Happy Friday {{first_name}}!

Welcome to #70 of the Weekly AI edge. I’m writing this one from my honeymoon in Jeju, South Korea. It’s a lovely island, with sea breeze, lots of tangerines, and a mountain in the middle. And a hotel that just tried to sell me a $22 toothbrush (tip: bring your own).

Anyway, while I was offline, the internet decided to join me.

The internet went to sleep this week. Literally.

AWS went down for six hours, taking Reddit, Slack, parts of Amazon, and even a few Sleep8 smart beds with it. For a moment, half the web remembered what centralization actually means: one outage, and the lights go out everywhere.

Crypto Twitter loved it, of course. “So much for decentralization,” they joked, as a few web3 frontends blinked offline too.

But not all of them.

The decentralized computing stack - like Akash, Io.net, Spheron, Aethir - stayed up. Compute, storage, and orchestration kept running while Big Tech scrambled to reboot. DeAI didn’t flinch. It proved the point it’s been making all along.

One world went to sleep. The other stayed permissionless, verifiable, and wide awake.

This is why I’m deeply bullish on decentralization in AI.

Let’s get into it.

The COT Meme of the Week

AWS broke. DeAI didn’t even notice. ☕

📊 Market Pulse

The AI token market cap went down 8% to $28B as the market struggles to recover from last week’s crash. DeAI mindshare fell 29% with attention drifting towards DeFi and robotics, but $TAO continues to hold strong and lead the sector.

🚀 Weekly Movers

$NIL is up 20% this week after announcing an upgrade to v2.0.

$AIA is up 60% this week after its Binance Alpha spot listing.

$UB is up 38% as Unibase becomes the first ERC-8004-powered multi-agent collaboration platform.

🔮 Narrative Watch

The spotlight’s shifting to agent datachains as Irys and compute networks like Giza form a new “verifiable AI stack” that connects live data, compute, and incentives.

🪙 Token Launches

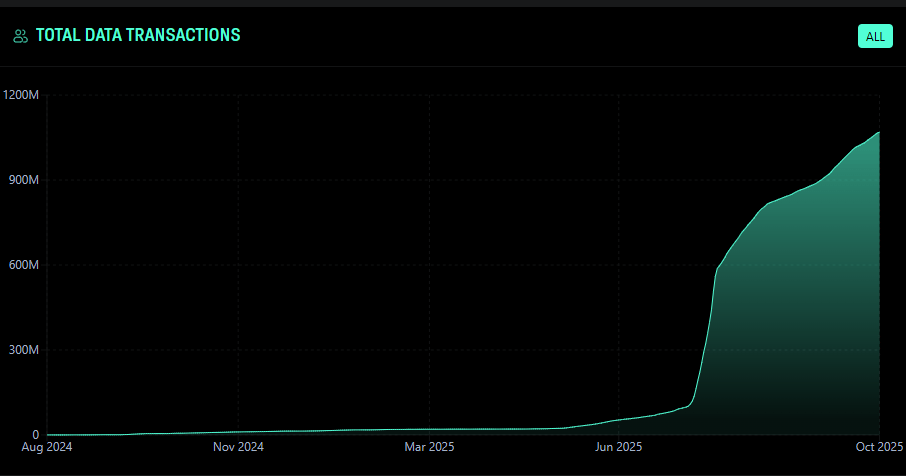

🕹️Irys Crosses 1B+ Data Transactions

Source: Irys Explorer

Irys’s testnet is now tracking over 2.7TB of indexed data and 1B+ data transactions, with mainnet slated for next month. It’s positioning itself as the first programmable datachain built for AI agents, verifiable compute, and on-chain intelligence.

You might remember 375.ai from a recent issue. Turns out Irys’s multi-ledger setup is what powers its data streams

The Wedge

Irys gives AI agents direct access to live on-chain data. They can read it, write to it, and interact with it without relying on off-chain infrastructure. That means fine-tuning and inference can happen next to the data itself. Agents can even prove what they learned, when they learned it, and from which source.

It turns real-world data streams from markets and sensors into sources that AI models can actually use and verify.

Because Irys comes from the Bundlr team, it inherits one of crypto’s most stress-tested storage systems, then layers on programmability and native incentives.

The Fine Print

EigenDA, Celestia, and Arweave are all circling the same “data-for-AI” lane, but Irys is betting that combining compute and storage is the real unlock.

Those headline stats come from controlled testnet activity. Real-world throughput and fee dynamics still need to be proven at scale.

Miner rewards, agent payments, and data pricing are still under wraps until mainnet goes live.

Irys is a bit different from your typical data storage network. It’s trying to make data computable. Something AI agents can train on, verify, and eventually trade.

That’s a bigger idea than most realize.

⚡Recall Network: The Public Arena for AI

Most AI leaderboards and benchmarks are theater. The same labs that build the models write the tests, and half the “breakthroughs” are press releases with charts.

Recall wants to fix that. It’s building an open arena where anyone can fund, test, and rank real AI performance. Out in the open, on-chain. We unpacked everything in our earlier deep dive on Recall.

The $RECALL token just went live last week, now trading at a $6M market cap and $30M FDV.

$RECALL is the native ERC-20 token that secures and coordinates Recall’s decentralized AI skill markets. It funds skill creation, secures evaluations through staking, distributes rewards, and supports governance across multiple chains.

The Wedge

Agents compete in open challenges where every result, score, and stake is recorded on-chain for anyone to audit.

Communities stake $RECALL to fund the exact AI skills they want built, turning user demand into the roadmap.

Developers and validators put their own tokens at risk, creating economic pressure for honesty instead of hype.

Platforms can plug into Recall’s rankings by API, so users and agents automatically pick the best performer for the job.

The Fine Print

Big AI platforms still control distribution. Recall must make open, verifiable discovery just as seamless.

Rankings only hold if competitions stay active. No new tasks means no new data, and stale rankings lose value fast.

The system fits cleanly with measurable domains like trading, writing, coding, and data extraction, but fuzzier or long-horizon work may never translate well to on-chain metrics.

If Recall works, it’ll be slow and hard-won. But it could redefine how we measure progress in AI, not by who markets best, but by who performs best.

Source: Nillion

Are you building something awesome in crypto × AI? Fill in this form and share it with us. We’ll feature the sharpest picks in the newsletter each week.

💸 Capital Flows

TAOX secured an $11M strategic investment, signaling steady venture and private capital inflows into the growing TAO ecosystem.

YZi Labs announces a $1B AI-first fund to incubate projects on the BNB ecosystem.

Helium announced it will start buying and burning HNT from the open market, injecting $20M in annual buy pressure and paving the way for an upcoming HNT DAT.

Sportstensor lands a $200K OTC investment from DSV Fund for its prediction markets.

⚙️ Infra & Protocols

Big news from Virtuals Protocol. They unveiled Virtuals Robotics, expanding its AI agent network from digital coordination and commerce into the physical world. They also announced ACP v2.

Related: BitRobot announced that Subnet 5, SeeSaw by Virtuals, is now live — a playful app where you record short clips of yourself doing everyday tasks (like tying your shoes) and earn rewards for it.

OpenServ launched Platform v1, an AI co-founder stack that lets solo founders build, launch, and run full crypto projects.

Kaiko launched ARC V1.5, its NEXUS-powered on-chain OS with ID rewards, agent training incentives, and the upcoming KAI-X1 emotional reasoning model.

🤖 Agents & Apps in the Wild

Questflow launched its Autonomous Browser Agent, enabling natural language control for web navigation, research, and task execution.

Crestal Network rolled out Agent Tokenization, letting users mint and trade custom tokens tied to their AI agents directly from profile pages.

Bitte Protocol is expanding across all Solana dApps, letting any project turn its API into an AI agent.

🧠 Bittensor Ecosystem

Chutes became the #1 open-source inference provider on OpenRouter, serving over 40B tokens per day.

Score (SN44) launched a new twin-competition incentive system to scale Vision AI workloads by testing and strengthening models through competitive validation.

Autoppia (SN36) launched Dynamic Zero, adding live web tasks, winner-takes-all rewards, and public leaderboards to benchmark miners against top AI models.

Bittensor reactivated subnet registration and deregistration. New subnets will replace the lowest-performing ones, with a 4-month immunity period.

🌐 The Web2 Giants

OpenAI launched ChatGPT Atlas, an AI-powered browser placing itself squarely into the browser and search layer dominated by Google..

Google announced a new quantum algorithm, Quantum Echoes, run on its quantum chip and claimed to be ~13,000× faster than the best classical algorithm.

Amazon introduced AI-powered smart glasses and robotics systems for delivery drivers.

Oracle unveiled native AI agents embedded within its Fusion Cloud Applications, and also its new AI Data Platform.

.

Source: Epoch AI

Remember when models couldn’t add 17 + 38 without hallucinating? Those days are over.

Epoch AI’s new FrontierMath report shows that frontier models (GPT-5, Gemini 2.5, and friends) can now solve 57% of the world’s hardest math problems, the kind that stump professional mathematicians.

GPT-5 alone scored 29% on its first try and climbed to nearly 50% after repeated runs, showing real signs of compounding reasoning, the ability to learn from its own process.

At this pace, models are projected to hit 70% accuracy by mid-2026 and approach perfection by 2028.

FrontierMath tests deep logic and symbolic reasoning, the cognitive scaffolding behind science, engineering, and discovery itself. Until recently, models barely moved the needle here

If the curve holds, AI might soon start discovering math we haven’t figured out yet.

Every robot today is basically a loner.

A $100,000 Boston Dynamics Spot still can’t open a door for a Figure humanoid. A Waymo can’t talk to the delivery bot parked beside it. OpenMind wants to fix that. A shared protocol so robots can finally learn, talk, and trade like a network, not a zoo.👋

Our deep dive last week was on OpenMind, the open-source stack wiring every robot on Earth into one collective intelligence.👇

🔥 Our Weekly Top 5

#1: DeepSeek and Grok Lead the AI Trading Wars

Alpha Arena’s new benchmark pits top AI models against each other using real capital.

#2: Ocean Protocol under fire for a $190M token swap

Fetch AI just accused Ocean Protocol of quietly offloading $190M worth of $FET from “community incentive” wallets.

#3: : Sentient AGI Launches the First AI Games Arena

Sentient AGI and top universities are building a unified arena at NeurIPS where AI agents battle in strategy, deception, and cooperation

#4: a16z Declares the AI–Crypto Convergence

a16z’s 2025 State of Crypto report shows how AI needs identity, payments, and provenance; crypto already solves all three.

#5: The AI Brain Rot Study

Researchers found LLMs trained on viral social data suffer lasting cognitive decay, reasoning fell 23%, memory 30%, and the damage didn’t heal.

That’s a wrap for this week! Got thoughts, feedback, or something cool to share? Just hit reply. We read it all.

Cheers,

Teng Yan & Ayan

Did you like this week's edition?

This newsletter is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.