I’ve actually lost count of how many startups call themselves the “Bloomberg for crypto.”

It’s an appealing pitch, because anyone who’s actually done crypto research knows how broken the process is. You start by checking DEX volumes on DeFiLlama, jump to X for sentiment, scroll through Telegram and tokenomics dashboards, and cross-reference half-translated Medium posts. By the time you’ve verified what’s real, the market’s already moved.

Even OpenAI hasn’t solved it. ChatGPT can write clean summaries, but it struggles with crypto because most of the relevant information is scattered across live blockchains, private chats, and constantly changing APIs. It can read the words but not the world they describe.

That’s the real bottleneck. Information is abundant; interpretation is scarce. The next wave of research infrastructure won’t be another dashboard or chatbot. It’ll be AI systems that reason directly on live, verifiable data.

That’s what Surf Copilot represents: an early prototype of the AI-native research stack. It reads the same data we do (on-chain flows, social signals, developer activity) and turns it into reports that look human-made and context-aware. It’s the difference between aggregation and understanding.

I’ve tested many of these assistants in search of something that genuinely makes research easier. Surf is one of the few that actually impresses me. No wonder top funds like Pantera, Hashed, and YZi Labs are using it to gain an edge.

What Surf Copilot Claims to Do

Surf calls itself a domain-native AI research copilot, trained on live on-chain, social, and technical data.

It’s built by Cyber (formerly CyberConnect), whose social-data layer already powers several Web3 apps.

Its promise is simple: less toggling, more thinking.

Surf runs on three core modes:

Ask for quick factual queries or price checks.

Research for deep, multi-agent investigations across 40+ blockchains and 100K+ X accounts.

Execution (currently in beta)— a preview of how users could one day fund wallets and let Surf perform on-chain actions live and transparently.

Behind the chat is a multi-agent system. Every prompt sets off a coordinated workflow of On-Chain, Social, Technical, and Deep Search agents that pull, analyze, and fuse live data into a single report.

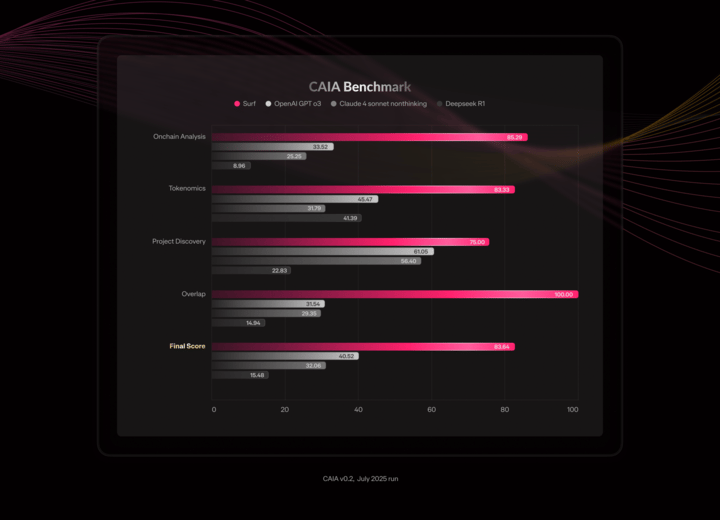

The team even built its own benchmark, CAIA (Crypto AI Agent Benchmark), showing Surf outperforming GPT-4 by 20–30% in crypto-specific accuracy, especially in tokenomics on-chain analysis, trend analysis, and project discovery.

CAIA Benchmark July 2025 Run

That’s the core idea: live verifiable data over generic summaries.

So I put that claim to the test across three different angles. One built for traders, one for fundamental analysts, and one for airdrop farmers.

Three completely different styles of research. One AI copilot to handle them all.

Task #1: The Memecoin Migration Test

Nothing tests a crypto AI faster than a trip to the memecoin trenches.

Memes move at the speed of attention, and the data that explains them is scattered across charts, group chats, and half-translated tweets.

My first prompt to Surf was:

“Recently, memecoin volume shifted from Solana to BNB Chain. Is it a short-term attention spike or a lasting meta? Also, which new BNB tokens have the best shot at a Binance spot listing?”

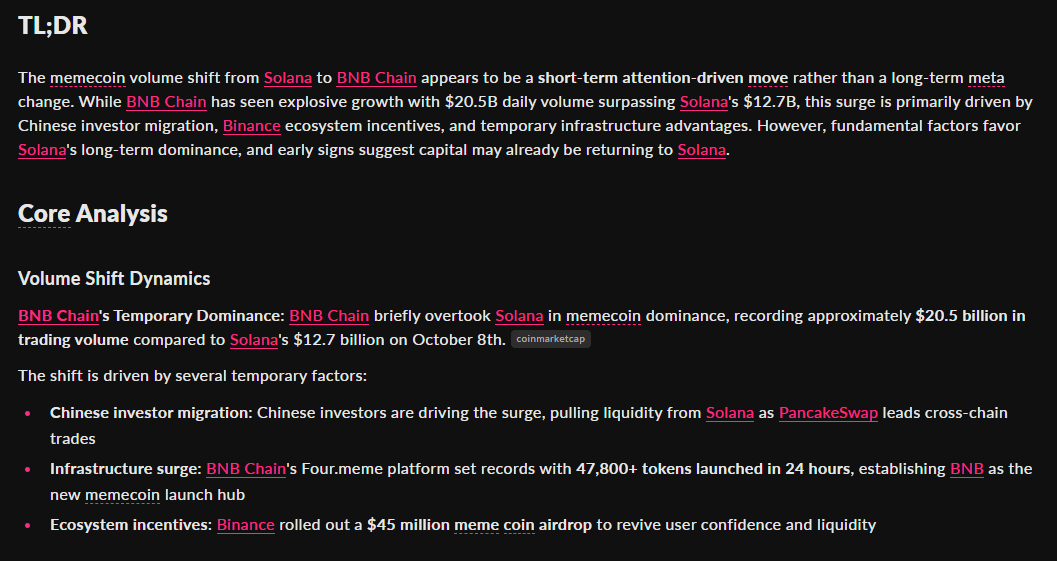

In Ask mode, Surf took less than a minute to reply. The answer was fast, clear, and broadly accurate. The memecoin migration, it said, was a short-term, attention-driven move rather than a lasting meta. It cited $20.5 billion in BNB DEX volume versus Solana’s $12.7 billion, pointing to Chinese capital rotation, Binance ecosystem incentives, and new meme infra.

Concise, intuitive, and right on the money. But when I asked it to list which recent BNB memes could get a Binance spot listing, it listed FLOKI, BAS, and Recall.

But FLOKI’s an old token that’s already listed, BAS isn’t a memecoin, and Recall isn’t even on BNB.

That’s when I realized Ask mode is perfect for quick factual checks, but once a question requires multi-layered reasoning, you need to bring in the heavy machinery.

So I switched Surf to Research mode, and everything changed.

This time, the process took longer (about 8 minutes) as the system spun up multiple specialized agents. First, a Task Planner Agent mapped out the research strategy, deciding what data was needed, which agents would handle it, and in what order. Then it dispatched them with well-structured prompts like a newsroom of bots working under one editor:

On-Chain: pulling 24-hour DEX volumes from PancakeSwap and Raydium.

Social Sentiment: scanning hundreds of X accounts for “BNB meme,” “Four.meme,” and “CZ.”

Deep Search: crawling APIs for token-launch data.

Trend Analysis: mapping liquidity flows against narrative spikes.

It was fascinating to watch, in real time, a coordinated research operation unfold line by line in the “Thinking” panel.

Thinking Panel on Surf

When the report landed, it was a different class of analysis. Surf reran everything from scratch and built a probability matrix blending historical Binance listings with live sentiment and liquidity data. The shortlist this time actually made sense.

Here are the top three from the five listed:

Token | Market Cap | Volume (24h) | CZ Engagement | Listing Odds |

BIANRENSHENG | $126 M | $540 M peak | ✅ Direct mentions | Very High |

$4 | $708 M | $87 M | Implicit “4” tweets | High |

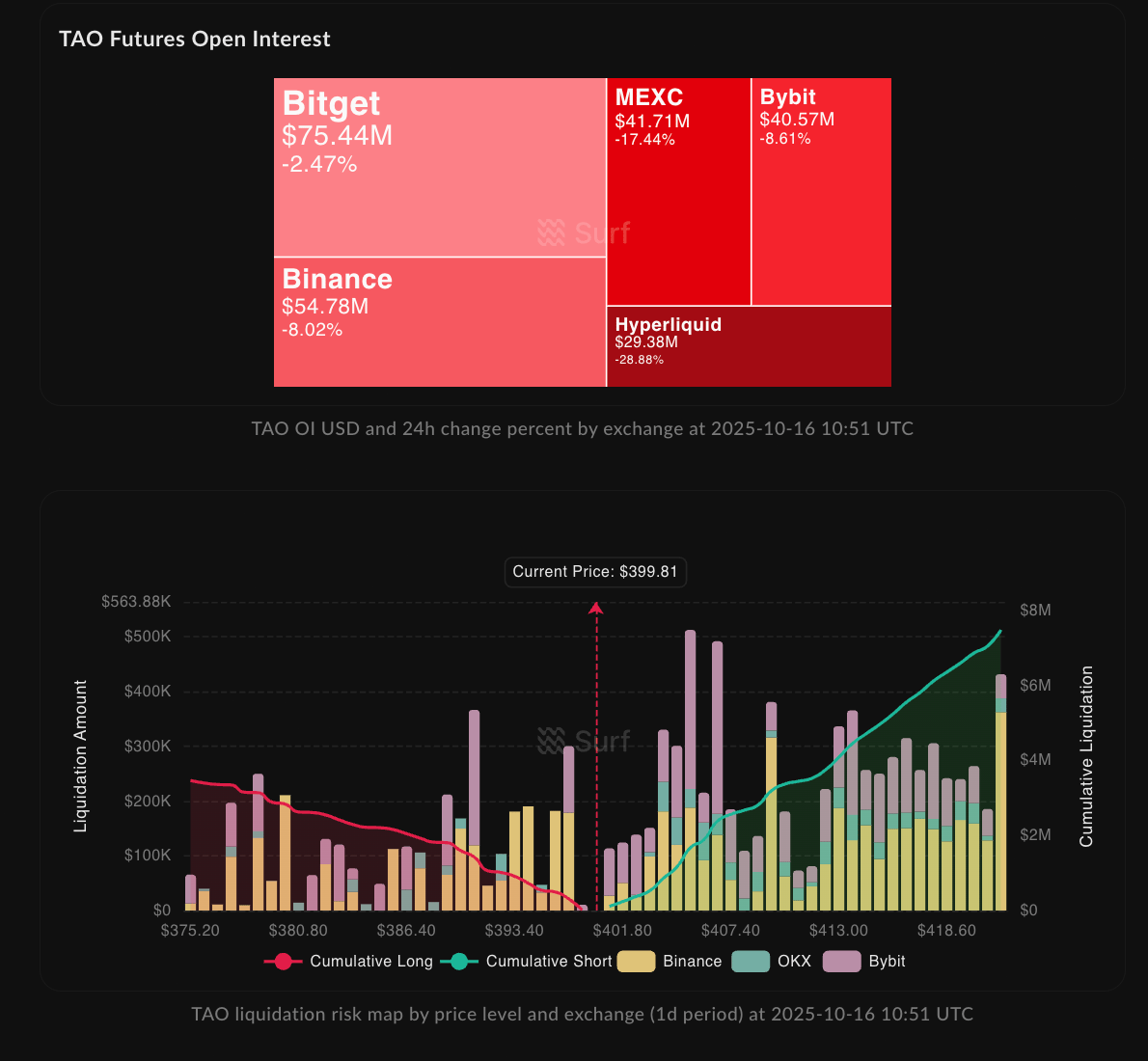

$GIGGLE | $116 M | $14 M | ✅ Charity endorsement | Medium |

These tokens made sense because they all had great volume and surpassed the $100M market cap within a few days after the launch.

One thing that surprised me the most was how Surf treated CZ’s influence as part of the dataset. Surf recognized that in the BNB meme ecosystem, analyzing just market cap, volume, and sentiment isn’t enough. You also have to factor in CZ’s tweet engagement and the ripple it creates.

As part of its analysis, it mapped through his tweets and meme references from the past 30 days, correlating them with token mentions and liquidity spikes across BNB Chain. That extra layer felt distinctly crypto-native.

It is worth noting that it got $4’s market cap wrong, putting it at around $700 M (it’s never crossed $350M and currently sits near $120M), but the reasoning behind the pick was still solid.

It was the kind of nuanced understanding that general LLMs simply don’t reach.

Overall, Surf impressed me with how deeply it analyzed the memecoin ecosystem, layering market data, sentiment, and social nuance to produce insights that felt both quantitative and cultural.

It found a way to include the “vibe” of the market, and that’s what made the analysis feel alive.

Task #2: The TAO Halving Analysis

After memecoins, I wanted to see if Surf could shift from chasing narratives to doing real on-chain fundamentals.

So I gave it a new challenge: Bittensor’s upcoming TAO halving. Bittensor has always been quite tricky for AI to navigate, because much of the information is fragmented across various sources and not available through standard data sources like DeFiLlama.

Here’s the prompt:

“With TAO’s December halving approaching, how does it change the risk-reward between the base token and subnet (alpha) tokens? What happens to inflation, validator sell pressure, and subnet mechanics?”

For this, I used the Research mode again and let it work. Within minutes, the analysis unfolded, clean and structured, like a quant desk briefing. The report’s TL;DR hit straight at the core:

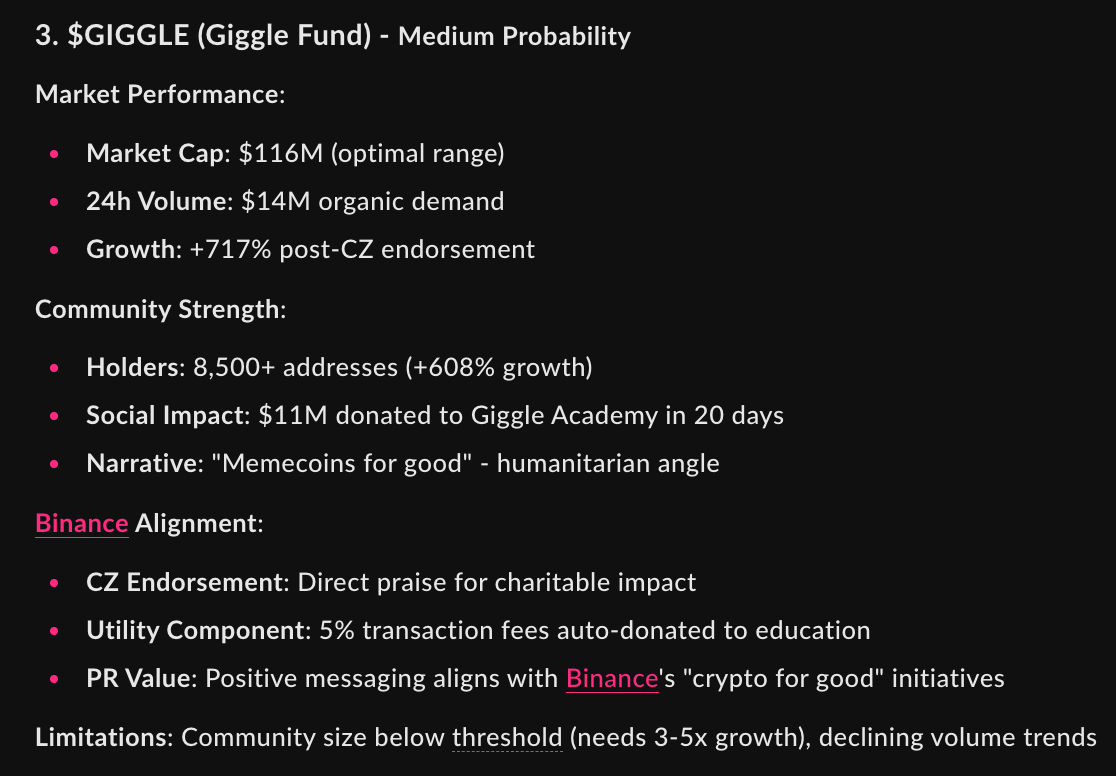

TAO’s halving on December 12 will reduce daily emissions from 7,200 to 3,600, dropping inflation from 26% to 13% and cutting validator sell pressure by roughly $730K a day.

With more than 70% of supply staked, Surf noted that even modest new inflows could trigger a “temporary supply shock” lasting one to two quarters. It also connected the halving to subnet mechanics and explained that every subnet runs an AMM-based TAO/alpha pool, and that halving doesn’t just reduce base emissions but also it halves the liquidity injections that feed subnet economies.

That syncs the scarcity event across the entire network. According to Surf, top subnets like Chutes, Ridges, and Lium stand to gain the most since they already command the deepest liquidity and highest emission shares.

The visuals made the analysis feel alive. Surf generated interactive charts mapping TAO’s futures open interest and liquidation risk across major exchanges.

Hovering over each block revealed live metrics like OI shifts, cumulative shorts and longs, and liquidation clusters.

Then came the portfolio logic. Surf recommended a 70% TAO / 30% Alpha allocation for the next six to twelve months. TAO as the defensive anchor and alphas as leveraged exposure to subnet growth. It outlined three scenarios:

Bull (60 %): post-halving scarcity and institutional inflows (Grayscale Trust, AI narrative momentum) → TAO to $600–$800, top alphas 2–5× stronger.

Base (30 %): gradual rise toward $500–$600 with steady staking yields as a buffer.

Bear (10 %): accumulation around $350 if AI momentum cools.

Surf even went a step further. Without being prompted, it laid out a clean post-halving monitoring framework: emission-share changes, staking flow ratios, subnet TVL rankings, and alpha/TAO price ratios, all tied to verifiable sources like Taostats, Backprop Finance, and on-chain feeds. It was the kind of output that instantly turned into a working checklist for tracking the ecosystem.

By the end, I had what felt like a compressed Delphi Digital report (chads btw). Built in real time, backed by live data, and formatted like something you’d actually want to read as an investor.

If the memecoin test proved Surf could read crypto’s mood, this one showed it could model its mechanics. It not only described the halving but also translated it into an actionable investment thesis, complete with structure, probabilities, and monitoring metrics.

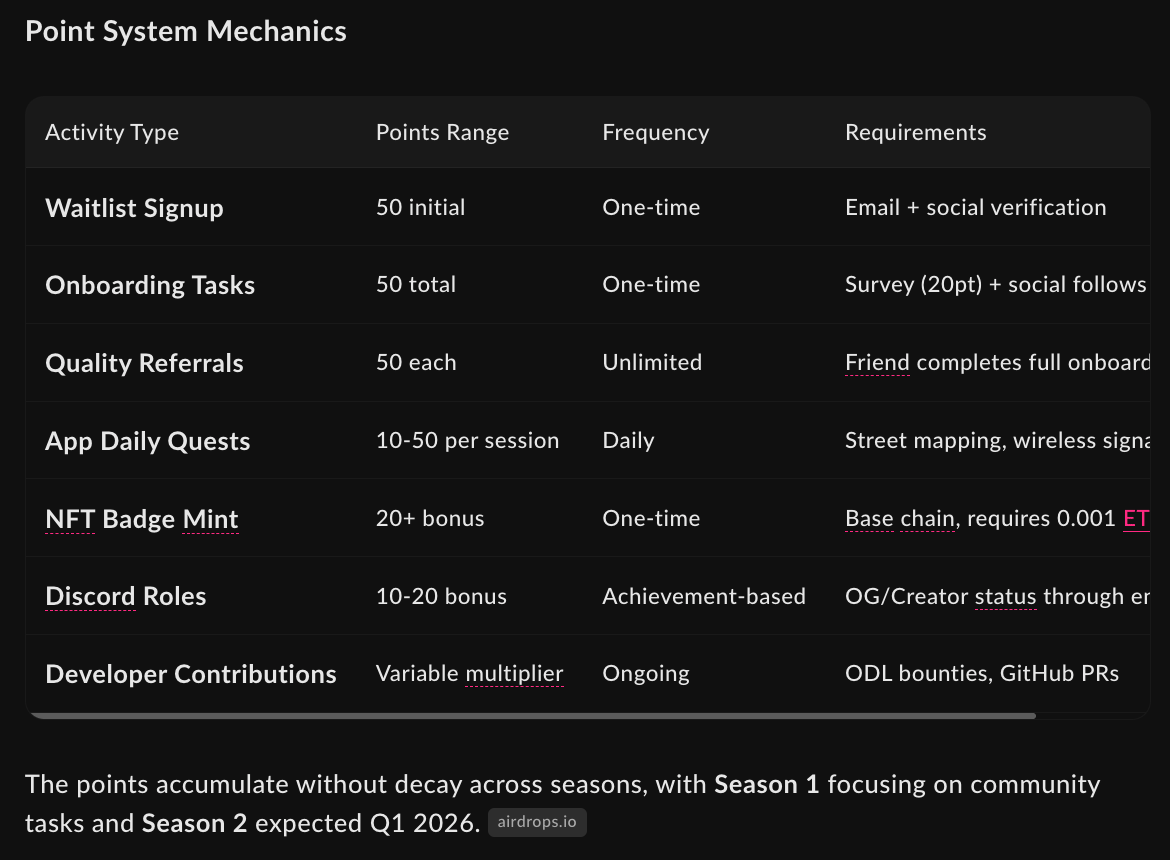

Task #3: The Airdrop Maximization Test

For the final test, I wanted to see if Surf could move from analysis to execution.

So I asked:

“OpenMind is still in pre-TGE. How can I maximize my potential airdrop allocation?”

Most AI tools would have thrown together generic “join the Discord and invite friends” advice. Surf didn’t. It instantly began crawling live program data and finding the Fabric waitlist, GitHub commits, airdrops.io, and even OpenMind’s Base contract, and came back with a plan so structured it felt like an airdrop farming operating manual.

The output read like something airdrop veterans would draft in CT. A full, three-tier playbook:

Tier 1: Foundation: complete onboarding, connect socials, fill the Fabric survey, join the Discord for roles, and mint the free identity NFT on Base.

Tier 2: Daily Engagement (30 min/day): run mapping quests through the OpenMind app, keep streaks for consistent points, and focus on high-reward urban areas.

Tier 3: Developer Multiplier: join the OpenMind Developer League (ODL), submit GitHub pull requests, and earn contributor badges.

What really stood out was how complete and accurate the framework was.

We’d recently published a full research report on OpenMind and I know how scattered all these information on app quests, identity NFTs, etc., are. It’s fragmented across Twitter threads, Fabric docs, and in-app instructions.

Yet Surf somehow found it all, verified it, and distilled it into a single, step-by-step roadmap that actually made sense.

It also noted that there’s no confirmed TGE date, warned that the snapshot could happen anytime, and emphasized maintaining a good 90-day streak at least, which is the kind of nuance only someone deep in the trenches would think to include. It was smart enough to prioritize quality referrals over spam, and even factored in metrics like waitlist growth and GitHub activity to gauge competition levels.

It turned a mess of scattered tasks into a simple, actionable strategy anyone could follow to maximize their airdrop potential.

If Task 1 showed Surf could analyze hype and Task 2 proved it could model fundamentals, this one showed it could operationalize knowledge, turning research into execution.

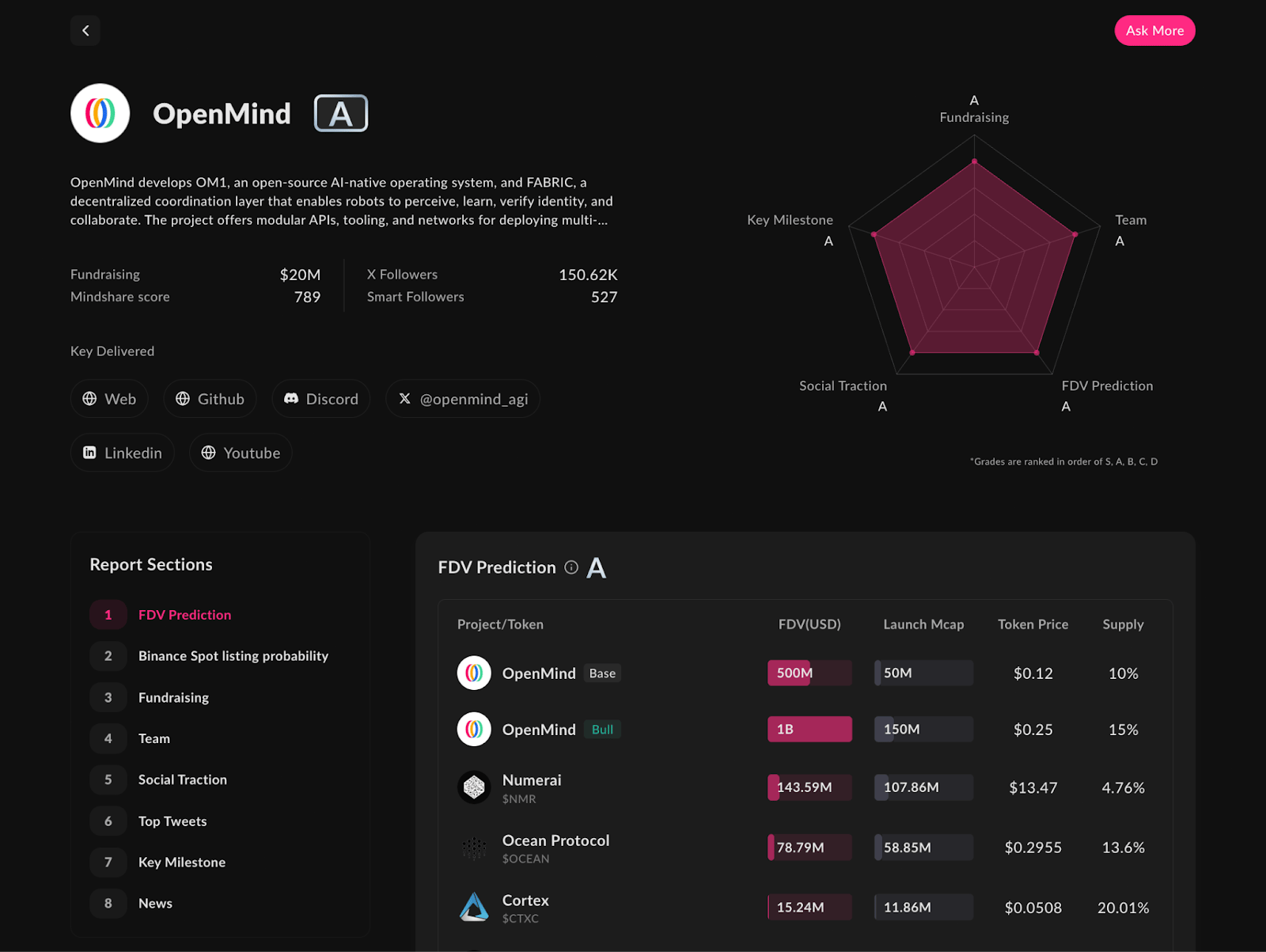

Bonus: The Pre-TGE Report Hub

The airdrop test got me thinking. If Surf could build such a clean playbook for one pre-TGE project, what about all the others still waiting to launch?

That’s where Surf’s Pre-TGE Report tab comes in.

It isn’t built for airdrop farming per se. It’s meant to showcase and grade upcoming projects across a range of metrics, from fundamentals and tokenomics to social traction and exchange probability. Users can then query those projects directly inside Surf to dig deeper, whether it’s for due diligence research or airdrop optimization strategies.

Surf tracks dozens of upcoming tokens like OpenMind, Monad, Sentient, KiteAI, Infinex, Allora, etc, and builds detailed profiles for each, complete with predicted FDVs, launch-price bands, Surf Grades (A–C-), and even a Binance-listing probability percentage (the famous, or lately infamous, number everyone checks first).

List of Pre-TGE Reports on Surf

Surf’s reports feel more like proper research briefs, blending on-chain metrics, social data analysis, team evaluation, and market modeling into a single, coherent picture.

Openmind Pre-TGE Report on Surf

When I looked at the Recall report before the token went live, Surf projected a $0.40–$0.65 launch range and an FDV of $60–$140 M. A week later, Recall went live at $0.58, right in the middle. Surf had modeled it with pretty good accuracy. You may remember that we wrote about Recall as the “Google for AI agents” in a deep dive a few months ago.

In a space where pre-TGE valuation debates often play out on X through gut feelings and hype, a tool like this could finally anchor those arguments in data.

It gives crypto researchers and traders a structured way to objectively compare projects, with enough signal to cut through the noise.

Verdict: Strengths, Gaps, and Who It’s For

After putting Surf through three very different tests (memecoins, fundamentals, and airdrop strategy), it felt like we’d covered a good spread of crypto behaviour: traders, researchers, and farmers.

And across all of them, Surf delivered something few AI tools manage: a product that actually thinks in crypto.

When Surf talks about validator sell pressure or liquidity migration, it’s not parroting someone’s blog post, but it’s pulling on-chain data, charting it, and reasoning across multiple data layers in real time.

That’s the difference between a chatbot and a copilot.

Its multi-agent reasoning gives it structure. You can literally watch how it thinks in the “Thinking” tab, as each agent fetches data, weighs confidence, and passes results to the next.

The interface might be its quietest strength. Reports feel alive with interactive charts, dynamic timelines, and exportable tables that adapt with the market. It’s clean enough for traders, yet structured enough for analysts. And somehow, it still manages to stay accessible: beginners can type “explain EigenLayer” and get a full visual breakdown, while long-time CT members can ask for subnet emission deltas and get multi-layered analysis.

That’s Surf’s biggest play. Depth for veterans, clarity for beginners. It doesn’t dumb things down, it translates them.

And for $29/month on the Pro plan, it’s hard to think of another platform that packages market data, reasoning, and prediction this seamlessly.

Of course, it’s not flawless.

It occasionally gets numbers wrong in Ask mode, though switching to Research Mode usually fixes that by pulling fresher data.

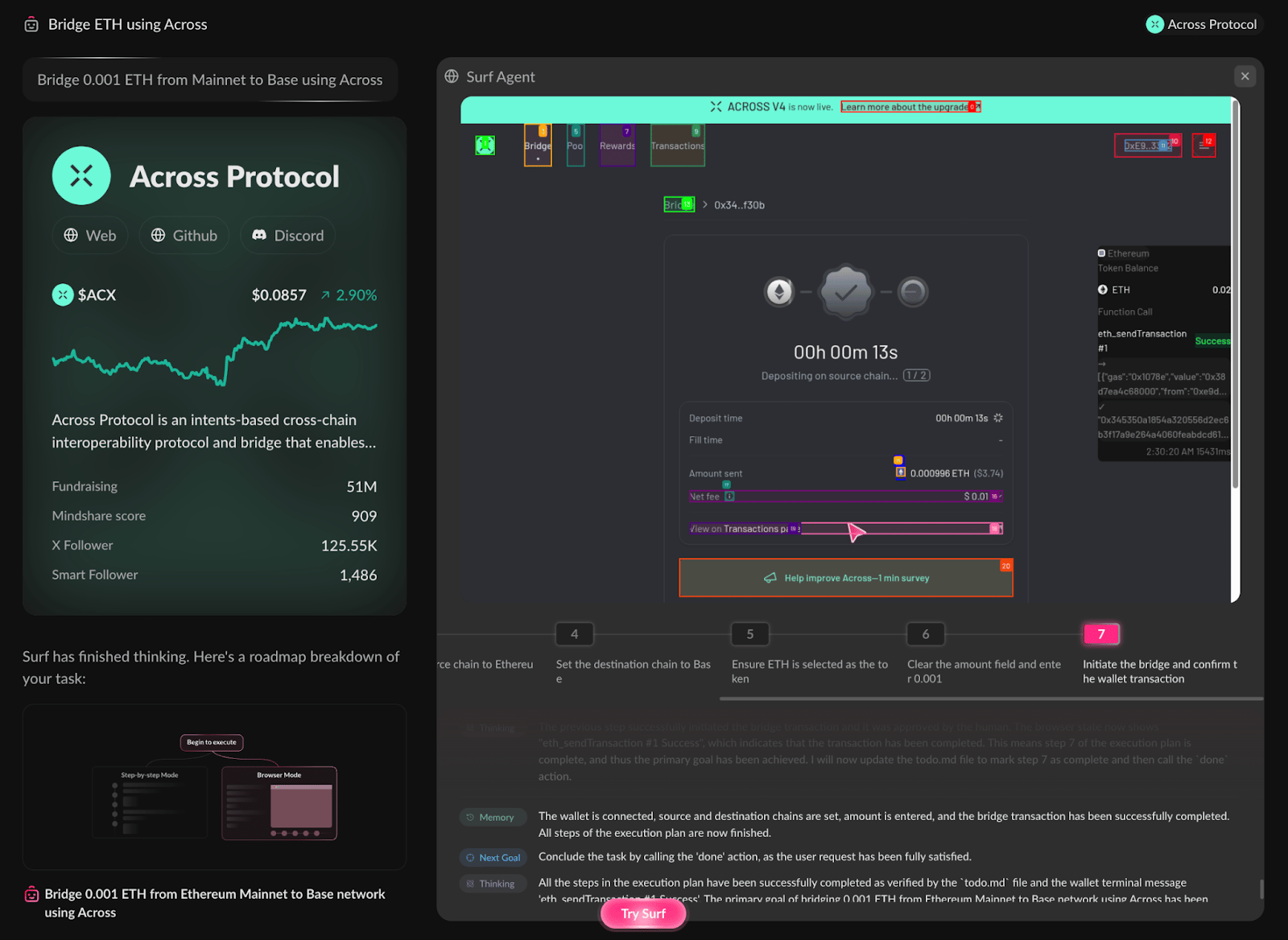

And while Execution Mode is live beta testing, it’s still early days.

Users can already perform many of the same on-chain actions showcased in the demo, like swapping, claiming, or staking directly through Surf, but the feature currently operates with limited capacity as the team focuses on refining it.

Surf Execution Mode Demo

Execution is something the team is long-term bullish on, though it’s not the immediate priority. There’s still a lot to solve, from high-frequency use cases to wallet UX, security, fee optimization, and more.

The mobile app also went live on October 21 and is currently available to Max subscribers as part of a phased rollout. It’s being stress-tested before expanding to all paying users in the coming weeks. Once stable, it will be a major unlock, bringing the research and execution experience together and making Surf accessible to an even wider base of crypto users.

If the team delivers on both fronts, Surf could evolve from a research copilot into a full action layer.

Among current tools, Surf feels like the synthesis of what Nansen and Delphi each do well.

Nansen’s new AI agent is great for wallet analytics, but doesn’t do narrative or fundamentals. Delphi’s in-platform chatbot is strong on deep research but lacks live on-chain data. I think Surf sits right between them.

For traders, it’s a faster, calmer way to parse DEX flows, whale movements, and market narratives.

For analysts and funds, it compresses the full research stack of say, Dune for data, Nansen for wallet intelligence, and Delphi for analysis into one workspace. Surf is already working with several top research firms, including Decentralised.co, Four Pillars and Tiger Research.

And for newcomers, it’s an explainer that actually makes crypto readable.

It’s not perfect yet, but it’s already useful. And in crypto, that’s a rarer statement than it should be.

Conclusion

Crypto doesn’t suffer from a lack of data. It suffers from a lack of understanding.

And clarity is what Surf gives. Surf Copilot is one of the first products that attacks that core problem by teaching AI to reason on live, verifiable data instead of static summaries.

The most interesting aspect is that Surf shows signs of good taste. Surf understands what actually matters to people who live in this space: flows, catalysts, entry points, airdrops, narratives, and it tries to be useful.

Yes, I’d use this more often.

And I can see it becoming a genuinely useful tool for many people in crypto, especially once the mobile app launches. Just like ChatGPT quietly replaced Googling and clicking through links, Surf could become that for quick, on-chain research.

That is what Surf delivers. The tool you open first, not last.

Thanks for reading,

0xAce and Teng Yan

Useful Links:

Main Website (+3 days free trial if you sign up using this link)

If you enjoyed this, you’ll probably like the rest of what we do:

Chainofthought.xyz: Weekly AI x Crypto newsletter & deep dives

Agents.chainofthought.xyz: Weekly AI Agent newsletter & deep dives (non-crypto)

Our Decentralized AI canon 2025: our open library and industry reports

Prefer watching? Tune in on YouTube. You can also find me on X.

This essay was supported by Cyber, with Chain of Thought receiving funding for this initiative. All insights and analyses are our own. We uphold strict standards of objectivity in all our viewpoints.

To learn more about our approach to commissioned essays, please see our note here.

This essay is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investments.