GM {{first_name}} !

Happy friday and welcome to issue #63 of Weekly AI Edge.

You can feel the scramble right now. Protocols are racing to get their TGEs done in Q4 before the year winds down. Almanak, Kite, OpenLedger, Everlyn, Linea, the list keeps growing. I’ll be watching what happens after launch: do users actually stick, or do they farm, dump, and vanish like interns after free pizza runs out?

Anyway, the buzz of the week is that Stripe just dropped a new blockchain.

It’s called Tempo. Built with Paradigm, it’s fully optimized for moving money (not trading JPEGs). Tempo is laser-focused on real-world payments: stablecoins, payroll, remittances, and autonomous agents transacting in the background.

It’s fast (100K+ TPS), final (sub-second), and cheap, with predictable fees paid in any stablecoin. The UX is payments-native too: batch transfers, memos, built-in compliance, the works.

Stripe also brought a squad: Anthropic, Deutsche Bank, DoorDash, Nubank, OpenAI, Revolut, Shopify, Visa, and more as design partners.

Tempo is permissionless, though for now select partners are testing use cases privately. Validator nodes will eventually be run by independent entities before the network opens fully.

If Tempo works, stablecoins could disappear into the background as pure infrastructure. But chains like this aren’t built for crypto natives the way Base or Solana are, and there’s no real way to share in the upside. So… yeah, impressive rails, but not exactly the chain you ape into.

👀 Quick shoutout: Our friends at Delphi Labs and Cyber Fund are putting together a decentralized AI conference on October 24 in San Francisco, pulling in a heavy lineup of speakers. I’m in Asia so won’t make it, but if you’re in town this is one to show up for. We’ve got a promo code for COT readers: use SAM20 for a ticket discount.

Gata has launched their GATA token alongside its tokenomics.

Kite has raised $18M in Series A funding led by PayPal Ventures and General Catalyst to build a blockchain that enables AI agents to communicate and transact. Read our deep dive on Kite here.

HyperbotAI’s $BOT token sold out in just 7 seconds during its Bonding Curve TGE on Binance Wallet.

Source: coinbase.com

Coinbase now writes about 40% of its daily code with AI, and Brian Armstrong wants that above 50% by October. At this rate, “Coinbase engineer” might soon mean “the guy who argues with Copilot.”

The surge comes from tools like Cursor, Copilot, and Claude Code spreading across its 1,500+ engineers. Frontend and greenfield projects are shipping faster, but AI code also brings more bugs. Coinbase’s answer: a repository sensitivity matrix. Basically a fancy filter for “please don’t let the AI break the exchange.”

Not every team can ride the wave. Low-level infra and trading systems still lean on human engineers. But the bet is clear: AI-native workflows will dominate, and Coinbase could become one of the first major companies where AI-written lines of code outnumber human ones.

🍄 Lium (SN51)’s Revenue Hits ATH

Lium is now generating $676 per hour in credit spend, up from $429 two weeks ago. That’s 9.4% weekly growth, on pace for $30 million in annualized revenue by year-end.

The platform lets users rent GPUs through a decentralized network built on Bittensor. You log into lium.io, choose machines based on price and performance, pay in $TAO, and track usage through a dashboard.

Source: lium.io

On the other side, miners contribute GPU hardware to earn emissions. Each setup includes a lightweight CPU-based server (the miner) that manages multiple GPU executors. These executors handle the compute tasks.

Rewards depend on performance rather than just GPU specs. Validators test and score executors, and the weight of each score matches the validator’s stake. If a validator controls 40% of the stake, their score accounts for 40% of the payout. This makes the choice of which validators to serve an important factor.

Every executor needs TAO collateral to be eligible for rewards, enough to cover 24 hours of rental. If a miner goes offline or fails to deliver, the collateral can be slashed. It keeps the system trustless and honest.

The final layer of enforcement comes from the subnet owner (called the Trustee), who handles slashing decisions and reviews collateral reclaim requests.

In short: Lium turns GPUs into on-chain, rentable assets.

🎥 Everlyn Raises a Round Valued at $250M

Most video gen AI today is locked inside closed, centralized systems.

Everlyn is building an open alternative.

The team has raised $15M to date, with new backing from Mysten Labs (creators of Sui) at a whopping $250M valuation. Other investors include Baseline, Selini Capital, Aethir, Nesa, and IONET.

At the core of the stack is Everlyn-1, an open-source autoregressive model that generates long, photorealistic video. It’s built for real-time output, low latency, and fine-grained control.

Surrounding that is Everworld, a platform for deploying AI video agents, human-like avatars that can perform tasks, interact with others, and represent users across digital spaces.

These agents are user-owned, upgradeable with developer-built APIs (AAPIs), and capable of on-chain actions using the $LYN token. Users can stake, subscribe, and help govern the system via Lyn DAO.

Source: lynlabs.gitbook.io

The system is designed for scale and openness, running on decentralized infrastructure with on-device models and encrypted memory.

The team includes researchers and engineers from Stanford, Oxford, DeepMind, Meta, and Google, with experience building models like VideoPoet, Make-a-Video, and Open-Sora.

The long-term aim is to move video AI from a closed product into an open protocol where users own the agents that represent them.

Are you building something awesome in crypto × AI? Or spotted a startup or product that more people should know about? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter each week.

⚙️ Infra & Protocols

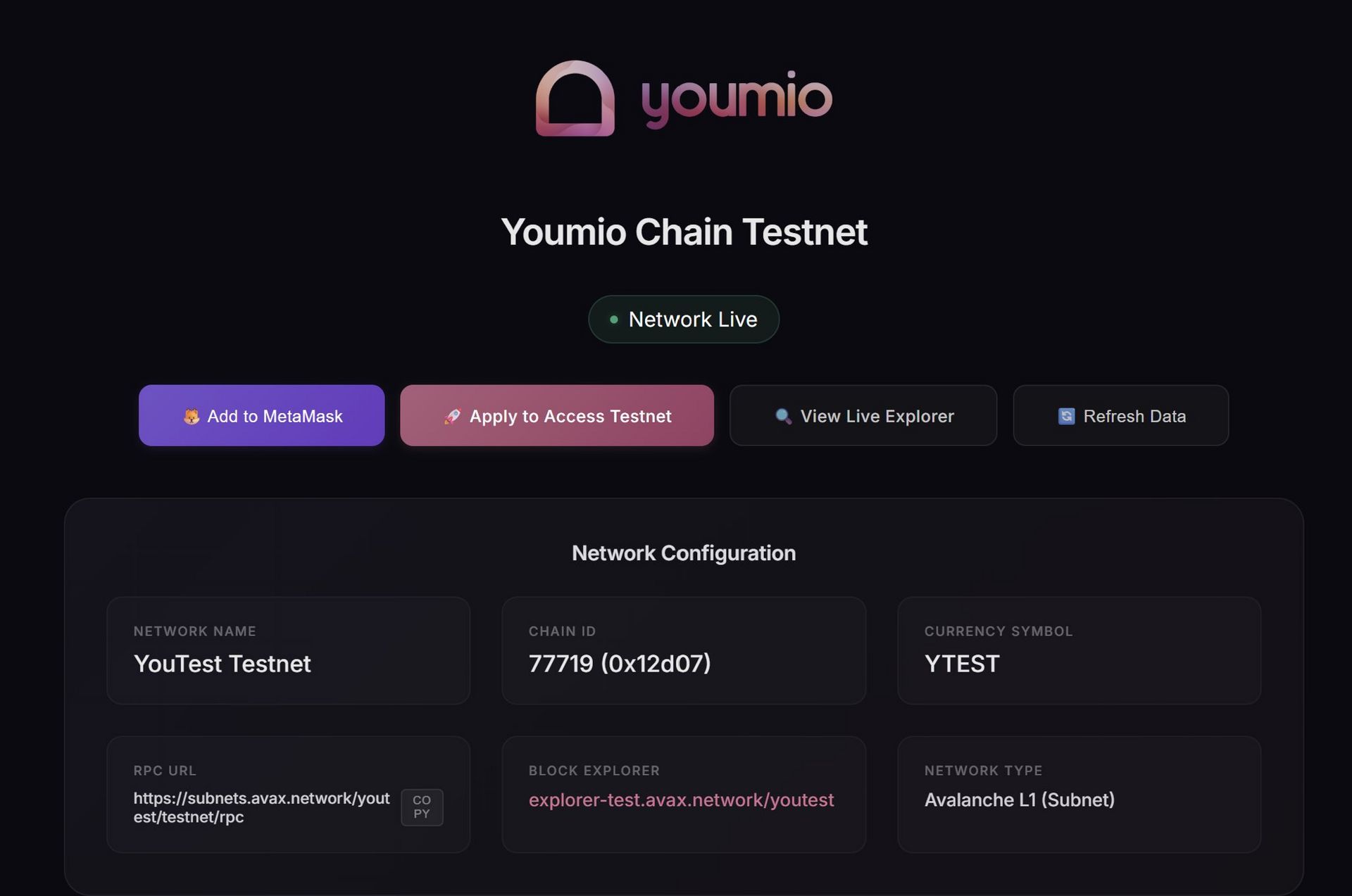

Youmio just launched its Testnet, kicking off the first phase of its agent chain. Seed holders get early access through Limbo AI, the main onchain interface. 50k+ apps are in review, and fresh features are dropping soon.

Sentient released ROMA, an open-source multi-agent framework that sets new SOTA in reasoning by breaking big tasks into smaller ones. Long workflows now run cleaner, smarter, and more transparently.

OpenSea rolled out their MCP, a universal plug for AI agents to access real-time NFT, token, wallet, and market data across 20+ chains. Devs can now apply for early beta.

Kaiko teamed up with Dubai’s The Block Global to get regulatory support, investor access, and a foothold in the UAE, backing its goal to build smarter, more human-like AI agents in line with the country’s 2031 AI strategy.

OpenLedger introduced $OPEN, the native token for its AI chain. It powers everything, payments, governance, model training, data rewards, all under one roof.

Nous Research just dropped Hermes-4-14B, their smallest, sharpest model yet. It runs on consumer hardware, nails math, code, STEM, and creative tasks, and supports tool use and hybrid reasoning.

Seal is live on Sui Mainnet, bringing native data privacy and access control to Web3. Paired with Walrus, it enables trustless encryption, gated content, and secure AI data.

🤖 Agents & Apps in the Wild

Poseidon launched an audio dropbox for the AI age, record real voices, accents, and background noise to help train models. Verified uploads earn Poseidon points and bonus rewards from partners.

Ask Caesar, a deep research agent for 𝕏, just entered beta. It’s live for users holding 10,000 $CAESAR, just connect your account to start crunching posts.

Nuwa went live on Virtuals Protocol with a “Human Search Engine” that turns a photo or name into instant profiles, socials, news, and connections.

Gigabrain released Brain V2, a multi-agent AI stack for whale sniping, instant trades, and nonstop market edge. Access it with 1M $BRAIN or snag a 7-day pass by reposting and replying with your wallet.

HyperSignals just rolled out Copy Trading, auto-mirror the top 0.1% of traders on Hyperliquid, filtered by HyperScore and customizable by strategy, assets, risk, and size.

Epoch Protocol has launched as an intent-based platform that simplifies Web3, handling tokens, chains, and DeFi end-to-end so users can enjoy seamless cross-chain transactions.

🌐 The Web2 Giants

Anthropic just raised $13B at a $183B valuation, led by ICONIQ Capital. The raise fuels more compute, better models, and deeper safety work.

Tencent open-sourced HunyuanWorld-Voyager, a long-range world model with native 3D output and scalable memory. It topped Stanford’s WorldScore for video and spatial AI.

ElevenLabs just dropped SFX v2, better sound quality, 30s loops, 48kHz crispness, and way more effects. Available in the UI, API, and baked right into Studio.

OpenAI is buying Statsig in a $1.1B all-stock deal, one of its biggest yet. The move brings A/B testing firepower to fine-tune LLM features, with Statsig CEO Vijaye Raji stepping in as OpenAI’s CTO of applications.

Atlassian is buying The Browser Company in an all-cash deal. The team stays independent and will scale its AI browser, Dia, across more platforms, while Arc and Arc Search keep running as-is.

ByteDance just unveiled OmniHuman-1.5, turn a single photo and voice clip into full-on minute-long videos with synced lips, gestures, camera moves, and multi-character scenes. Powered by a multimodal LLM + diffusion transformer.

CK and I did a podcast with Anand Iyer (Canonical, Lightspeed Ventures) last week! Been waiting for this for a while. He drops. We went deep on the truth about market trends. Is AI the biggest bubble of our lifetime? Also: founder dynamics in early stage deals

And yes, we made him tell us what he really thinks about crypto x AI..

Most AI agents feel clever in the moment but wake up with amnesia the next day. Rei Network wants to fix that with an AI “brain” built to remember, learn, and get smarter the longer you use it.

The protocol is building in public and funded by its own community. It has already shipped a memory system, a reasoning engine, and an agent factory.

This week’s deep dive unpacks how Rei works and why it might be the most important web3 AI experiment hiding in plain sight. 👇

🔥 Our Weekly Top 5

#1: VEED just launched Fabric 1.0, a new talking video model.

Google taps out at eight seconds; VEED lets your avatar monologue for three whole minutes. Finally, a video model that can overshare like a podcaster on Adderall.

#2: Ridges AI (SN62) just hit 80% on SWE-Bench, surpassing Anthropic and OpenAI.

It did this in ~45 days with just under $1M in miner rewards. Essentially what a Series-C founder calls “coffee money.”

#3: McKinsey projects AI data centers will require $6.7T in compute spend by 2030.

$5.2T will go into infrastructure, with 60% to chipmakers, 25% to energy, and 15% to builders, making resource control a key competitive edge.

#4: Chutes just hit an all-time high, 163B tokens processed in a single day.

After switching on revenue two months ago, volume has fully recovered. When it reaches a 1T tokens daily, Chutes will finally finish reading the internet, including the comments.

#5: We now have AI farmers.

Orchard raised a $22M Series A to build the AI farmer securing America’s food supply. FruitScope OS is basically FarmVille, except the corn actually sues you if you overwater it.

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Issy

Did you like this week's edition?

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.