenAI launched Sora 2, a video and audio generator that models physics more realistically and syncs dialogue with effects. It comes with a new iOS app for creating, remixing, and sharing clips, including playful “cameo” drops of yourself or friends.

CoreWeave signed a $14.2B multi-year infrastructure deal with Meta, supplying AI compute capacity through 2031 to fuel Meta’s AI efforts.

Microsoft rolled out Agent Mode in Copilot, bringing task-running agents to Word and Excel. The new Office Agent generates full docs and decks, with “Vibe Working” for iterative edits.

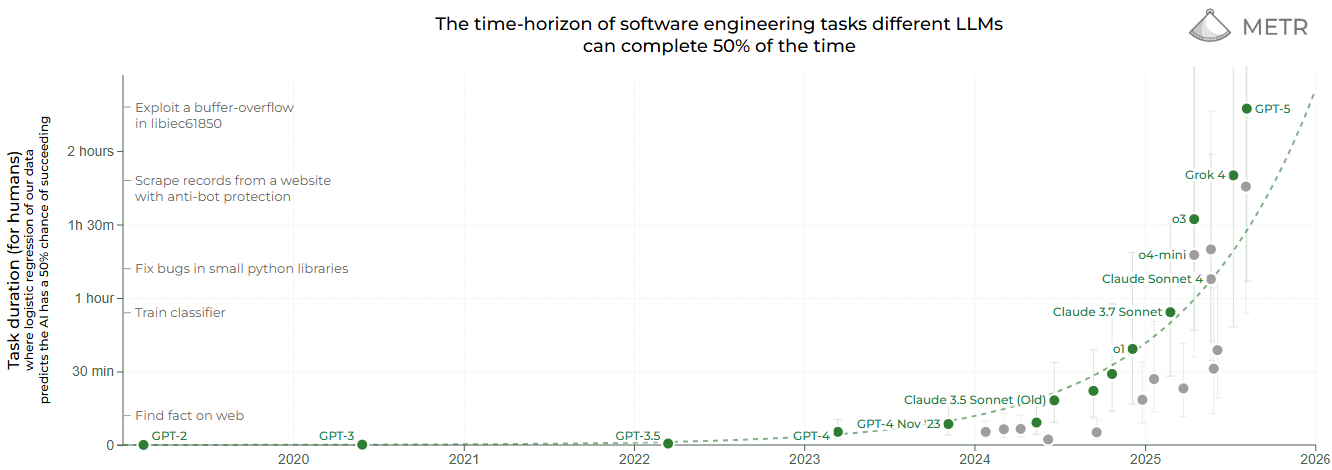

The exponential is real, and it’s happening faster than anyone thought.

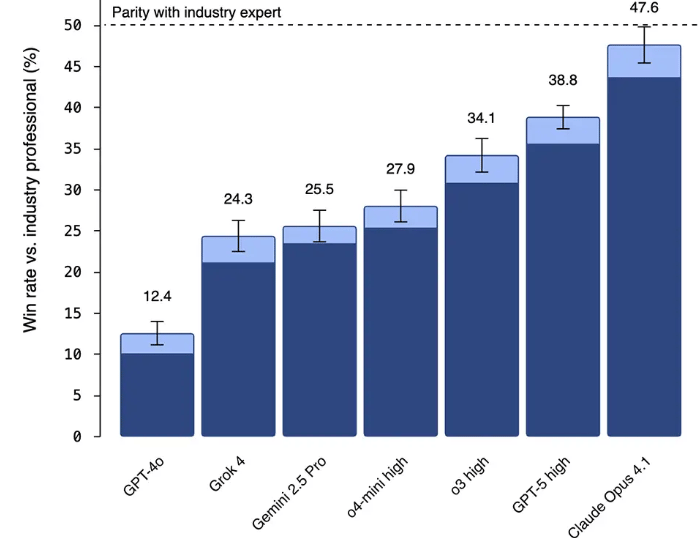

METR’s latest eval shows models that could barely last an hour on autonomous coding tasks in early 2025 are now reliably grinding through two-plus hours.

Grok 4, Opus 4.1, and GPT-5 aren’t just on trend but overshooting METR’s own exponential forecast (graph updates in real-time).

And it’s not just coding toys. OpenAI’s GDPval benchmark tested 44 real professions with 1,300 tasks judged by industry veterans. GPT-5 is basically human-level, while Claude Opus 4.1 is already matching experts with 14 years of experience.

Source: GDPVal

The slope is brutal: by mid-2026, models will run an entire 8-hour workday solo. By 2027, they’ll outperform human specialists across multiple industries.

If you’re still betting on “AI plateau,” you’re ignoring the graph. The curve doesn’t seem to be slowing down, it’s only bending upward.

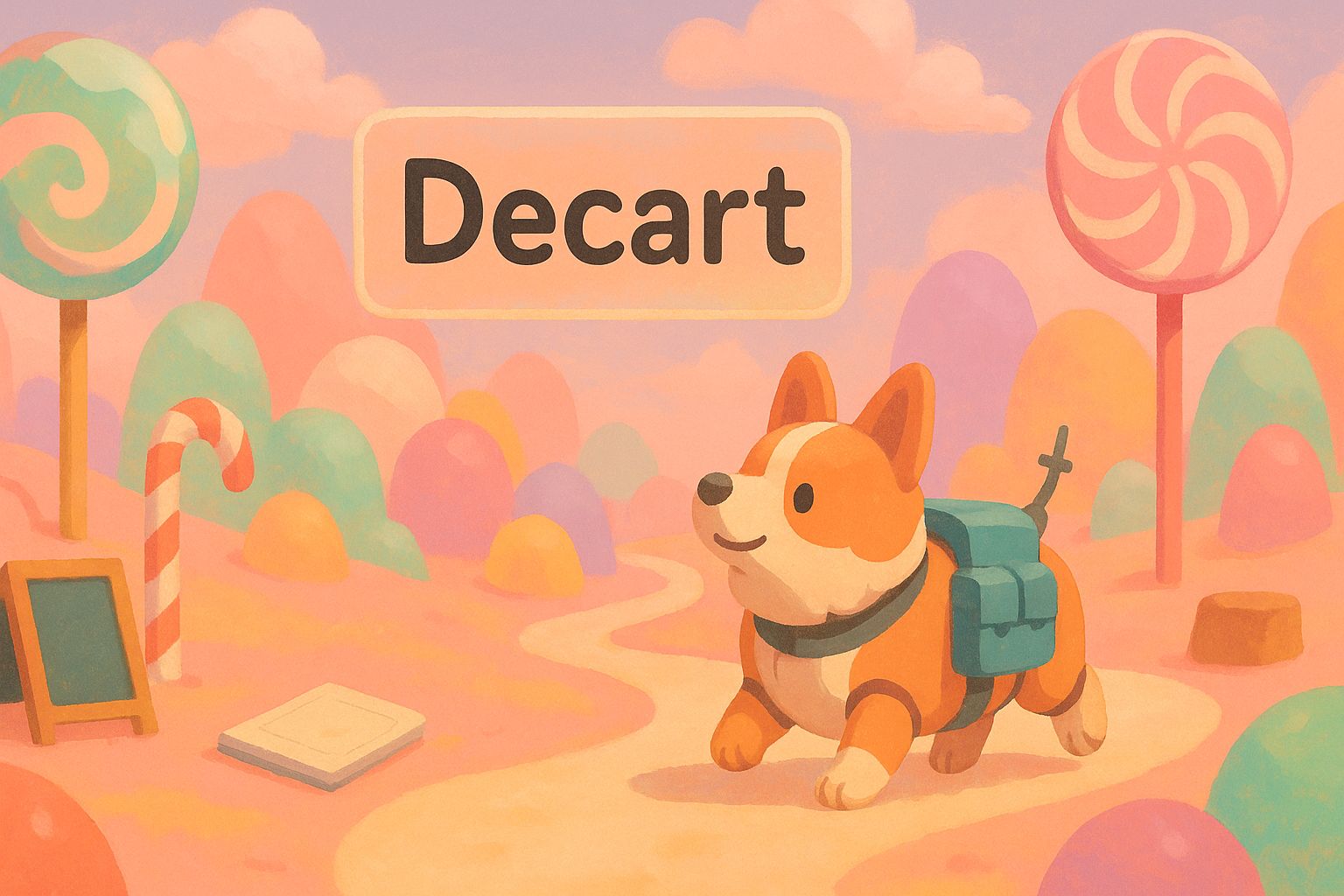

Our deep dive this week is on Decart, a startup betting that real-time world models are the foundation of a new kind of media.

Decart isn’t competing with AI labs. Its rivals are Netflix and TikTok. The fight is over where our free hours go once AI wipes out the boring work. Gaming is the first testbed: infinite Minecraft terrain, Roblox maps that build themselves overnight.

The backstory is absolutely fascinating. In less than two years, Decart went from an idea to a $3.1B unicorn reshaping how digital worlds are built. We unpack how it happened, and why it might rewrite entertainment as we know it. 👇

🔥 Our Weekly Top 5

#1 Sora 2’s breakout hit? Shoplifting at Target

The model’s “top video” this week is fake CCTV of Sam Altman stealing GPUs at Target. Cool tech, but maybe not the best demo to win over regulators.

#2 Meet Tinker, Fine-tuning without the headache

You write the training loop in Python on your laptop, Tinker spins it up across distributed GPUs. A private beta just opened, giving devs an easier on-ramp to custom open models.

#3 Perplexity just moved a trillion parameters in 1.3 seconds

That’s a 20x speedup in GPU weight transfer, cutting one of the biggest bottlenecks in training trillion-parameter models.

#4 Ten Minutes to Self-Automation

Someone asked Claude Code to build an MCP server for n8n workflows.

Ten minutes later, the agent had shipped end-to-end automation, no human hands needed.

#5 Humanoids are spies?!

New research shows Unitree’s G1 phones home with audio/video and can be hijacked over Bluetooth/Wi-Fi — quiet surveillance plus a ready attack surface.

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

Did you like this week's edition?

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.