Happy friday {{first_name}} !

If you were active on X this week, you’d probably be thinking that AI just declared war on humanity.

Apparently, it’s drinking all our water, eating all our electricity, stealing jobs, and plotting to replace us with robots that don’t unionize.

I mean, he isn’t entirely wrong.

Between Nvidia, AMD, and OpenAI’s trillion-dollar GPU loop, we’re burning through gigawatts at a rate that makes Bitcoin mining look quaint.

Here’s the catch though: the same infrastructure critics are calling dystopian is also the scaffolding for the next phase of intelligence. Once the dust settles, we’ll be left with a global network of chips, models, and protocols that can power the next digital century.

The “AI is stealing our water” take isn’t entirely right either.

Data centers don’t destroy water, they evaporate and recycle it through cooling. The issue isn’t depletion but local strain where too much vapor leaves dry regions even drier.

So yes, the grid might be groaning and the lakes are sweating, but humanity isn’t ending. And the AI frontier is definitely not slowing down.

Let’s get into it.

The COT Meme of the Week

Apparently, GPUs around the world are magically disappearing 🔮

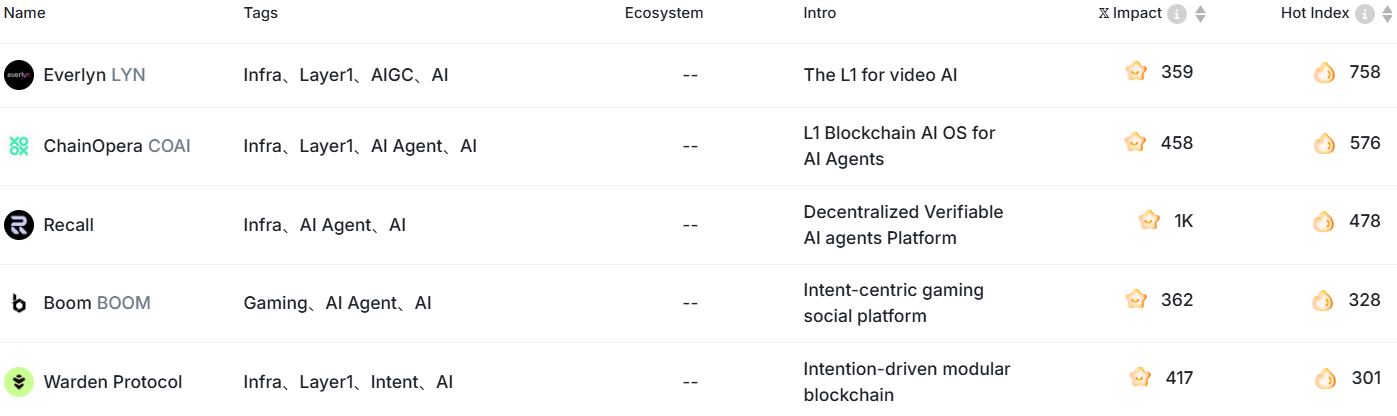

Everlyn AI launched its $LYN token, introducing a L1 protocol for on-chain verification and control of AI-generated video content.

ChainOpera’s $COAI surged over 2000% this week amid new listings and hype from the AMD–OpenAI chip deal.

Recall launched its $RECALL airdrop, rewarding early contributors and partners of its decentralized AI skill market.

One thing I’d pay very close attention to this coming week: OpenMind (a web3 Robotics startup) is rolling out its FABRIC identity network. You’ll be able to mint your own badge and plug into the ecosystem early. Feels like the start of something big.

Source: Crypto.com

💻 ChainOperaAI’s $COAI Just Exploded 2000%

$COAI has officially entered meme-pump territory.

In just one week, the token surged more than 2000%, pushing its FDV past $6.5B and making it one of the highest-valued projects in the Crypto x AI space.

The timing was surgical.

ChainOpera launched across Binance, Bybit, Bitget, Gate, and Aster just as the BNB ecosystem hit peak activity. It capitalized on that wave to cross 3M AI users and become one of the fastest-growing communities in Web3.

The token has since been smashing all-time highs for five straight days. Easily one of the wildest charts we’ve seen from a crypto × AI project in a long time.

Its success also reflects a broader rotation into AI infrastructure plays.

ChainOpera runs a full-stack AI agent network on BNB Smart Chain, linking users, models, and data streams inside a live agent economy. That narrative synced perfectly with the OpenAI–AMD partnership news, which reignited investor appetite for AI compute networks.

Our take? Much of the valuation still prices in future execution.

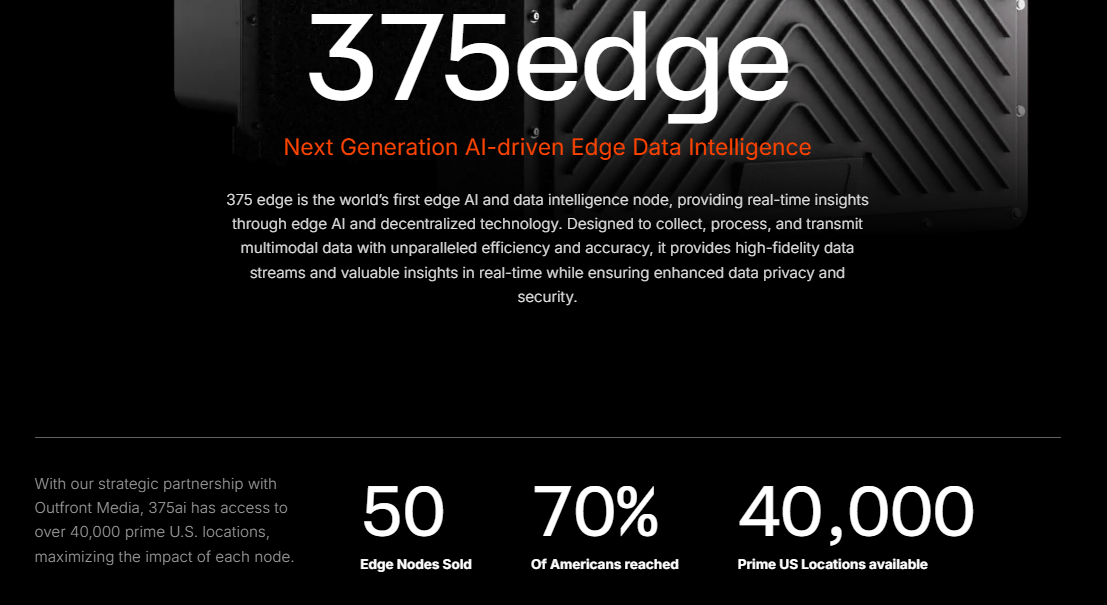

📊375.ai Raises $10M to Build the Real-World Data Layer

Most AI models still run blind to the physical world. 375.ai wants to change that by turning real-world sensors into a decentralized intelligence network.

The company just raised $10M from Delphi Ventures, Strobe Capital, and HackVC.

The funds raised will go towards building out 375ai’s deployments and its ability to capture real-world data, especially its 375edge devices.

The Wedge: Edge-native, privacy-first data capture

375edge nodes are modular devices equipped with cameras, environmental sensors, and AI compute (e.g., NVIDIA Jetson-class hardware) that can collect traffic, mobility, and environmental signals right where they occur.

Because the data is processed and anonymized on the node, the system minimizes raw data transmission and preserves privacy.

They’ve already secured access to 40,000 prime U.S. locations via Outfront Media for node deployment

Contributors (whether via nodes or the 375go mobile app) are rewarded in tokens. The ecosystem double-plays as a data source and a validator

Source: 375.ai

The Fine Print

Edge AI and sensor networks always lean on tradeoffs: latency, power consumption, and maintenance will be constant levers.

Verifiability will demand cryptographic proofs or attestations (e.g. zero-knowledge proofs) to ensure data hasn’t been spoofed or tampered. That adds overhead.

Data types are biased by location. Cities get coverage before suburbs, limiting granularity in underserved regions.

If they pull it off, AI stops training on internet leftovers and starts learning from the world itself. It’s an ambitious bet, but someone has to wire reality.

Are you building something awesome in crypto × AI? Or spotted a startup or product that more people should know about? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter each week.

⚙️ Infra & Protocols

Virtuals just unveiled Unicorn, its new launch model for AI agents built around conviction.

Fluence has launched a decentralized GPU compute network for AI workloads, delivering significantly lower costs than traditional cloud providers.

CrunchDAO raised $5M co-led by Galaxy and Road Capital to build their decentralized network of 10,000+ ML engineers for crowdsourced AI development.

Gaib AI raised its deposit cap to $150M, filling within hours, a $60M surge that underscores soaring demand for synthetic dollar yields and DeAI financial primitives.

Rezolve AI has acquired Subsquid ($SQD), marking a key consolidation move to build the decentralized data and payments backbone of the AI economy.

Bittensor subnet creation now requires burning $TAO, which is permanently destroyed. Previously, registering a subnet required just locking TAO. Bullish for the demand side?

Bagel introduced Paris, the first diffusion model trained through decentralized computation. It achieves comparable quality to SOTA distributed approaches using 14× less data and 16× less compute. We’ve always been a fan of Bagel.

🤖 Agents & Apps in the Wild

Fetch.ai has launched ASI:One, a mobile app that lets users create personal AI agents with custom voices, data, and memory.

ARMA is now live on Plasma, offering agentic yield optimization across stablecoin markets.

Coral Protocol partnered with Solana to host the Internet of Agents Hackathon, drawing 3k+ developers who built revenue-ready AI agents across finance, healthcare, and DeFi.

Elastics has partnered with Kalshi to develop AI trading agents, aiming to build an AI-native operating system for markets that trade on live and alternative data.

ERC-8004 (trustless agents) by the Ethereum Foundation is now officially under review. It represents agents as NFTs, making them portable with a reputation.

NewOS just dropped: a platform to spin up a personal AI that thinks like you, with its own memory, identity, and EVM wallet. Every AI gets a trust score and cryptographically verified interactions

🌐 The Web2 Giants

OpenAI unveiled AgentKit and Apps SDK at DevDay 2025, enabling custom agent building and ChatGPT integrations with apps like Spotify and Canva.

AMD sealed a $100B deal with OpenAI to deploy 6GW of GPUs, giving OpenAI equity warrants and securing a major foothold in the AI chip race against Nvidia.

Google DeepMind unveiled CodeMender, an AI agent powered by Gemini Deep Think that autonomously patches security vulnerabilities, already delivering 70+ verified fixes across major projects.

Microsoft launched the open-source Agent Framework to simplify building and governing multi-agent systems in Azure AI Foundry.

Source: Boomblerg

The AI boom might have just started cannibalizing itself.

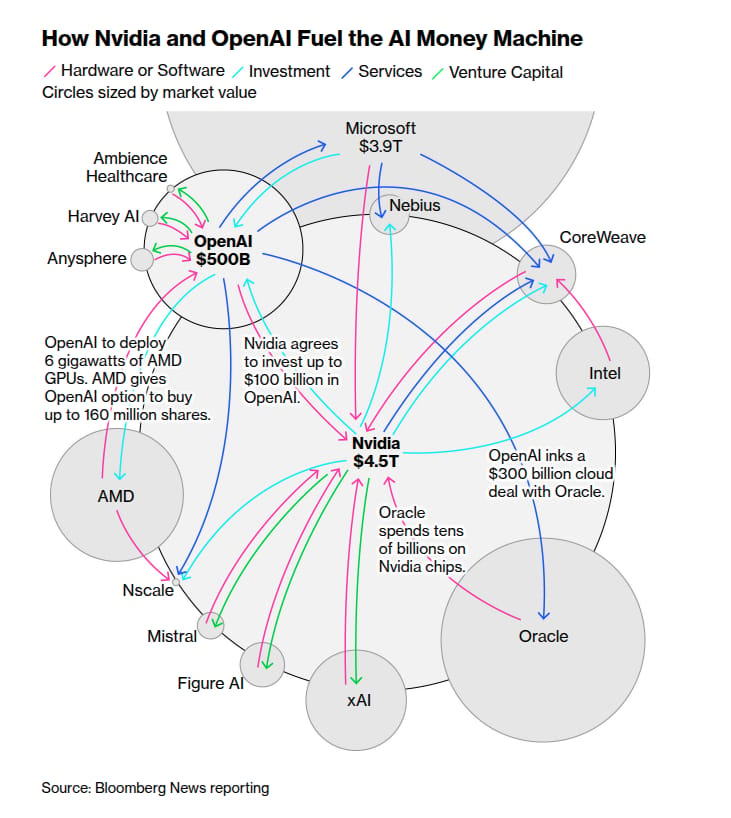

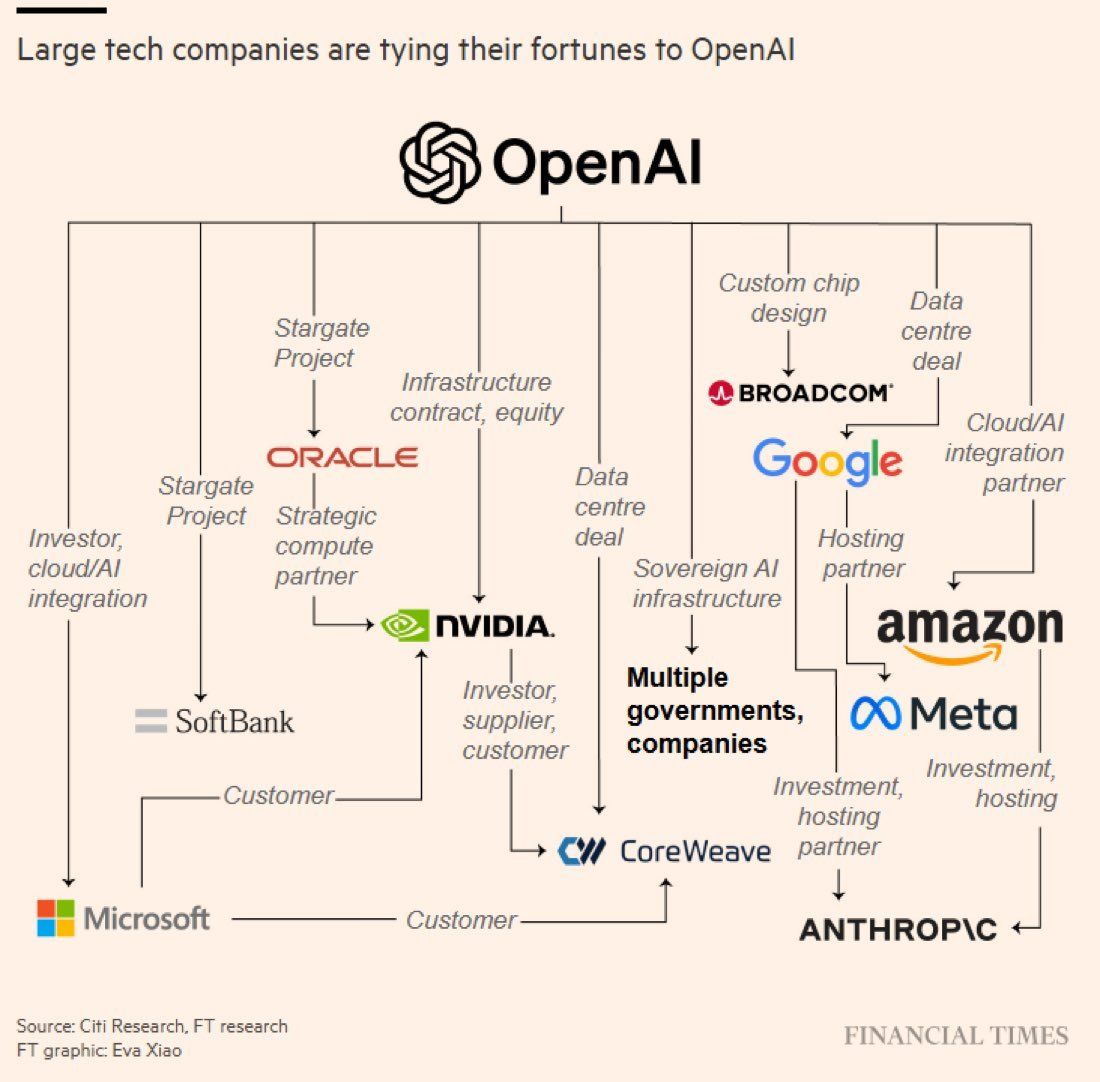

According to Boomblerg’s Report, OpenAI and Nvidia now sit at the center of a trillion-dollar feedback loop driving the AI economy.

In just two weeks, Nvidia pledged $100B to OpenAI, which in turn committed to buying millions of Nvidia chips. Then OpenAI struck a similar multibillion-dollar deal with AMD, becoming one of its largest shareholders. Oracle joined in with a $300B infrastructure pledge, much of it powered by Nvidia hardware.

Here’s how the cycle spins: Nvidia funds the companies that buy its GPUs. Those companies resell compute. Cloud providers lease it back, often with Nvidia’s capital. Valuations rise, liquidity circulates, but its questionable how much new value actually gets created.

The network of commitments now exceeds $1T, with Nvidia at the center of almost every deal. Morningstar called it “the early breadcrumbs of a potential AI bubble.

It’s a race to lock down compute before the next shortage. But the circular financing multiplies the same dollars across balance sheets instead of generating real productivity.

As one analyst put it, “Altman has the power to crash the global economy for a decade or take us all to the promised land.”

The AI boom is very real, but some parts of it are starting to look like a house of cards.

A few weeks ago, we wrote about 404-gen, a Bittensor subnet that turns text into 3D assets. Basically, Midjourney for world-building.

It’s already live and cranking out millions of objects. And once monetization switches on, it could rocket from $0 to $500M just as fast as Midjourney did.

Should we dig deeper into other Bittensor subnets next? Tell us 👇

🔥 Our Weekly Top 5

#1: Robots Can Shower Now

DEEP Robotics’ new DR02 is the first all-weather humanoid, casually tanking buckets of water like it’s in a shampoo ad.

#2: Anthropic says 100M-word context is already possible

That’s about a human’s lifetime of input, and models are learning inside the prompt itself without ever updating their weights.

#3: Meet Paris, the world’s first decentralized diffusion model

Trained across continents with zero communication between nodes, it matches SOTA quality using 14× less data and 16× less compute

#4: TRM just shattered the ARC AGI benchmarks

A 7M-parameter model trained for under $500 outperformed giants on ARC-1, ARC-2, Sudoku, and Maze tasks.

#5: LLMs are catching up to superforecasters

New research suggests that models could match or even outperform elite human forecasters by late 2026.

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

Did you like this week's edition?

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.