GM {{first_name}} !

Been off Twitter this week because I went full video goblin.

Dropped $1K testing AI video models, trying to see what actually makes watchable YouTube Shorts. Most are ok. Google’s Veo3? Absolutely insane. Pricey, yes. But it gets physics, camera movement, and even lighting. It’s cracked.

I’m convinced: video generation is the short-term alpha. Hollywood is toast. If you’re even vaguely creative, learning how to make films with AI is the next-gen power move. And it’s got me thinking how Web3/crypto can make a difference here. Ownership, licensing, even funding new types of studios.

Our friends at Delphi intelligence also dropped a really good deep dive on video models. Perfect timing

Just take a look at this and tell me you’re not blown away…

In other news: Meta and OpenAI are in a full-blown AI infrastructure race, and they’re building at a scale we’ve never seen before.

Meta is skipping normal data centers and putting up giant hurricane-proof tents in Ohio. It sounds wild, but it’s working. Their new site, Prometheus, will use over 1 gigawatt of power by 2026. That’s massive, enough to support one of the world’s biggest AI training clusters.

OpenAI is scaling even harder. This week, they teamed up with Oracle to build 4.5 more gigawatts of capacity for their Stargate project. That brings the total to 5 gigawatts, enough to power 2 million AI chips.

OpenAI’s already training next-gen models at their Texas site, and say the expansion will create 100,000+ jobs.

The race is on, and the battleground is pure infrastructure.

🤔 Did you know we’ve got a YouTube channel? It’s a little bare now, but trust us, there are big things on deck.

Go hit that subscribe button so you don’t miss it. 📺

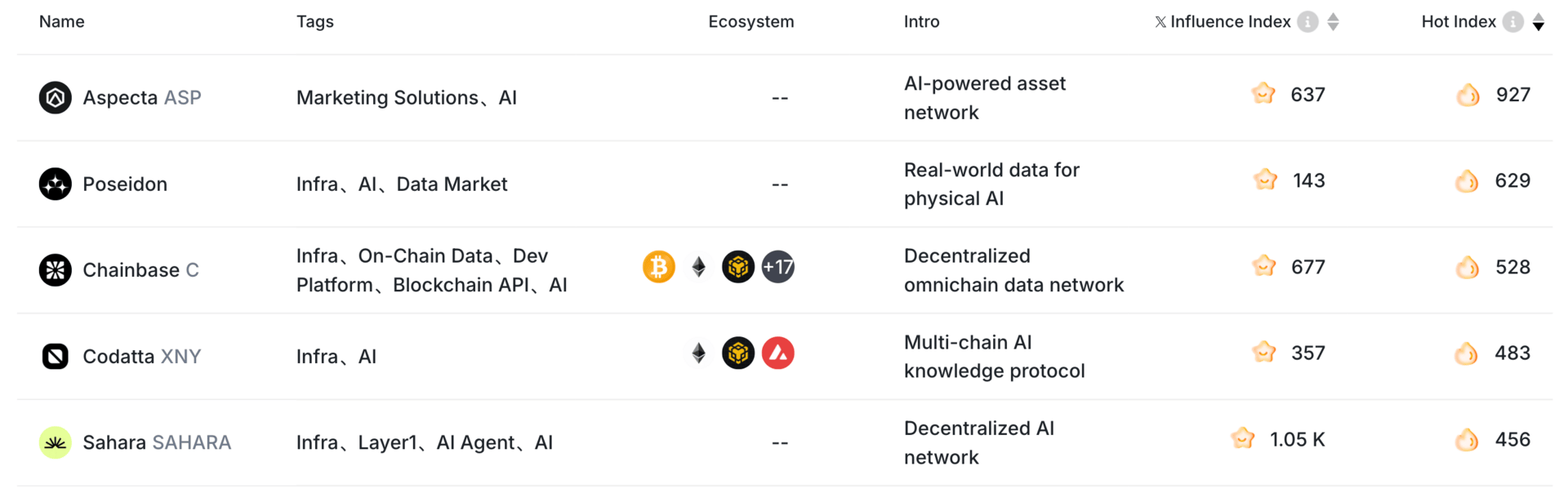

Theoriq s kicking off its community sale at 8:24 AM ET on Friday, July 25. Valuation is set at $75M, with a 25% unlock at TGE.

Aspecta has launched the $ASP TGE airdrop portal, allowing users to check their token allocations ahead of their TGE.

Chainbase’s newly launched $C token is featured on Binance Square’s Creator Pad. A share of $100,000 is up for grabs by posting about Chainbase.

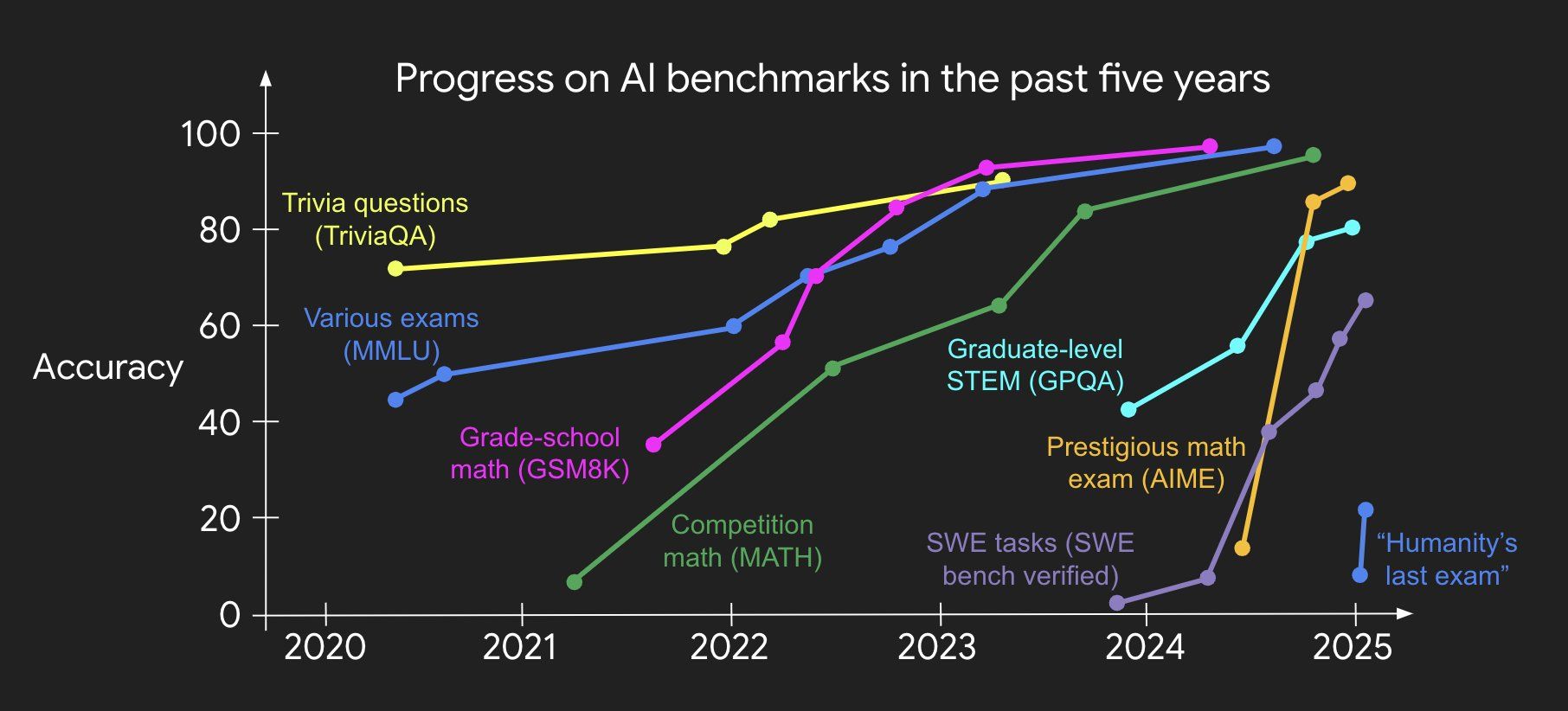

Five years ago, AI couldn’t pass middle school math. Now it's cracking Olympiad-level problems, acing coding interviews, and cleaning up on standardized STEM exams.

The pace? Absurd. Chart’s basically a straight line up.

Source: ysymyth.github.io

OpenAI researcher Shunyu Yao explains the recipe in his recent blog post “The Second Half“: first, train the model on massive amounts of language so it learns how the world works, then sharpen with reinforcement learning that rewards correct reasoning.

This combo teaches models how to actually think, not just autocomplete.

And it’s hitting some very smart humans like a midlife crisis. We trained the machines, and now they’re better at our jobs. Cool cool cool.

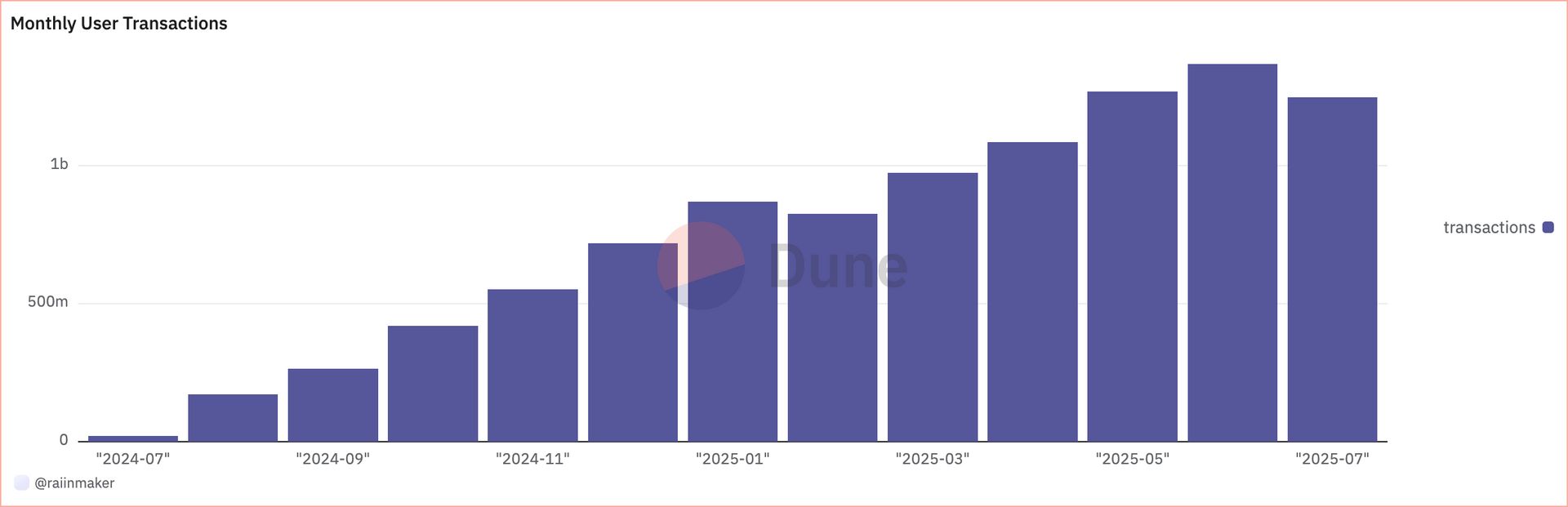

💧 Raiinmaker Launches The RAIIN Token

Raiinmaker just launched $RAIIN, now trading on SEI, Base, and Kraken.

It’s a decentralized network where users, called Citiizens, earn crypto by submitting short videos from their phones to help train AI models. Over 450,000 people are already contributing with >1 billion monthly user transactions. (yes that’s a B)

The Raiinmaker mobile app (iOS & Android) transforms smartphones into validator nodes, letting anyone capture, annotate, and upload video data directly from their device.

Every action is cryptographically signed and verified on-chain, making each contribution part of a transparent AI training pipeline.

Under the hood, Raiinmaker runs on a three-layer blockchain architecture:

User Action Layer (UAL): Signs and verifies all user activity.

Enterprise Application Layer (EAL): Offers smart contracts, analytics, and tools for data consumers.

Network Validation Layer (NVL): Finalizes proofs and anchors them to chains like SEI.

The platform uses a dual-token setup: COIIN for micro rewards and social reputation, and $RAIIN for staking, governance, and liquidity.

Citiizens engage through a gamified world called Cloud Ciity, where they level up by contributing data, inviting others, and helping run the network.

Raiinmaker is laying the groundwork for a new kind of AI labor market, open, transparent, and built by its users.

✨ Poseidon Raises $15M From a16z Crypto

Poseidon has raised $15M from a16z crypto to fix AI’s biggest data problem: the real world.

AI models have already chewed through the internet. What’s left is either low quality, synthetic, or legally murky. And for emerging use cases like robotics, autonomous vehicles, and spatial AI, that kind of data doesn’t cut it.

These systems need high-fidelity, hard-to-source input: bodycam footage, multilingual speech, weird driving scenarios. Stuff you can’t scrape or simulate.

Led by AI researchers and engineers from Stanford, UT Austin, and Story, Poseidon is building a decentralized pipeline to collect, clean, and license that data.

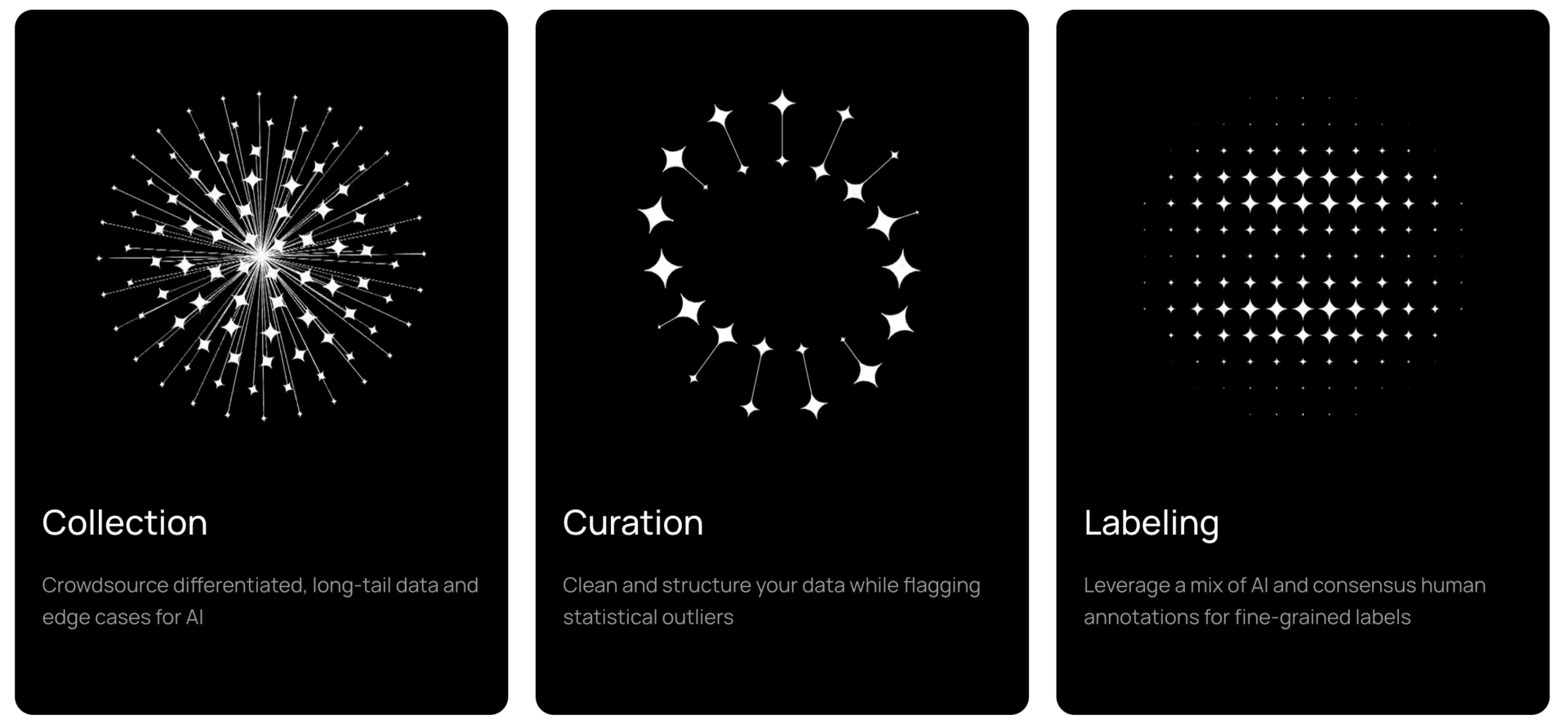

Here’s how it works:

Contributors upload data using SDKs and DePIN apps.

ML pipelines handle cleaning, labeling, and quality scoring.

Every dataset is registered on-chain using Story’s IP infrastructure for traceability and legal safety.

AI builders license that data by default, without murky legal gray zones.

Source: psdn.ai

The first focus is robotics. But the roadmap includes healthcare, biometrics, and other domains where physical-world complexity matters. In a future where models are open and GPUs are cheap, premium data is the moat.

Fundraises

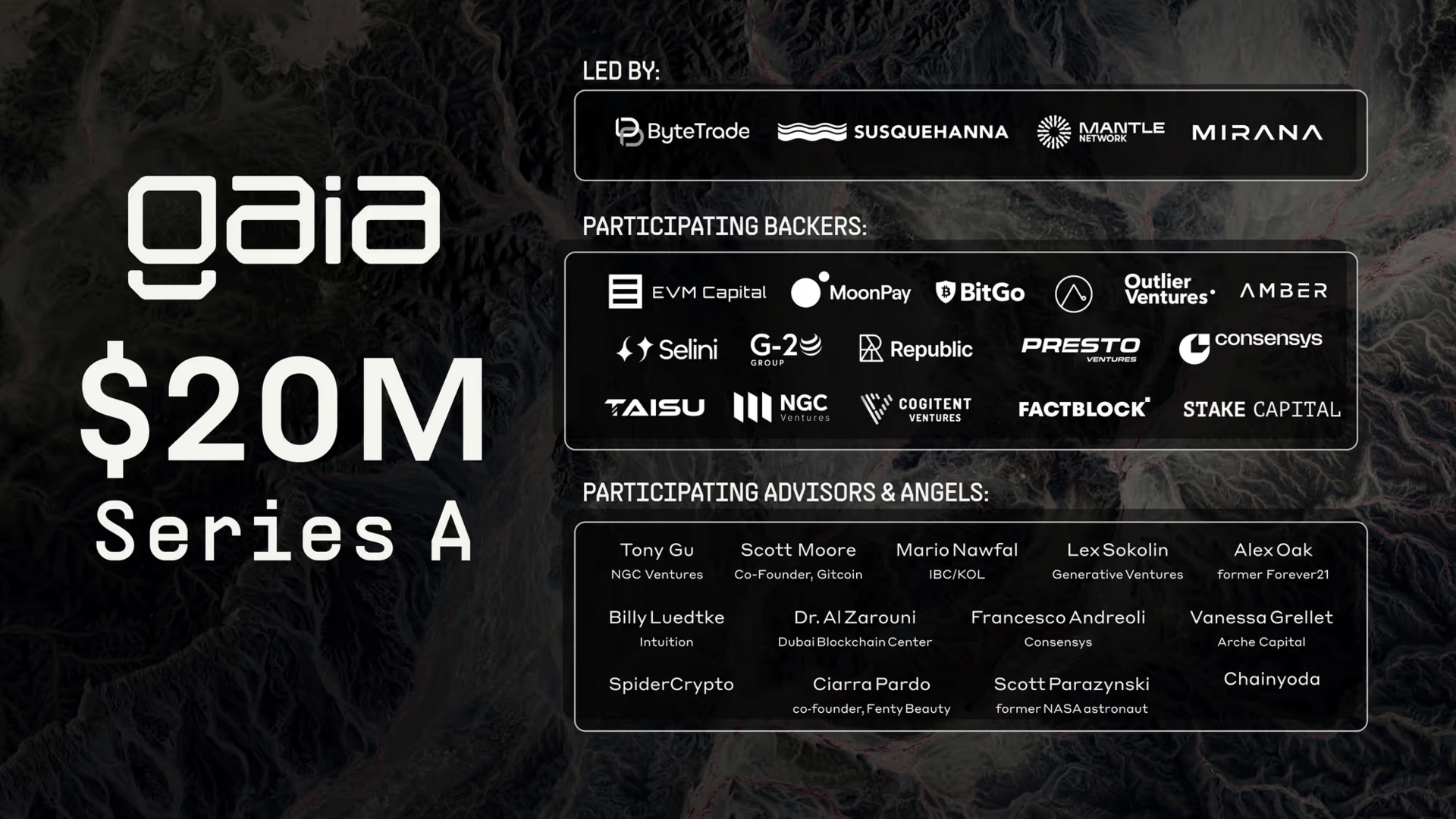

Gaia Labs just pulled in $20M to build a decentralized, censorship-proof AI stack, and they’re dropping a smartphone with fully local, user-owned AI.

Questflow raised $6.5M to build a decentralized AI agent economy, composable agents, on-chain workflows, real-time micropayments. Backers include Animoca, Delphi, and Cyber Fund.

Project Updates

Sahara’s Data Services Platform is live. Users get paid to help train AI with over $450K in incentives across $SAHARA and partners.

The Edge is now live: 3,700+ nodes across 36 countries stitched into a decentralized compute mesh for real-time AI, built on peaq. The $TOPS token launches with it.

Opinions Fun V2 just launched on Solana, letting people trade viral debates with “Agree” and “Disagree” tokens. Backed by KaitoAI and Meteora, it rewards creators, traders, and anyone who stirs the pot.

General Impressions unveiled Equa, a portfolio system run by $GEN agents. It lets AI manage and rebalance assets in real time, with fully transparent, on-chain logic.

Bittensor

xTAO is now trading on the TSX Venture Exchange (XTAO.U), fresh off a $22.8M raise backed by DCG, Animoca, and other crypto whales. They’re scaling validators and going all-in on Bittensor.

Backprop Finance dropped a mobile Telegram bot for trading dTAO with full self-custody and live PnL. No browser, no tabs, just chat.

Chutes launched a founder-friendly accelerator with $20K in AI compute credits, dev support, co-marketing, and API access. High-octane fuel for early-stage teams.

Taoshi rolled out PTN Collateral System v1. Theta miners can now lock tokens to access up to $250K in trading capital. It’s live now, with collateral rules kicking in August 4.

Bittensor just cut swap fees big time. Native swapping drops from 0.3% to 0.05%. Backprop’s UI is already updated.

Infinite Games launched AION Vaults (pre-public) on Subnet 6. Live trading is up, using ML and stat-based strategies. Full access opens after the vaults get tested in the wild

AI Agents

Bio Protocol just launched its first tokenized AI scientist, kicking things off with a well-known longevity researcher. It’s a launchpad for biotech, letting scientists tokenize private lab data and crowdfund real-world experiments.

HeyElsaAI added real-time web search to its agent. You can now pull up crypto headlines and market data, like “ETH ETF inflow”, without leaving the convo.

Elite Agents just opened beta access to its MCP Marketplace. It’s a no-code platform for building and selling AI agents using modular tools. Developers can also deploy their own monetizable abilities through open-source libraries.

Fraction AI launched a new Space for automating Polymarket strategies. Set custom rules for price, volume, or timing, and let your agents handle the trades.

Magic Newton rolled out a new “Recurring Sell” agent and expanded “Recurring Buy,” giving users more control over automated DCA strategies on Base.

Web2 AI

Alibaba dropped Qwen3-Coder, a monster code model with 480B parameters (35B active), native 256K context, and extrapolation up to 1M. Open-source CLI included. It tops SWE-bench-Verified.

Neta Lumina is live. An open-source anime model trained on 200+ styles, with precise prompt control and native support for English, Chinese, and Japanese.

Google Labs dropped Opal, a tool for building and sharing AI-powered mini apps using plain language and a visual editor, no coding needed. It’s in public beta, US-only for now.

Memories.ai unveiled the first Large Visual Memory Model. It gives agents human-like video memory with nearly unlimited context. Backed by $8M from Susa Ventures, they’re building AI’s memory layer.

It’s not often we come across a protocol that grabs our attention like Recall. They’re building AgentRank, a PageRank-style system for the age of AI agents.

This might be the Google of the agent economy.

We just dropped a deep dive on how it works and why it matters 👇

🔥 Our Weekly Top 5

It might take 600,000 Gwh (20% of US electricity) to train AGI, according to Tommy

GPT-5 is coming soon

Could DeAI agents bring about the next Cambrian explosion?

The Kaito-powered social liquidity platform, Yarm, releases their docs

A reminder to go and do good things with your lives

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply—we read it all.

Cheers,

Teng Yan & Issy

Did you like this week's edition?

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.