Happy weekend {{first_name}}

Welcome to #72 of the Weekly AI edge.

Feels like the market keeps finding new ways to crawl back into the gutter. After days of sideways chop, the TAO uptrend (imo one of the few clean charts left) finally giga-nuked with the rest of the board

It’s struggling to recover for now, but there’s some good news. This week, Bittensor is rolling out its biggest change since dTAO.

TAO Flow changes everything. Emissions will no longer reward price but only real demand. Subnets bleeding TAO get nothing. Subnets generating consistent inflow, utility, or revenue get more.

It’s Bittensor’s most Darwinian update yet, and the ripple effects are already hitting the network.

Let’s get into it.

The COT Meme of the Week

Tears powered by efficiency gains 💧

📊 Market Pulse

The AI token market cap dropped 6% to $25.3B as broader crypto weakness hit AI sectors. Mindshare stayed flat at 27%, but capital still continued to rotate into x402 and agentic commerce.

🚀 Weekly Movers

$ICP surged 70% following Dfinity's Caffeine AI launch

$AIA went up 64% amid Sui AI agent rotations from Momentum Finance

$ARC is up 104% on pump.fun hype, whale inflows, and meme-AI virality

🔮 Narrative Watch

The agentic commerce narrative stays dominant as Coinbase, Tether, Mastercard, and VISA align around x402 as the core payment rail for A2A transactions.

🪙 Token Launches

🗓️ Upcoming Events

CGPT ($CGPT): 0.89% supply unlock on November 9

IO ($IO): 6% supply unlock on November 10

AGI ($AGI): 2.53% supply unlock on November 10

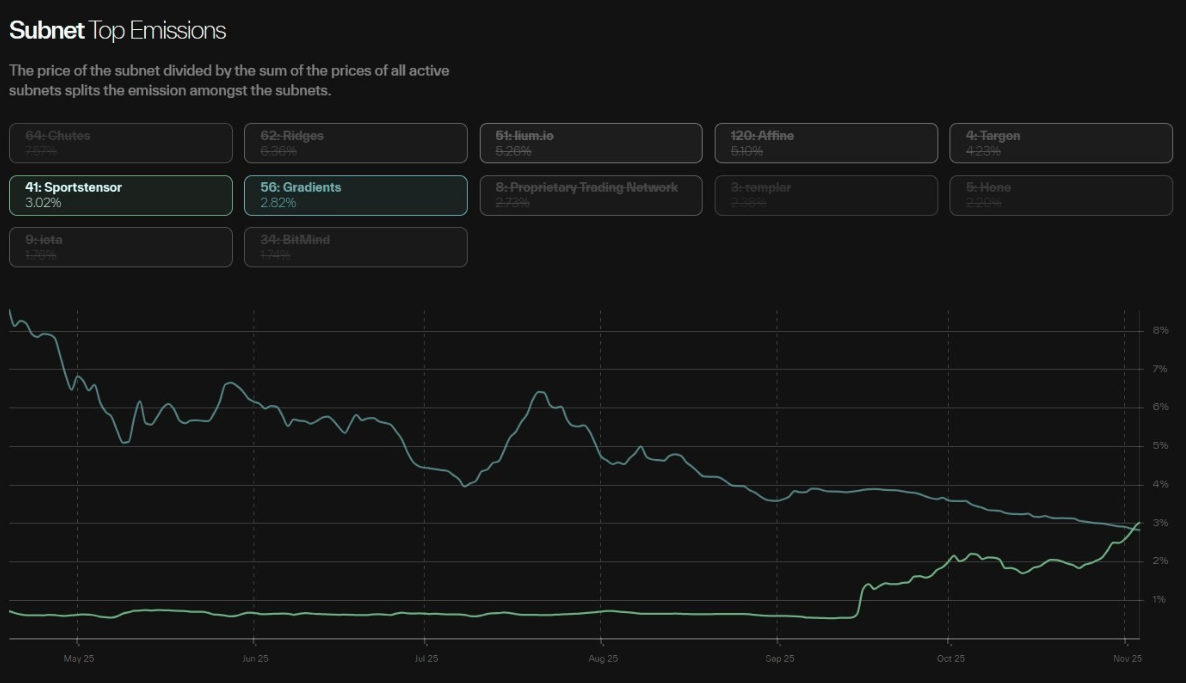

⛏️Sportstensor Hits ATH in Subnet Emissions

Source: taostats

Sportstensor just pulled off a power move.

It hit an all-time high in emissions share this week, overtaking Gradients to claim the #6 spot in Bittensor emissions, capturing 3.1% of total TAO emissions.

Only a few weeks ago, the split was 0.6% vs 8%. The reversal’s timing also aligns with Bittensor’s shift from price-based to net-flow-based emissions, a move that rewards sustained TAO inflows.

The Wedge

Capital rotation: Validator stake is starting to migrate toward subnets that generate verifiable inference outputs rather than those optimized for static model benchmarks.

Sportstensor’s edge: Its agents continuously price live, uncertain outcomes (sports, prediction data, etc.), so performance can be audited in real time. That creates a true feedback loop between the model's output and on-chain rewards.

Structural signal: Bittensor’s emissions system is evolving into a kind of proof-of-utility model, where economic gravity follows useful work instead of market speculation.

The Fine Print

The current snapshot still reflects hybrid emissions weighting; full net-flow adjustment will phase in over the coming epochs. Emissions will self-tune based on true TAO inflows and withdrawals.

Inside Bittensor, the tone has shifted, and for good reason. Subnet deregistrations are back on, and emissions are starting to favor real utility over token optics. That means a lot more competition and capital is finally getting a signal to move where the work is.

I think we'll see a lot more subnets start optimizing for value creation itself.

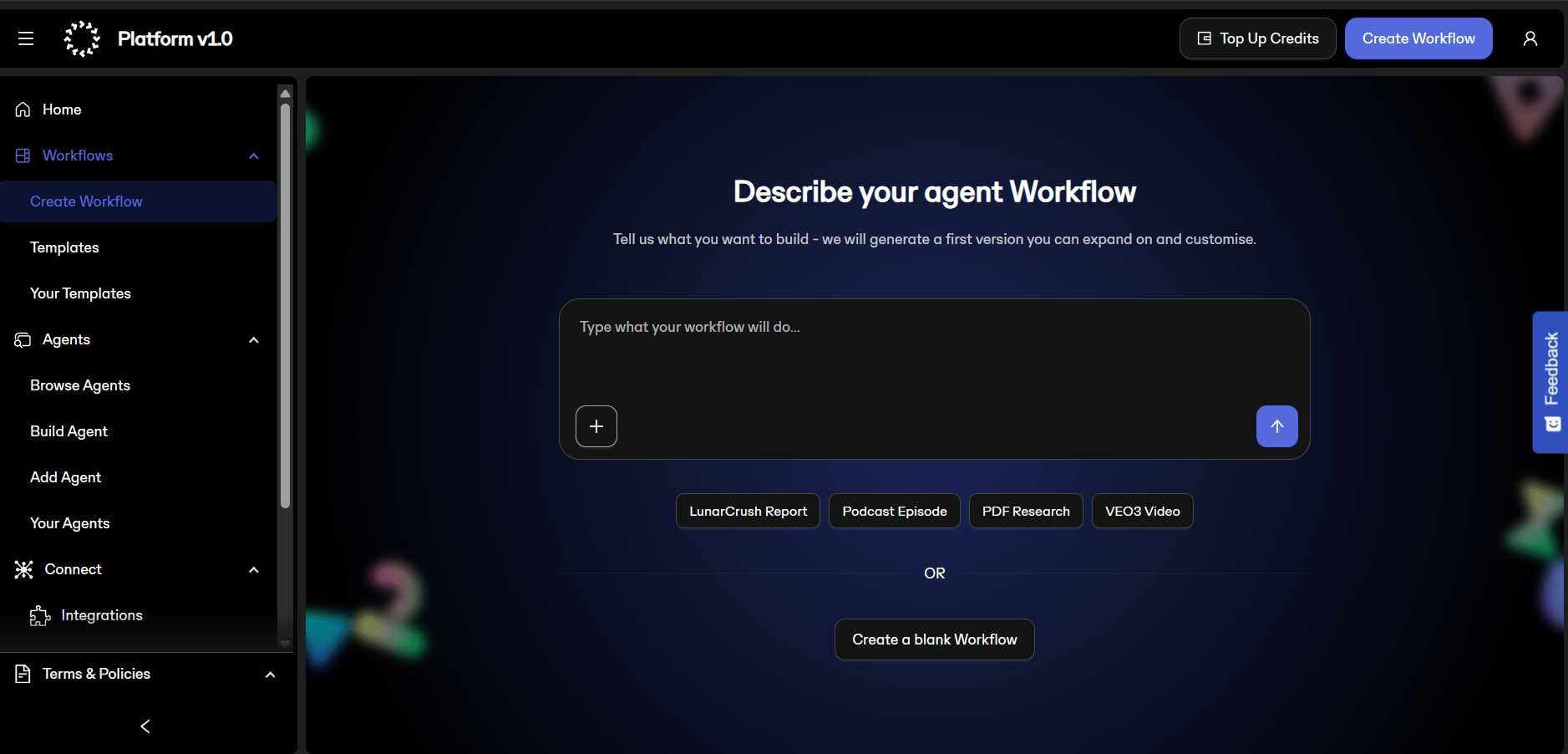

💻 OpenServ: The AI Startup Stack

The next unicorn founder might not have a team. Just a dashboard, a few AI agents, and OpenServ.

After a year in stealth, OpenServ dropped Platform v1, a no-code system that lets solo founders build full-stack, production-ready apps using AI workflows. You drag, drop, connect your hosting and database, then deploy straight to the web

Source: OpenServ Platform

Once your app works, OpenServ shifts gears into crypto-native mode. Their Launch Rails turn your project into a tokenized organization, complete with treasury setup, contributor permissions, and multi-chain deployment on Base and Solana.

It’s basically the AWS Console for decentralized startups, minus the panic attacks. 🥹

Post-launch operations are managed by SERV Autopilot, a coordination layer of AI agents responsible for growth, content, and community management. These agents track performance data and maintain engagement through automated activity loops

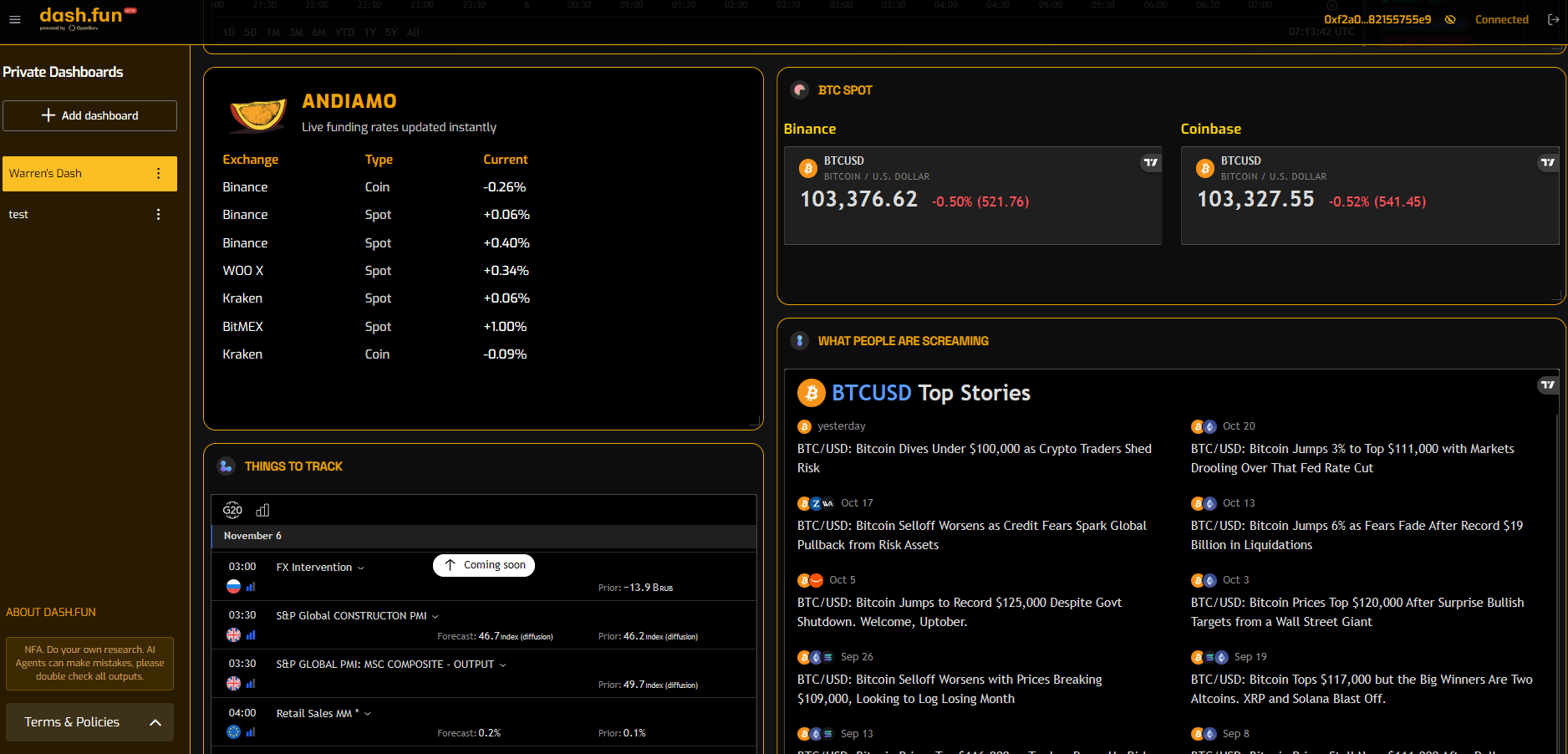

I also came across another one of their cooler beta tools dash.fun, a founder dashboard that unifies token charts, analytics, and social feeds into a single glassy interface. It’s clean, functional, and deeply addictive if you’ve ever rage-ALT+Tabbed between twenty analytics tools.

Source: dash.fun

OpenServ is betting that the future startup team isn’t five people in Slack, but one person with five agents.

Still early to tell if that’s fantasy or the next YC meta, but among the noise of “AI-for-startups” pitches, OpenServ is one of the few that’s attempting to actually build the operating system for it.

Source: X

Are you building something awesome in crypto × AI? Or spotted a startup or product that more people should know about? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter each week.

💸 Capital Flows

Semantic Layer closed a $5M Series A led by Greenfield Capital to accelerate development of its on-chain network for AI agents

TAO Synergies invested $750,000 in Yuma Asset Management’s Bittensor Subnet Funds to increase its exposure to subnet-based assets

Donut raised $22M to build an agentic crypto browser spanning web, mobile, and Telegram for on-page trading, AI charts, and real-time market signals.

xTAO raised $7.3M from Off the Chain Capital, expanding its $TAO treasury and validator stake by 41.5%

⚙️ Infra & Protocols

Akash Network announced its Burn-Mint Equilibrium model, which directs compute fees to buy and burn AKT

Cortensor pushed its Stake-to-Use prototype live across all testnets, enabling payment and rate-limiting modules ahead of its mainnet launch

Numerai released Dataset V5.1 “Faith”, its largest upgrade yet, adding 186 new features for tournament data scientists

Gensyn launched CodeAssist, a coding assistant that continuously learns from your edits and sessions

VaderResearch launched EgoPlay v2, a decentralized data platform that rewards users for recording daily-life videos to train humanoid AI models

🤖 Agents & Apps in the Wild

Olas launched Pearl v1, an on-chain app store for self-custodial AI agents.

Lush AI Agency rolled out AI Ambassadors, hyper-realistic social media agents that autonomously engage users to grow brand reach

BlockAnalitica launched Agent_Sphere, an AI-powered stablecoin analyst that surfaces risks and opportunities in the market

Sail deployed the first on-chain AI agent capable of autonomously executing non-custodial swaps and bridges

🧠 Bittensor Ecosystem

Bittensor rolled out the Net TAO Flow emissions system, shifting rewards toward network utility and new inflows rather than price performance

Bitsec announced V2, a rebuilt Bittensor subnet that evaluates AI auditors on real codebases to improve automated vulnerability detection

qBitTensor Labs launched on Subnet 48, bringing live quantum computing to the Bittensor network with access to real QPUs from Rigetti, IonQ, and IQM

Subnet 13 launched Data Universe Marketplace, letting users buy curated, high-signal datasets

🌐 The Web2 Giants

Google announced Project Suncatcher, a plan to launch solar-powered satellites running radiation-hardened TPUs for AI workloads in orbit

OpenAI signed a $38B deal with AWS to run core AI workloads on massive NVIDIA GPU clusters through 2026

Apple finalizes a $1B/year deal to power the upcoming Siri with Google’s Gemini

Microsoft announced it’s spinning up a dedicated “Superintelligence” team under its AI division

.

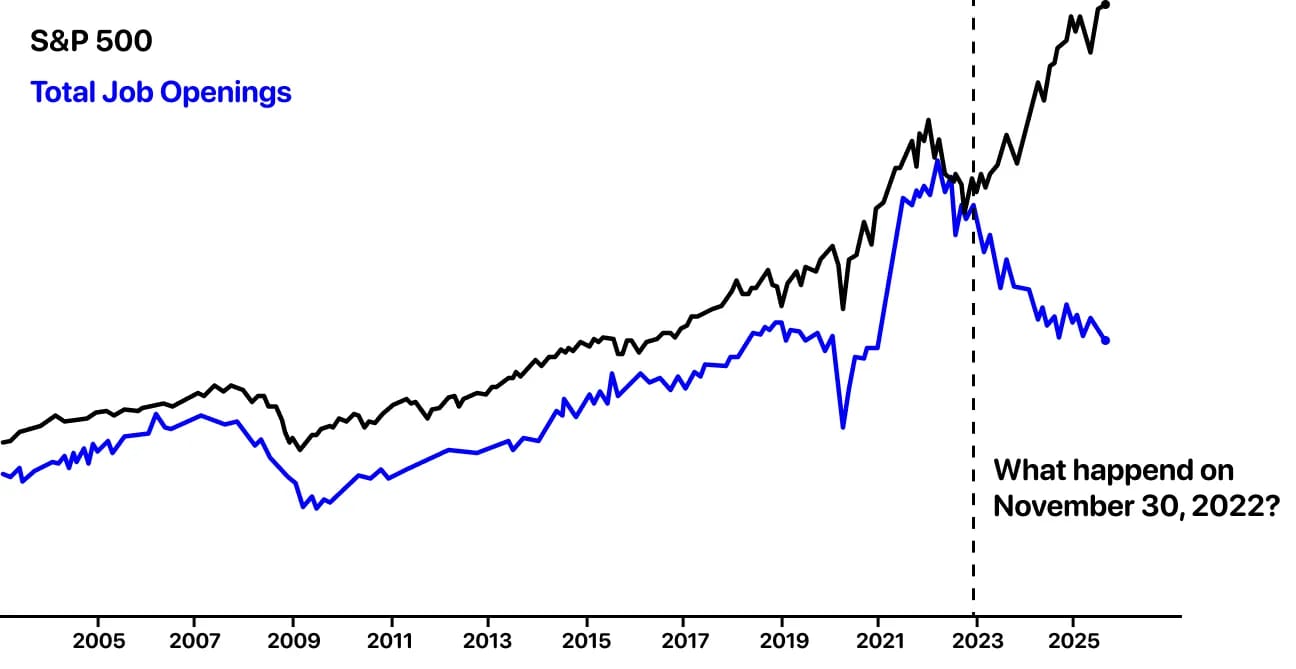

Source: X

Something snapped after November 30, 2022.

This single chart tells the story: since the day ChatGPT went live, the S&P 500 has surged 40% while U.S. job openings have collapsed back to 2019 levels. For decades, those lines rose together. Now, capital is compounding without labor.

Skeptics were quick to say correlation isn’t causation, and they’re right that rate hikes and other macro factors played a role. But that doesn’t fully explain it. Productivity gains don’t usually show up this fast without a real shift in leverage, and AI has become that leverage.

This also disproves the recent notion that AI hasn’t shown up in productivity data. The returns are here, just not in the places economists expected.

Jan Klosowski calls this the loom machine moment. The inflection point at which the machines start compounding faster than the economy can reabsorb the people they replace.

Scary thought.

👋 This week’s deep dive is on TinyFish. I stumbled across this under-the-radar startup while doing our market research on AI agents. Turned out they raised $47M to make software that actually understands the internet’s broken half.

Its agents read pages like humans and rebuild the data underneath so it’s finally usable. (not a sponsored post).👇

🔥 Our Weekly Top 5

#1: Qwen 3 MAX takes the crown in Alpha Arena’s finale

Alibaba’s model clinched the top spot after a neck-and-neck finish, showing LLMs can form distinct trading “personalities” even in chaotic markets.

#2: Kaito’s new launch just nuked early investors

PLAI dropped from a $50M FDV to $8M on day one, a 80% wipeout that proves VC backing doesn’t mean safety.

#3: China just set a world record with 16,000 AI drones

A smart control system synced every drone in Liuyang’s night sky, turning the “Home of Fireworks” into a living neural network of light.

#4: DeFi just got hit with a triple blow

DeFi took a $224M beating in 30 hours: Moonwell, Stream, and Balancer all hit.

#5: The AI arms race isn’t even close

While headlines ask if China’s winning, OpenAI’s GPT-5 Pro is matching o3’s 20K-GPU performance at one-tenth the cost.

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

Did you like this week's edition?

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.