Happy Friday {{first_name}}!

Welcome to #76 of the Weekly AI edge.

The Big Story: AI Agents are exploiting smart contracts.

The Alpha: GEODNET hits $7.3M revenue & OpenQuantum launches.

The Weird: A robot with "violent confidence."

One of my biggest worries in DeFi has been that smart contracts are immutable once deployed. Which means that they have to be flawless at launch.

Where else in tech do you have to launch a new product and expect it to be perfect on day 1? Most products go through many rounds of iteration with real users before they work well. Well, you can upgrade your smart contracts (deploy a new one and migrate), but that’s a painful process.

So when I read Anthropic’s latest red-team post, the knot in my stomach tightened. It showed that AI agents can independently find and exploit real-world vulnerabilities in smart contracts.

My nightmare has come true!

GPT-5 and Sonnet 4.5 were able to uncover genuine zero-days and built working exploits by scanning 3000+ newly deployed contracts. They did it by raw trial and error, cycling through every attack path they could dream up until one cracked open. These agents now sit roughly at human-attacker skill level across a wide chunk of active 2025 exploits, and they can uncover fresh bugs at around break-even cost.

The economics will improve with every model generation.

Founders will have to assume that every contract they deploy will be probed continuously by AI agents. The silver lining: AI can also harden contracts on day one by flagging weak spots before deployment. But sloppy dev work is about to get punished fast, and we’re likely to see a jump in exploits in the coming months.

Kinda like this cat…

Anyway, last week I took a poll of our readers on whether we’re sitting inside an AI bubble - thanks for responding! 53% of you said yes, we’re in full bubble mode.

The mood this week didn’t calm that energy. Many discussions on X kept drifting back to one thing: OpenAI losing altitude. Benchmarks, coding speed, image tools, research assistants, even DeepSeek V2 carved past them across the board.

Google and Anthropic feel like the ones pushing the tempo right now.

OpenAI still has one of the sharpest teams in the game, and I wouldn’t bet against them. But they need to figure things out. Quickly.

Onward.

COT POLL: Who do you think will win the AI race?

Market felt muted again. AI tokens pulled back 1% to $21.2B, and mindshare kept sliding away from the sector.

The mindshare rotation from to DeFi, ZK, and prediction markets has been surprisingly fast. Memes and AI saw the biggest drop. Eyes on $TAO halvening coming up next week.

$IN +30% ahead of 200K+ agent transactions milestone.

$ARC +40% after explosive Solana AI meme hype.

🪙 Token Launches

🗓️ Upcoming Events

io.net (IO): 5.6% token supply unlock on December 11

Delysium (AGI): 2.5% token supply unlock on December 11

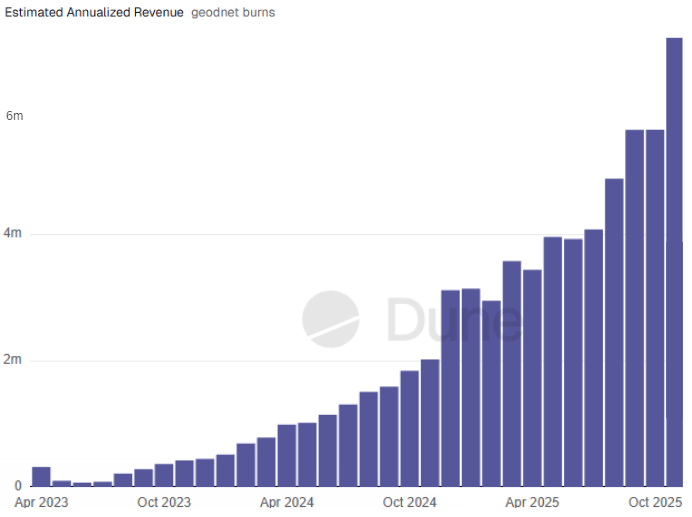

🕹️GEODNET Hits $7.3M Annualized Revenue

Source: Dune Analytics (1) / (2)

Who doesn’t love a parabolic revenue chart?

GEODNET just slipped past a $7.3M annualized run rate, up from about $5M just a few months ago.

The chart used to look like someone dragging a pencil in a straight line. Now it’s curling upward. Some internal projections put the network on track for $50M+ ARR within two years

80% of revenue goes to token burns. It comes from paid access to GEODNET’s global GNSS correction network. The system provides centimeter-level positioning data used by:

Robots that need precise localization

Drone fleets doing mapping and inspection

Autonomous vehicles requiring high-accuracy navigation

GEODNET has grown into a mesh of tens of thousands of stations across 100+ countries, thick in the US, Europe, and East Asia. Although coverage still remains uneven in parts of the world. As more stations appear, accuracy sharpens; as accuracy sharpens, more subscriptions roll in.

This is what a DePIN project looks like when people are actually paying for the product.

🎭 OpenQuantum: Quantum Compute for Everyone

Quantum access just got as easy as…calling an Uber.

Quantum computers are improving fast, but the bottleneck has been access. It’s out of reach, gated by long queues and reserved for specialists.

This Bittensor subnet cuts through all that, giving users a simple API to access QPUs.

Source: SubnetAlpha

The Wedge

OpenQuantum is the access layer for Bittensor’s Quantum Compute subnet. You upload a circuit, pick an actual quantum device, and send the job through either the public line or a priority lane funded by credits

Staking TAO drips monthly credits, which lets power users pre-pay for quantum runs.

Subnet 48 is paired with Subnet 63, which focuses on algorithm development. One runs the machines. The other hunts for breakthroughs.

The Fine Print

Quantum devices have tight limits on circuit depth and coherence, so long sequences will quickly hit hardware ceilings.

Queue times vary. Quantum machines cannot be parallelized the way classical clusters can.

I love how crypto is democratizing access. Even tiny QPUs (5–50 qubits) are useful for researchers to test circuits. DSV recently backed Quantum Compute to push Subnet 48 toward enterprise volume.

Are you building something awesome in crypto × AI? Or spotted a startup or product that more people should know about? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter each week.

💸 Capital Flows

Bitfury Group made a $50M strategic investment in Gonka.ai, a decentralized AI compute network, signaling miner interest in AI infrastructure.

DeepNode AI raised a $2M seed round at a $25M FDV. Major TAO validator groups and Gateway ETH joined the network.

TrueNorth raised a $3M pre-seed round to build AI agents modeled on professional traders, backed by major crypto funds.

⚙️ Infra & Protocols

NEAR launched its AI Cloud and Private Chat, offering hardware-backed confidential inference and verifiable privacy for everyday AI use.

REI Labs launched the Core Sandbox alpha, giving developers an environment and tooling for building with its agent abstraction framework.

Telegram announced the launch of Cocoon, a decentralized compute network now running private AI workloads and paying GPU owners in TON.

Inference Labs enabled ONNX → ZK conversion, pushing zkML into practical territory through DSperse slicing.

🤖 Agents & Apps in the Wild.

HAiO launched AI music agents on 0G mainnet, pairing agentic creation with an iNFT drop

OpenGradient introduced “Council Mode”, where multiple agents debate and synthesize a final verdict.

Beep launched Agent Trader: Season 1 (Grand Prix) on Sui, the first autonomous AI trading championship running live on Bluefin.

Circle partnered with OpenMind to develop USDC-powered micropayment standards for agent transactions.

🧠 Bittensor Ecosystem

Macrocosmos launched SN1, a Bittensor subnet where miners compete on matrix-compression and neural-activation optimizations

Sportstensor (SN41) launched its Almanac beta, bringing prediction-market UX live.

Ridges (SN62) updated its incentive mechanism, reducing the maximum time for AI agents to solve problems from 40 to 25 minutes.

IOTA (SN9) now lets MacBook users mine and is rolling out a “train at home” initiative to lower the barrier to the distributed training network.

🦾 Robotics On-Chain

BitRobot Network’s development lab open-sourced Earth Rovers, including 7,000+ hours of sidewalk navigation data.

Peaq integrated Acurast to bring its global decentralized cloud compute resources into the Peaq DePIN ecosystem.

EngineAI just revealed the closest thing to a full-blown Terminator.

EngineAI’s new T800 robot moves with a kind of violent confidence we have not seen from a full-scale robot. The launch reel shows chained kicks, airborne transitions, and footwork that makes every previous humanoid look like it runs on dial-up.

The motions looked so out of band that many viewers immediately assumed the footage was CGI. (myself included)

The T800 is a mid-weight, 29-Degree-Of-Freedom robot with high joint torque, fast cycle times and a depth+LiDAR sensing stack backed by Nvidia’s Thor-class compute. In simple terms: it’s equipped with the best, and configured to handle quick, forceful movements without losing stability.

Although the demos so far have mostly been of it doing mixed martial arts, the company says it can also handle heavy industrial tasks, navigate complex spaces, and perform precise hand movements.

The contrast with its earlier PM01 prototype is almost comedic. That unit danced on iShowSpeed’s stream, lost its center of mass, and folded onto the floor. The T800 looks like it came from a different company.

This level of stability and motion in a 75kg robot means Chinese teams are now iterating hardware faster than they can publish models.

It’s already tiers above anything we’ve seen in the Tesla Optimus demos, and I can’t help thinking the robotics race is about to look a lot like the AI race: China pushing hardware faster and the US eventually forced to answer.

👋 In this week’s deep dive, I unpacked Codatta.

Most conversations about AI focus on models and GPUs, but the real bottleneck is still the human judgment we rely on for data. Codatta is one of the protocols I’ve seen that tries to give that judgment structure, pricing, and royalties. So that we can train better, specialized AI models.

If you’re trying to understand how data becomes an asset class in the machine economy, this one is worth reading:

🔥 Our Weekly Top 5

#1 Messari says DeAI is entering its “Enlightenment” phase

Their State of AI 2025 report shows funding cooled, but breakthroughs, soaring inference demand, stronger open-source models, and new infra-finance markets are setting up a sector revival.

#2 LLMs got smoked by NFL games

Recall tested 1,500+ live predictions across three NFL matches and every pregame call was wrong.

#3 China just ran a cleaning robot showdown

A national competition put autonomous cleaning bots head to head, showing how close we are to offloading nonstop, low-value city work to machines.

#4 Calls for a US–China robot showdown

After Optimus’ running demo, the debate shifted to “let the robots fight,” with people already betting a Figure vs Tesla match would fill an arena.

#5 A wave of AI launches is coming up

From Talus’ verifiable agents and Almanak’s swarm-driven DeFi vaults, the next two months are packed with high-signal releases.

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

If you enjoyed this, you’ll probably like the rest of what we do:

The Agent Angle: Weekly AI Agent newsletter & deep dives (non-crypto)

Our Decentralized AI canon 2025: our open library and industry reports

Prefer watching? Tune in on YouTube. You can also find me on X and LinkedIN

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.