Bittensor = the “Bitcoin of AI”?

Happy Friday {{first_name}}!

Welcome to #81 of the Weekly AI edge.

The year’s off to a solid start for DeAI, especially considering the broader market has mostly been asleep. But what grabbed me this week was a quote.

Jensen Huang was talking about Bitcoin and accidentally described Bittensor almost word-for-word:

So you took energy from one place and now you’ve transported it everywhere… now, of course, that’s just Bitcoin.”

Imagine a much more universal currency… called intelligence.

Also worth your time: Claude Code. I started vibe-coding a few tiny personal apps with it, and it feels like cheating in the best way. You describe what you want, it fills in the gaps, and suddenly you have something that works. If you want an easy way to get started, Alex Finn put together a solid video guide that’s easy to follow.

In a hotter market, I’m quite sure Claude Code would’ve triggered an explosion of new tokens, the same way AI agents did last year. It’s simply too easy to spin up a prototype now. That means 2026 will flood VCs in startup pitch decks. If they don’t have an AI agent filtering inbound by then, they’re going to drown under PDFs.

Let’s get into this week’s edition:

The Big Story: Score Vision is making every camera useful, on-chain.

The Alpha: HeyElsa usage surpassed 10K DAUs ahead of the TGE.

The Weird: A robot farm just harvested crops and paid holders on-chain.

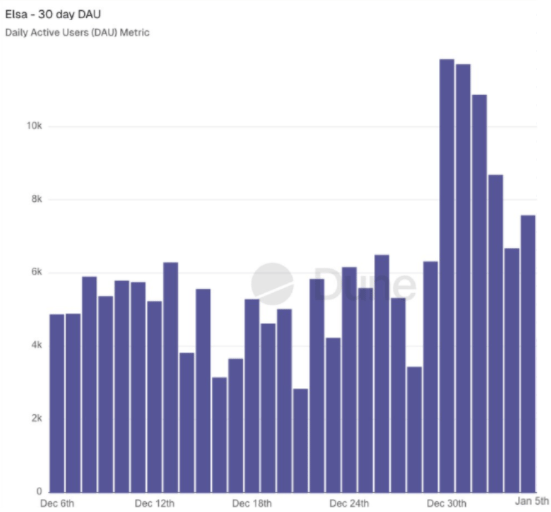

⚡HeyElsa Usage Breaks 10K+ DAUs

Source: Dune Analytics

Something changed for HeyElsa around New Year’s, and I don’t think it’s just luck.

After weeks of flat usage through December, DAUs (Daily Active Users) climbed from ~5k to over ~11k in 2 weeks.

HeyElsa is an AI crypto co-pilot. You tell it what you want in normal English, and it handles the ugly parts like routing, bridging, and execution across chains, using agent workflows and MPC wallets.

More context: HeyElsa has already processed $370M+ in lifetime USD volume. It shipped its own x402 facilitator last week and has a token launch scheduled for later this month. It could be noise, of course, but it’s a healthy sign that people are using the thing because it’s useful.

👁️ Score Vision: Making Every Camera Useful

Elite vision analytics aren’t just for the biggest sports clubs anymore.

Score, built on Bittensor Subnet 44, has achieved SOTA (state of the art) in football annotation at production scale.

It’s becoming a high-speed deflationary engine for computer vision, turning a "human-heavy" process into a commodity.

Source: Score

The Wedge

Score ingests raw video and produces frame-by-frame tracking of players, the ball, and events — all in real time.

Traditional annotation teams take hours and thousands of $$$ per match. Score can process a whole match in minutes and at a fraction of the cost because lightweight validation and distributed compute replace expensive human tagging.

Recent partnerships span elite football, fruit packing operations, and national vehicle wash networks.

The Fine Print

Output quality depends heavily on miner participation and incentives holding up over time, which is harder to guarantee in an open network than in a tightly managed lab.

What’s live today is coming from the open miner models, not Score’s best private ones. So I’d treat current performance as the floor, not the ceiling.

Score is becoming one of my favourite subnets to track. A loose swarm of miners turning football matches into usable signals is something I never thought I’d see.

Score’s token is trading at $24M market cap / $125M FDV today.

🥬 A Farm That Settles Onchain

Peaq just crossed a line that made the Machine Economy feel real.

Their tokenized robo-farm finished its first actual harvest. And to be clear, I’m not talking about farming imaginary tokens...

Robots grew fresh greens, those crops were sold locally, and part of the cash flow was distributed on-chain to token holders who own a slice of the operation

The Wedge

peaq is building infrastructure for machines to operate as economic actors. Robots have identities, wallets, and the ability to earn and pay on-chain.

The RoboFarm in Hong Kong is a vertical, hydroponic facility that automates about 80% of the labor (planting, monitoring, harvesting). It cranks out more cycles per year than traditional farms and uses way less land and water.

Returns are from real business cash flow, not DeFi incentives: ~18% annual yield, paid monthly in USDT and backed by produce sales with on-chain and legal enforcement.

The Fine Print

People buy leafy greens every week. The risk here is not whether anyone wants the product. It’s whether the operation is run well. Margins live and die on execution and pricing.

I’ve been tracking peaq for a while, and this feels like an early proof point of our Machine Economy thesis. A machine did real work, generated real revenue, and settled it on-chain.

That’s the smallest meaningful unit of the Machine Economy.

peaq is trading at $58M market cap / $149M FDV today.

⚙️ Infra & Protocols

NousResearch released NousCoder-14B, an Olympiad-grade coding model hitting 67.9% Pass@1 accuracy using verifiable RL training. That’s +7% over the base Qwen model it was trained on.

DGrid launched Genesis Premium, unlocking higher API limits, dual-token rewards, and priority access for ecosystem co-builders.

DeepNode partnered with OpenLedger to bring verifiable, high-quality datasets on-platform for next-gen AI models and agents.

🤖 Agents & Apps in the Wild.

Virtuals unveiled Pegasus, Unicorn, and Titan, a three-track framework for agent launches from early experiments to large-scale deployments.

Warden launched Warden Studio, a no-friction platform to build, launch, and monetize AI agents with built-in distribution from day one.

Fraction AI launched Signature Agents on Base, letting users create and share personalized stablecoin agents inside Stable-Up.

Destra Network introduced Destra Edge, a mobile app that turns smartphones into user-controlled nodes powering DeAI inference.

🧠 Bittensor Ecosystem

Loosh AI launched the Cognition Engine beta on SN78, exposing inspectable multi-stage reasoning, memory, and ethics layers for agents and robotics.

Vericore launched a beta news platform that audits headlines in real time using a decentralized truth engine on Bittensor.

Cartha launched its testnet. It is a decentralized liquidity engine on Bittensor that provides Liquidity-as-a-Service for the 0xMarkets DEX.

🦾 Robotics On-Chain

XMAQUINA’s $DEUS community auction sold out in 30 minutes at $60M fully diluted valuation. The robotics DAO holds $3.6M of stakes in Apptronik, Figure, Agility, and 1X Robotics (original purchase price) .

OpenMind launched the Fabric Foundation, a non-profit to support agent-native governance and coordination infrastructure for robotics.

🗓️ Catalyst Calendar

io.net (IO): 12.8% token supply unlock on January 10

Zama: Dutch auction token public sale for the Fully Homophobic Encryption protocol begins January 12

🔥 Our Weekly Top 5

#1 Decentralized AI just got a nod from Anthropic

Jack Clark dropped a commentary on decentralized AI training, signaling it’s now big enough to matter. Bittensor and @tplr_ai didn’t go unnoticed.

#2 A flying robot hand just became a thing

Differential Robotics showed an autonomous flying gripper that can pinch, grab, and perch mid-air.

#3 AI is coming for your crypto taxes

AwakenTax hinted at AI-powered crypto tax audits that flag errors and risk levels automatically.

#4 CES 2026 turned into a humanoid robot parade

CES was flooded with humanoid robots from Shenzhen this year. They can dance, fight, and move pretty impressively.

#5 Bittensor in 60 seconds

A new cinematic clip summed Bittensor up cleanly: miners supply the intelligence, the network supplies the incentives.

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

P.S. I also write a weekly newsletter on AI agents.

Are you building something awesome in crypto × AI? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter.

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.